Date & Time: 28th March 2022, 05:30 PM IST

Speaker: Mr. Nimesh Mehta, Director & Country Head – Business Development & Products, ASK Investment Managers

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Nimesh Mehta, Director & Country Head – Business Development & Products, ASK Investment Managers.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer finest PMS selection process analyzing products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes covering 9 ratios, before offering the same to investors.

We are a responsible, long term investment service provider in the space of Alternates.

Invest with us in the best quality products and make informed investment decisions.

Webinar on ASK GOLDEN DECADE Fund

We at PMS AIF WORLD believe that current decade offers best wealth creation opportunities, and in fact have been running an educative webinar series since the beginning of this decade – “Crystal gazing next decade of wealth creation for investors.”

And, ASK has recently launched an AIF that matches out views on GOLDEN DECADE OPPORTUNITY.

So, we conducted detailed webinar with ASK to understand and deep dive ASK GOLDEN DECADE FUND in terms of portfolio structure, ideology, portfolio allocation construct, fees structure etc.

ASK has over 21 years of track record of managing public equity. Acing the PMS industry for offering great investor experience for the returns be it from the point of view of Alpha or be it from the point of view of Consistency. As we at PMS AIF WORLD, give utmost significance to PEOPLE, ASK’s success conveys that Team ASK is highly experienced and the name ASK evokes highest levels trust and faith amongst High-Net-Worth Investors. The firm manages an AUM of over ₹35,000 crore and its one of top Alternates focused companies in India.

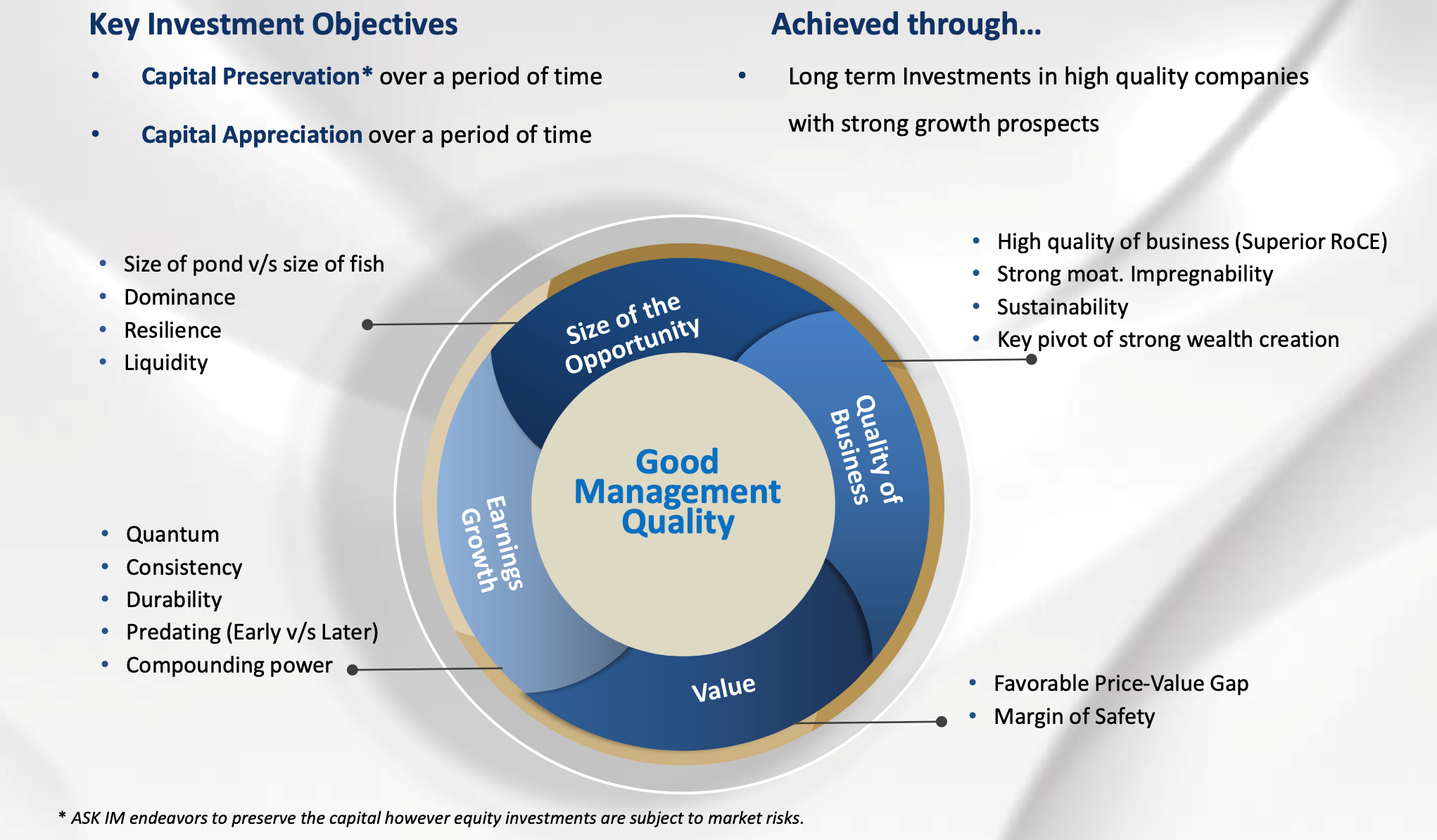

The long track record further entails deep engraved PHILOSOPHY which is capital preservation and capital appreciation over a period of time. The pie chart explains in depth the Philosophy of investing at ASK IM.

It does not matter how big a company is, it matters how big the company will turn out to be in the future, says Mr. Nimesh Mehta, stating that it is the starting point of view for investments at ASK.

Currently, Indian economy is a $3 Tn+ in its size. Let’s compare this to a few other larger economies to understand the perspective –

- United States: $20+ trillion.

- China: $14+ trillion.

- Japan: $5+ trillion.

- Germany: $3.5+ trillion.

- United Kingdom: $2.5+ trillion.

- France: $2.5+ trillion.

- Italy: $1.75+ trillion.

We will experience in this decade, the Indian economy transitioning from being a $2.5tn+ economy to a $5tn+ economy and to understand its implications and how Big is this opportunity for equity investors, one must check how the stock markets of developed countries created wealth for equity investors during this transition.

Also, the US achieved the target in 10 years, Japan did it in 8 years, while China accomplished the same within 5 years. Let’s also understand, how much time would India take to travel this journey of transitioning to a $ 5 Tn economy and then becoming part of world’s top 5 or top 3 economies during this decade.

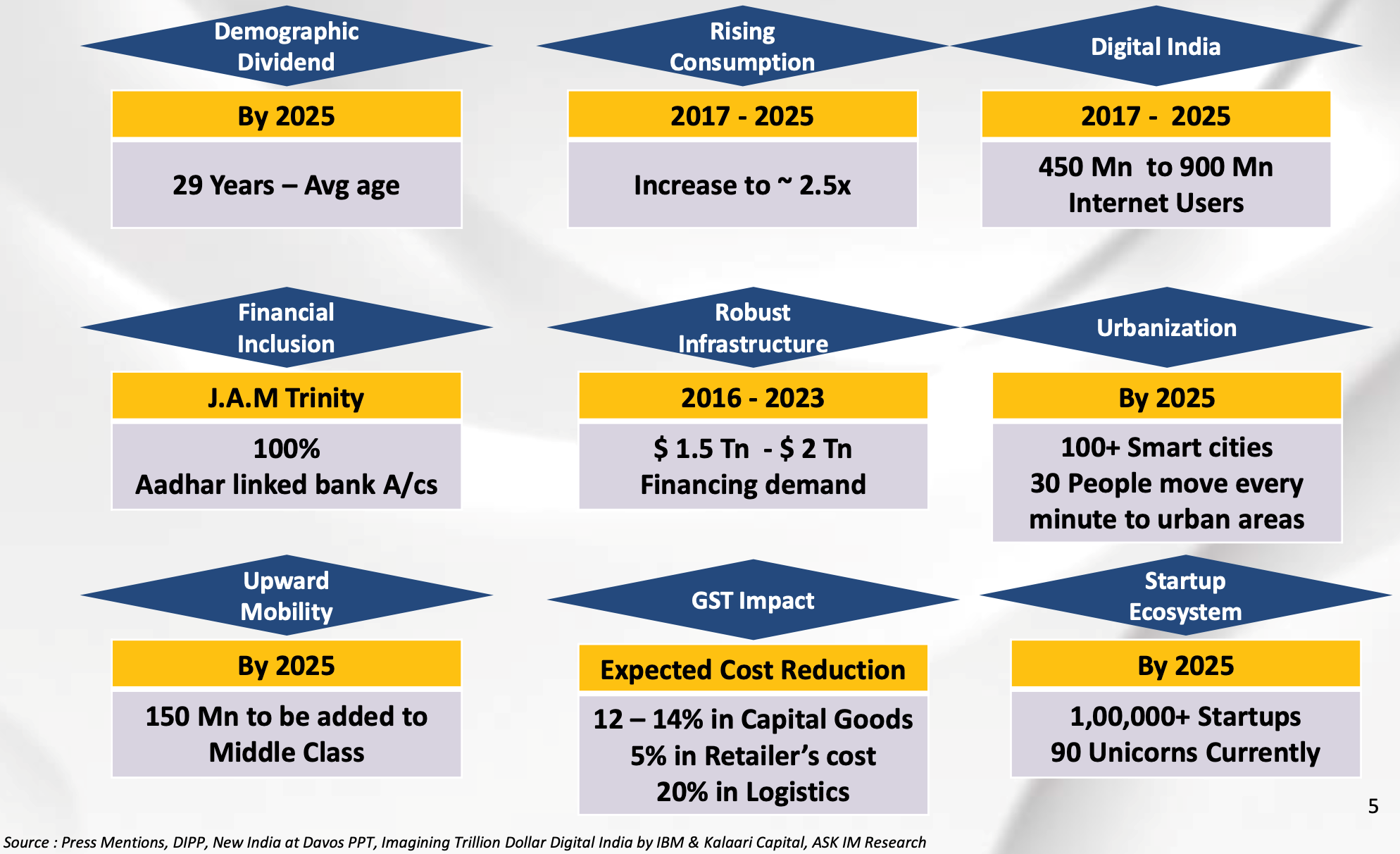

Indian economy offers many areas of potential growth because of the demographic dividend, low banking penetration, low household leverage. And, several government initiatives like Aadhaar, GST, RERA, Bank recapitalization, and so on, have paved the way to tap all these areas of growth potential. Then, the Digital revolution is also playing a significant role. It is infact world’s largest business opportunities with 1.2 billion people on wireless subscriptions and 0.8 billion with broadband subscriptions. Furthermore, one out of 13 unicorns in the world happen to be from India with the numbers reaching 100+ by 2022. UPI transactions and the no. of debit cards issued have also increased by leaps and bounds.

Per capita GDP and the equity markets are bound to grow due to the above factors.

And the outcome is “a Golden Decade of Growth in front of us”

Also, a value shift in businesses is evident. And, the drivers of value migration include technology, cost of capital, innovation and lower switching costs among others. This Value Shift is leading to the rise in market share of better run private sectors businesses over the PSUs – especially in the banking, or insurance sector. This provides one of the huge opportunities in this decade to financial & insurance sector going forward. Besides, the on-going urbanization and rising income will provide a massive boost to discretionary spending.

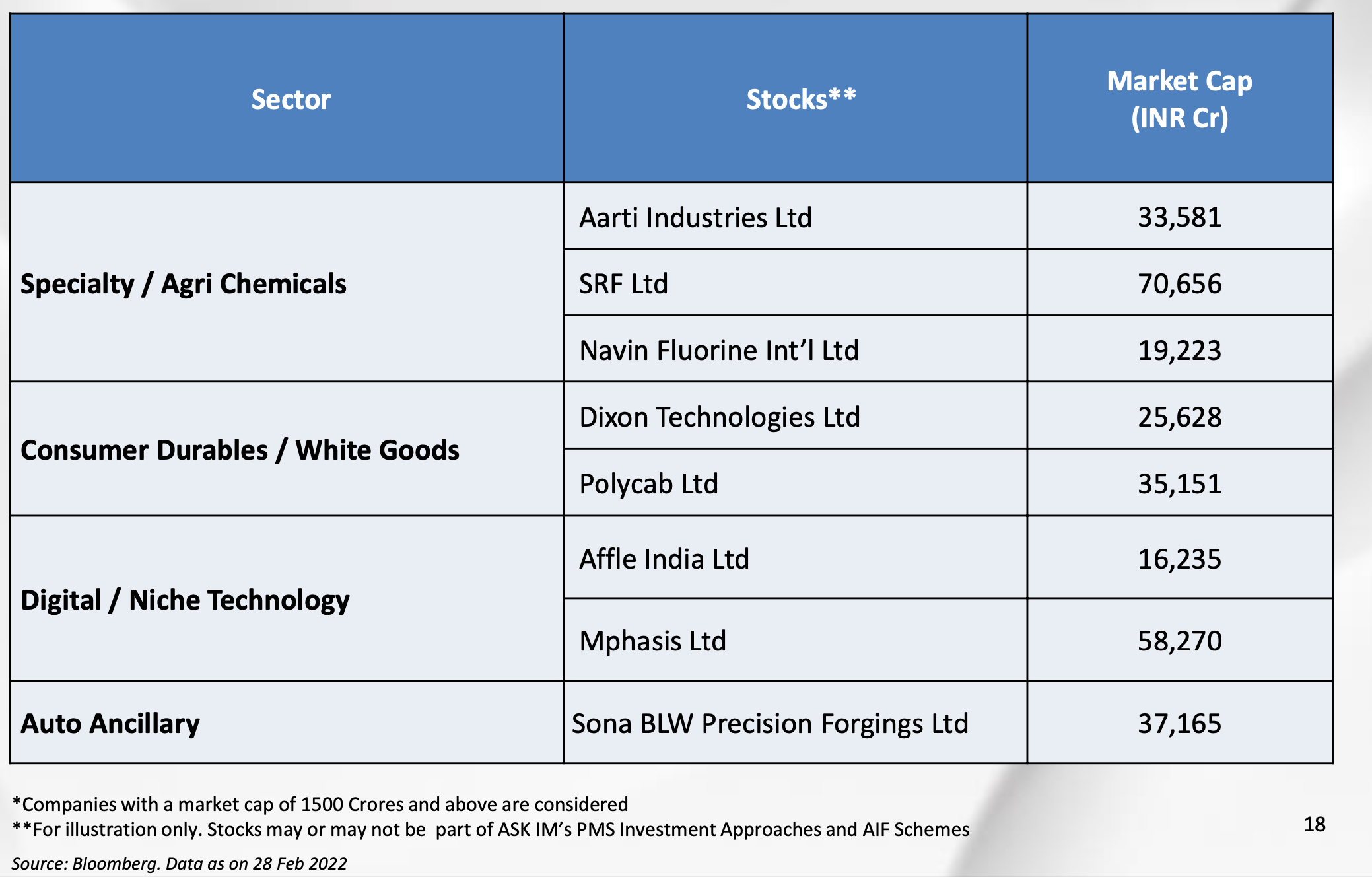

The sector positioning for ASK’s Golden Decade Long Only Category III Fund covers the sectors like financials, IT, manufacturing, chemicals, discretionary consumption and pharma. IT, manufacturing, chemicals, and pharma form the 50% of the fund’s sector holdings as opposed to none in the year 2018.

Investible Universe for ASK Golden Decade Fund is:

The ASK Golden Decade Close-ended Fund belongs to the CAT III AIF with a 4-year period.

The current Growth portfolio of the Golden Decade Long Only Category III Fund is skewed broadly 55% towards large cap, 40% mid caps and 5% small caps. They continue to have

a flexi-cap strategy as the Golden Decade fund will have companies with strong leadership and also be a part of the transition from a $3tn economy to a $5tn economy.

There is an umbilical cord relationship between the price and the earnings of the company.

At ASK Investment Managers, the management has steered clear of leverage, pre-IPO offers and derivative strategies. It is only lately that they have allowed their portfolio managers to take part in certain IPOs if they meet the requirements and adhere to the in-house process. Blackstone’s takeover of ASK IM has barely changed the values and ethics that the latter stands for. The takeover has brought along with itself a lot of expertise and financial exposure for the management.

‘What we learn from history is we don’t learn from history’ is a quote that Mr. Nimesh Mehta and the team at ASK believes in. The growth strategy investing has been imbibed from discipline and consistently reaching small milestones. Growth investing entails pricey valuations but high conviction level helps you sail through.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION