Q1. What are the top three tailwinds and headwinds facing equity markets going forward?

Top 3 headwinds:

- Geopolitical risk: Along with the deteriorating global political environment, there persists a risk of global recession.

- Rural Demand: The rural demand has been a major concern for various industries, and we believe that rural consumption remains to be a challenge, though the incremental deterioration has started to slowdown.

- Domestic Food Inflation: Even though the domestic core inflation has been in control, there has been significant food inflation which has been a driving factor of overall inflation missing RBI’s target levels.

Top 3 tailwinds:

- Fall in Interest rates: As inflationary pressure has eased, there are expectations of ease in the interest rates, both globally and domestically.

- Private Capex: Private capex has started to rise, after remaining subdued. Rise in private capex, clubbed with the high government capex is expected to be a major tailwind in the market.

- Flows in the market: Both DII and FII flows were strong in CY23 and moving ahead, it would be a major factor to provide continuous liquidity in the markets.

Q2. Is 2024 anticipated to be a year characterized by rate cuts, and how do you perceive the pace at which rates will decline in the US?

Source: CMIE, Kotak Institutional Equities, ASK IM Research

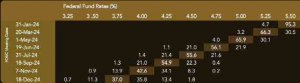

We are now at a point where peak interest rate is in sight and should possibly see drop-in rates in CY24 in India and developed economies in general. FED may deliver large rate cuts if recession risks escalate. We expect that in the forthcoming FED meetings this year, each can witness a rate cut of around 25 bps. This should take the rates to 4.75 – 5.0% by June this year and there is a high probability that FED Rates will reach 4% by the end of this year.

Q3. There’s a viewpoint that the Small & Mid Cap segment in Indian Equities has become expensive, warranting caution until a significant correction occurs. Do you agree with this perspective, or are you more optimistic about the segment’s prospects?

In CY23, there has been a significant outperformance by midcap and small cap which has been driven by valuation re-rating in the stocks in this band of market capitalization. Such a high rerating was not visible in the large cap space. Returns from hereon are expected to be more driven by earnings delivery and hence execution prowess of management will be a differentiating factor.

Further, we believe the broader market continues to present opportunities to create returns based on size of opportunity, quality of management and superior earnings growth. Market capitalization is an outcome of these above investment traits. We at ASK Investment Managers, focus more on these investment traits as compared to market cap of a business, which are selected on a bottom-up basis while constructing portfolios.

Q4. Which sector or thematic trend do you believe will perform well irrespective of global risks, and uncertainties surrounding domestic elections?

In the interim budget 2024-25, the Government continued its stance of high govt. capex by hiking the allocation by over 11% YoY. Along with that, riding on private capex we expect manufacturing and infrastructure sector and capital goods to be large beneficiaries moving forward.

With domestic elections around the corner, there is an expectation that there will be larger focus on reviving the rural demand along with increasing the overall consumption in the domestic market. This can potentially help consumption and financial sectors to play out in the upcoming short run.

Q5. How do you see sector weights changing in the composition of Nifty 500 as we see market cap crossing $6 trillion & move towards $10 trillion by 2030?

Indian Government has been focusing on increasing the share of Indian manufacturing sector’s contribution in the overall GDP, which currently constitutes majorly of agriculture and services. Further, there would be focus to increase goods exports, which has been a laggard compared to service exports. This is expected to continue and pan out in the next few years. This would increase the weights of manufacturing, capital goods, defense and automobiles.

Further, as India’s per capita income rises, there would be a rise in the disposable income which would be beneficial for the discretionary consumption sector. Lastly, we might see some new age companies rise and witness holding a larger weight in the broader market. These companies might give rise to new specific sub sectors like platforms, AI based technology companies, etc.

The author is the Senior Vice President – Products. The views and opinions expressed in this article are personal.