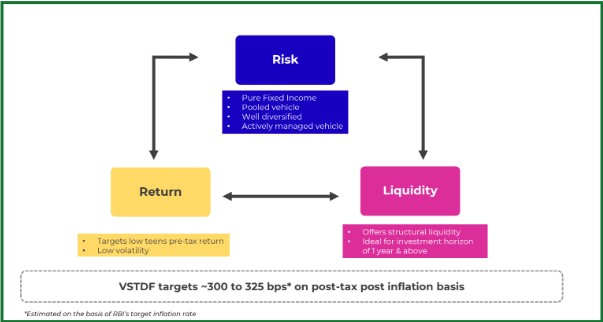

The Vivriti Short Term Debt Fund aims to deliver consistent returns by targeting 300-325 basis points of post-tax, post-inflation real returns. The fund is designed for a minimum investment horizon of one year, offering structural liquidity and low volatility.

The Vivriti Short Term Debt Fund is designed to generate superior risk-adjusted real returns by investing in investment-grade debt securities issued by mid-market operating companies, ensuring diversification across issuers and sectors. As a pure fixed-income product, the fund delivers relatively predictable and less volatile returns compared to other open-ended mutual funds. Structured as a Category III AIF, it offers the flexibility of quarterly partial or full redemptions, providing investors with a unique combination of liquidity and stability. Additionally, the fund enables quicker and more consistent access to private credit markets compared to Category II AIFs, making it a compelling choice for investors seeking stable income with efficient portfolio management.

Key Features

- Target Returns:

- Pre-tax XIRR: 13.5% to 14%.

- Post-tax XIRR: ~7-7.25%.

- Subscription & Redemption:

- Fortnightly subscriptions and quarterly redemptions with a 15-day notice period.

- No lock-in period; however, a 2% exit load applies for redemptions within 180 days.

- Risk Management:

- Strict adherence to investment-grade credit quality.

- Positive ALM even under stress scenarios (20% stress factor considered).