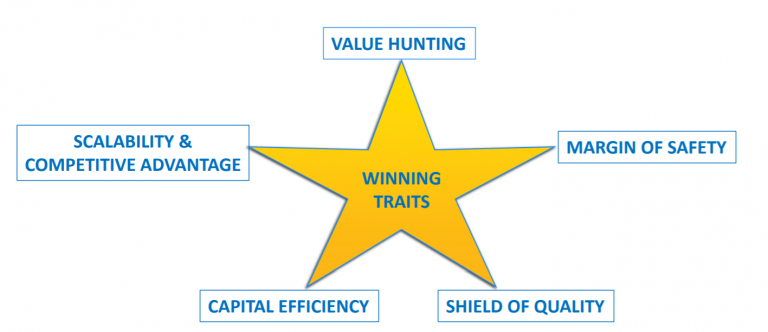

• Stock Selection is market cap agnostic. We understand that price and value are two different things. – VALUE HUNTING.

• Investment is contemplated only when the value determined is greater by at least 15% to the current market valuation. – MARGIN OF SAFETY.

• Invest in companies with high standards of corporate governance and high moral values. We are comfortable investing in such companies going through tough times because of external environment rather than investing in companies declaring great numbers belying environment. – SHIELD OF QUALITY.