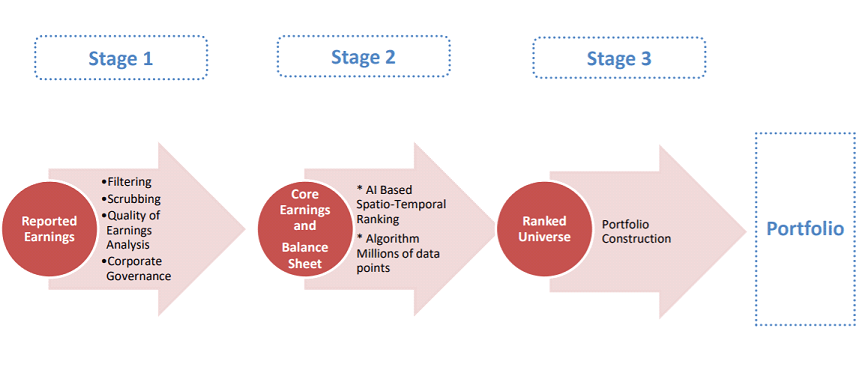

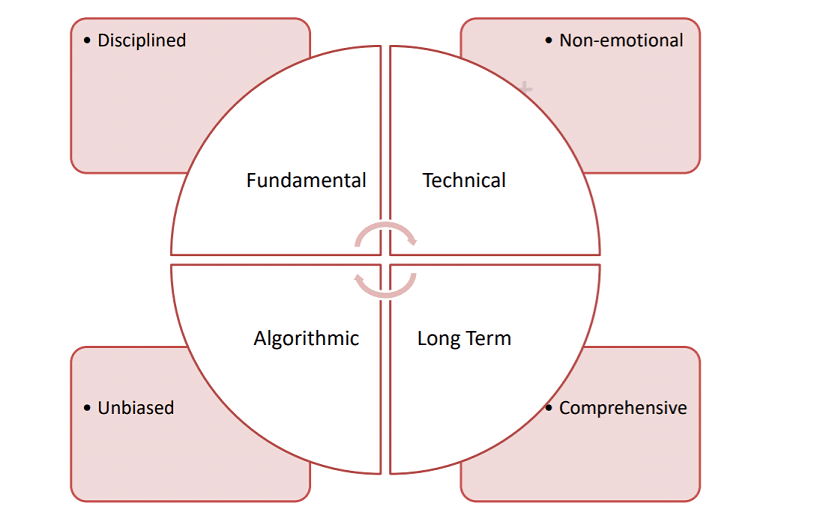

Own diversified portfolio of 12 – 35 high-quality Companies with Intelligent Ranking Algorithm / Strong focus on Business Fundamentals/Risk Management

| Alpha (1Y) | Beta (1Y) | Standard Deviation (1Y) | % of +ve Months (SI) |

|---|---|---|---|

| -2.45% | 0.59 | 11.53% | 64.22% |

Performance Table #

| Trailing Returns (%) | 1m return | 3m return | 6m return | 1y return | 2y return | 3y return | 5y return | 10y return | Since inception return |

|---|---|---|---|---|---|---|---|---|---|

| AccuraCap Alphagen | 9.30% | -13.00% | -16.60% | 1.80% | 21.00% | 11.20% | 22.00% | - | 12.90% |

| BSE 500 TRI | 7.30% | -4.40% | -11.80% | 6.00% | 21.80% | 13.70% | 26.30% | - | 14.60% |

QRC Report Card *

| Strategy | Category | Fund Manager | Date of Inception | Age Of PMS | Corpus (in Cr, approx) | Benchmark | Returns SI (CAGR) | Stocks In Portfolio | Sectors In Portfolio |

|---|---|---|---|---|---|---|---|---|---|

| AccuraCap Alphagen | Multi Cap | Dr. Naresh Chand Gupta and Raman Nagpal | 31 December 2015 | 9Y 3M | 71.48 | BSE 500 TRI | 12.90% | 35-40 | NA |

| Portfolio Quality (Q) | Portfolio Risk (R) | Portfolio Consistency (C) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Index | Category Alpha (1Y) | Relative Alpha (1Y) |

% of +ve Months

(Fund Data) |

Alpha (1Y) | Beta (1Y) |

Standard Deviation (1Y)

(Fund Data) |

Sharpe Ratio (1Y)

(Fund Data) |

Alpha (SI) | Information Ratio (SI) | Consistency Ratio % |

| Nifty 50 | 12.70% | -0.02% | 64.22% | 12.68% | 0.76 | 11.53% | 1.54 | 2.20% | 0.25 | 53.21 % |

| Nifty 500 | 8.12% | -1.8% | 6.32% | 0.81 | 0.79% | 0.11 | 50.46 % | |||

| Nifty Midcap 100 | -1.03% | -1.34% | -2.37% | 0.76 | -2.42% | -0.27 | 44.95 % | |||

| Nifty Smallcap 100 | -0.75% | -1.7% | -2.45% | 0.59 | 0.82% | 0.07 | 43.12 % | |||

VIEW DETAILED QUALITY, RISK, CONSISTENCY ANALYSIS

Portfolio Holdings

| Holding | % |

|---|

Sector Allocation

| Holding | % |

|---|

Market Cap Allocation

| Allocations | % |

|---|---|

| Large Cap | 32.86 |

| Mid Cap | 24.67 |

| Small Cap | 39.94 |

| Cash | 2.54 |

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION

Disclaimer

#Returns as of 31 Mar 2025. Returns up to 1 Year are absolute, above 1 Year are CAGR.

*QRC Report Card data is updated quarterly. Current data is as of Dec 24.