The name “Four2Eight Opportunities Fund” signifies the fund’s target of leveraging India’s economic growth trajectory. The fund aims to capitalize on India’s potential growth from a $4 trillion economy to an $8 trillion economy over the next 7-8 years. This ambitious goal reflects the fund’s strategy to invest in sectors and companies that are poised to benefit from this substantial economic expansion.

Abakkus Asset Managers Four2Eight Opportunities Fund- Category II AIF

Fund Category: Category II AIF

Sub-Category:

Long Only / Short Only / Private Equity / Debt / Growth Stage Unlisted etc

Structure: Close Ended

Fund Tenure: 6 years & 6 months (from first close) + 1 + 1 years

Founder's Name: Mr. Sunil Singhania

Fund Manager: Ankit Agarwal

Investment Objective

Investment Philosophy

Abakkus Asset Manager LLP’s Four2Eight Opportunities Cat II AIF Fund adheres to an investment philosophy focused on generating alpha by investing in fundamentally undervalued businesses with reasonable growth expectations. The fund believes in:

- Alpha Generation: Investing with the intent to outperform market returns by focusing on growth companies with higher-than-average profitability.

- Fundamental Analysis: Emphasizing bottom-up research, concentrating on balance sheet strength, and prioritizing earnings over presentations and hype.

- Contrarian Approach: Being willing to invest early or exclusively, not chasing market momentum, and considering opportunities across sectors, market caps, and business cycles.

- Patient Investment: Approaching investments with a long-term perspective, akin to a business partner.

- Agility and Flexibility: Evaluating each investment opportunity on its individual merits, without being constrained by a specific theme or style.

- Risk-Reward Balance: Ensuring that expected returns justify the risks taken, focusing on the price paid and the value derived.

Investment Strategy

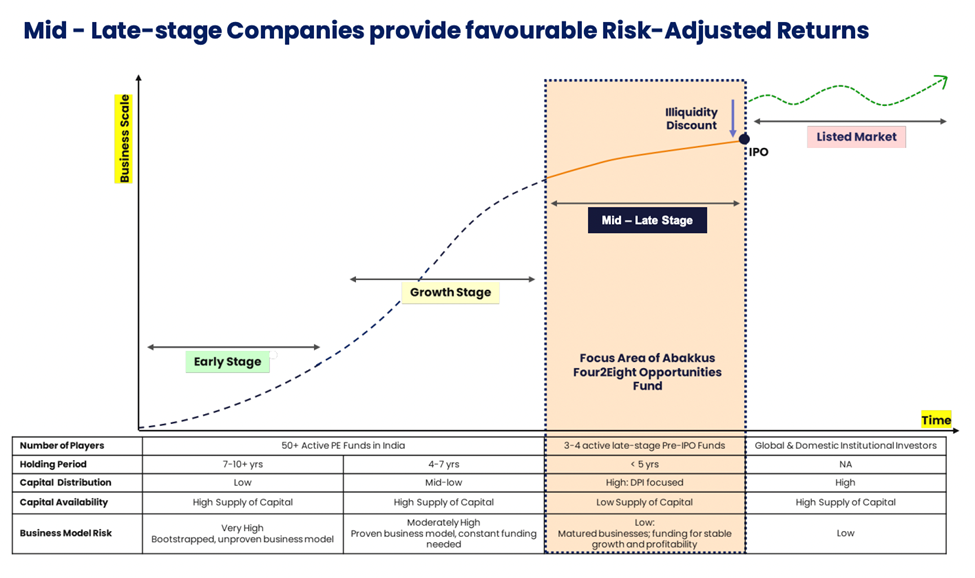

Abakkus Asset Manager LLP’s Four2Eight Opportunities Cat II AIF Fund’s strategy is to invest in mid to late-stage companies that are on the verge of going public. It primarily focuses on:

- Mid to Late-Stage Companies: Targeting companies with established business models, profitability, and strong management teams.

- Secondary Market Opportunities: Investing in companies where promoters or private equity/venture capital funds are looking to exit.

- PIPE (Private Investment in Public Equity) Deals: Providing growth capital or recapitalization to listed companies.

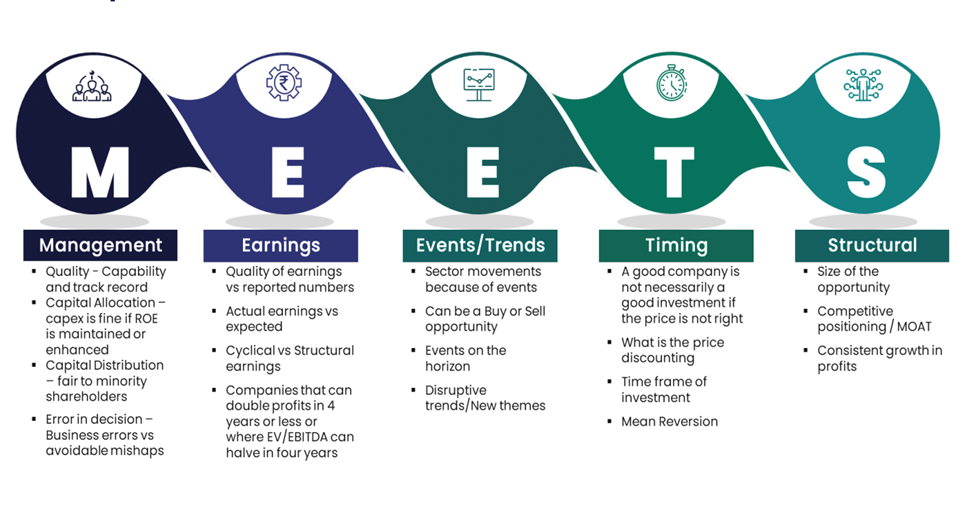

The fund follows a time-tested investment philosophy and MEETS framework to achieve its objectives.

Investment Process

Abakkus Asset Manager LLP’s Four2Eight Opportunities Cat II AIF Fund employs a rigorous investment process encompassing:

- Company Selection: Focusing on established, profitable companies with robust management.

- Due Diligence: Conducting thorough reference checks with listed peers and leveraging industry connections.

- MEETS Framework: Evaluating opportunities based on Management quality, Earnings quality, Events/Trends, Timing, and Structural factors.

- Risk Management: Assessing and mitigating risks associated with each investment.

- Exit Strategy: Identifying optimal exit points through secondary market sales or IPOs to maximize returns.

The 4 Ds: The expected growth from $4 trillion to $8 trillion is attributed to four key drivers:

- Democracy: Political stability promoting inclusive development and long-term investment.

- Domestic Consumption: Increasing consumer demand, incentivizing investment in capacity expansion and technology.

- Demography: A young and growing population driving consumer demand and economic activity.

- Digital Dividend: The digital revolution fostering entrepreneurship, innovation, and financial inclusion.