Topics that are not just to-the-point, but also address real questions and attempt to answer with a practical approach.

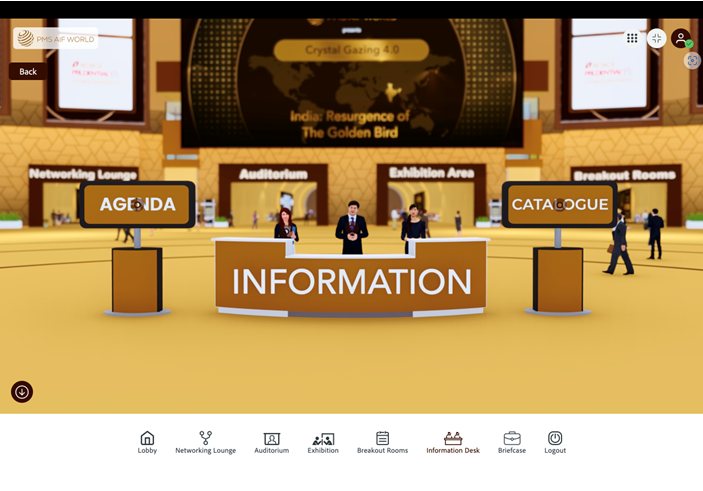

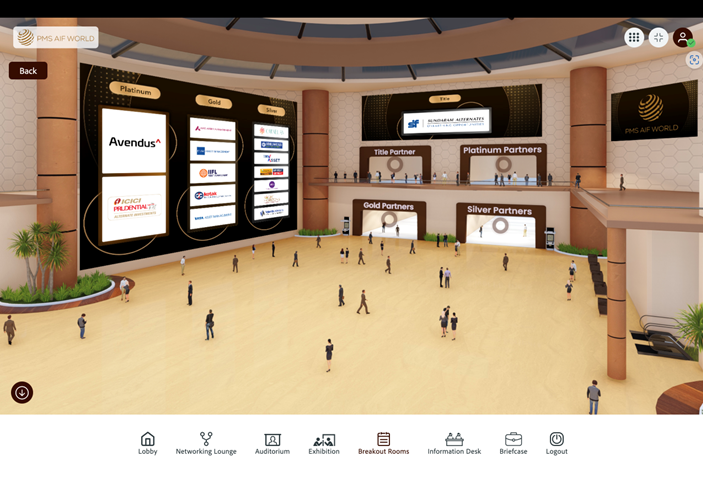

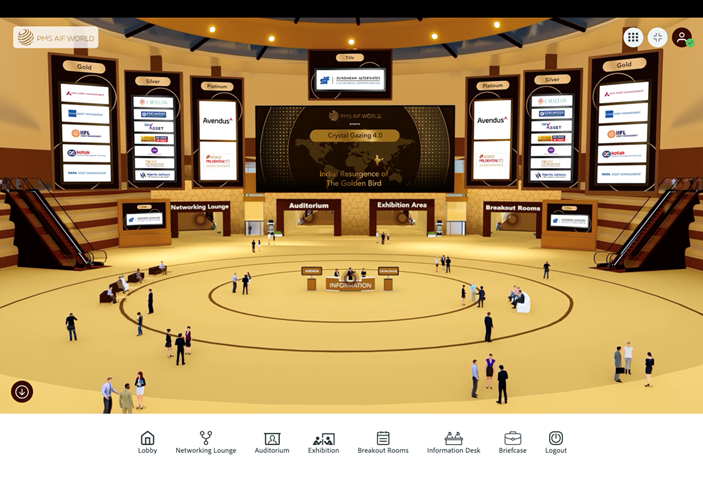

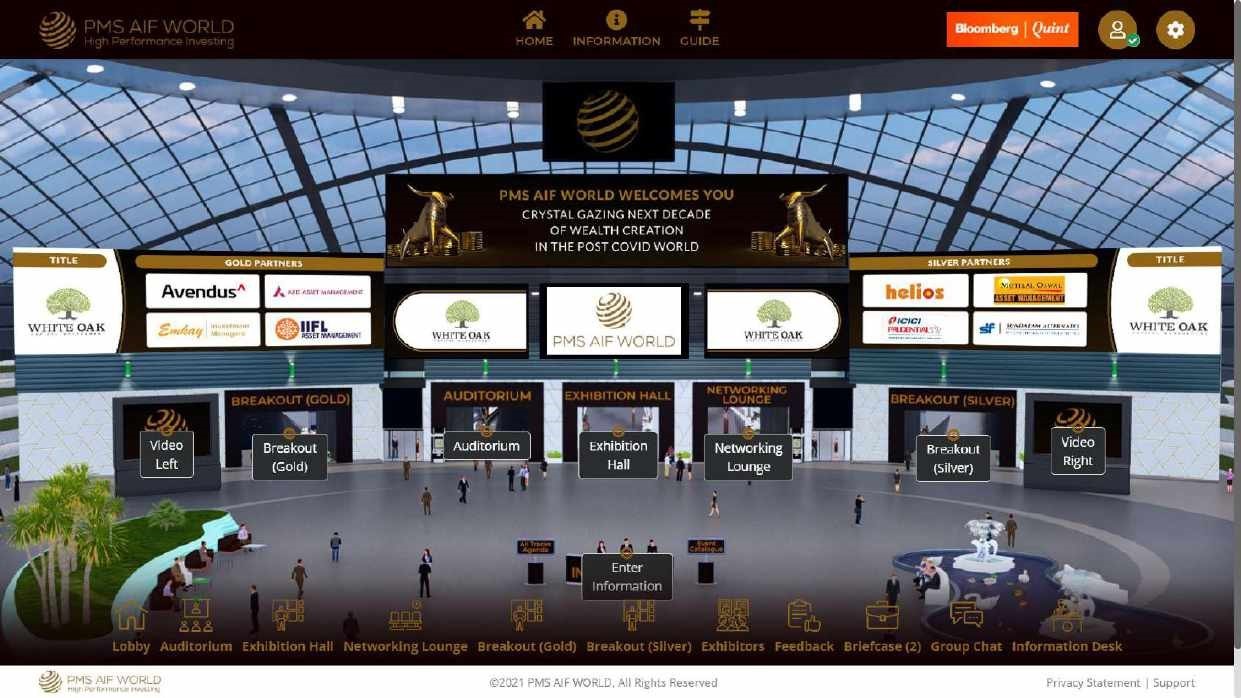

Virtual Event

Crystal Gazing 2.0

Where Will Wealth be Created In The Post Covid World

5th and 6th February, 2021

Expert talks with

Industry Leaders

High Performance

Philosophies

Relevant

Call to Actions

Mark Your Calendar

05 Feb 2021

02:30 PM to 07:30 PM

06 Feb 2021

10:00 AM to 03:30 PM

What Can One Expect?

Discerning Topics

Distinguished Panel

Speakers selected and placed with aim of adding immense insight & justice to the topic of panel discussion throughout.

Domain Experts

Finest minds from different areas who are domain experts from industry, sector, economy to discuss related topics.

Decisive Judgements

Not just convincing arguments, but decisive judgments that eventually provides fine learnings and clarity to the viewers.

We welcome you to this insightful experience!

Esteemed Speakers

Prashant Khemka Portfolio – White OAK Capital

Mr. Prashant Khemka, Founder – White Oak Capital Management

Prior to setting up White Oak Capital Management Consultants LLP in June 2017, an investment advisory firm in India, Mr. Prashant Khemka spent 17 years at Goldman Sachs Asset Management (GSAM) from March 2007 to March 2017, and also for the Global Emerging Markets (GEM) Equity from June 2013 to March 2017. He won several accolades as the CIO and Lead PM of GS India Equity. He and his fund won several awards including AAA rating from Citywire and Elite rating from Fund caliber among others. In addition to his long-standing India investing experience, Prashant brings a unique perspective derived across developed and emerging market equities and has successfully managed US and global emerging markets funds for leading institutions, during the last two decades.

Prashant graduated with honors from Mumbai University with a BE in Mechanical Engineering and earned an MBA in Finance from Vanderbilt University, where he received the Matt Wigginton Leadership Award for outstanding performance in Finance. He was awarded the CFA designation in 2001 and is a fellow of the Ananta Aspen Centre, India.

Andrew Holland Portfolio – Avendus Capital

Andrew Holland

CEO – Avendus Capital Alternate Strategies

Prior to joining Avendus Capital Public Markets Alternate Strategies LLP, Andrew was the CEO of Ambit Investment Advisors where he built one of India’s largest and most successful Hedge Funds. He also was the Managing Director – Strategic Investment Group for Merrill Lynch in India.

He has worked with leading investment Banks, including County Nat West in UK, Barclays in UK and South Korea, Credit Suisse in Japan; with a total investment banking experience spanning 30 years. Throughout his career, Andrew has been recognised as a leader and a visionary in Institutional Equity Research and has been rated among the top 3 analysts consistently by independent surveys in UK and South Korea.

Raamdeo Agrawal Portfolio – Motilal Oswal

Raamdeo Agrawal

Chairman, Motilal Oswal Financial Services Limited

An awardee of Rashtriya Samman Patra by the Central Board of Direct Taxes, Raamdeo Agrawal is chairman of Motilal Oswal Financial Services Limited (MOFSL) and the driving force behind the company’s approach to investing. Mr. Agrawal has created the “QGLP” (Quality Growth Longevity & favorable Price) Investment Process and its ‘Buy Right, Sit Tight’ investing philosophy. Mr Agrawal is also the driving force behind the MOFSL Groups highly awarded research. He has been authoring the annual Motilal Oswal Wealth Creation Study since its inception in 1996. An Associate of Institute of Chartered Accountant of India and a member of the National Committee on Capital Markets of the Confederation of Indian Industry, he has also been featured on ‘Wizards of Dalal Street on CNBC TV 18.

Samir Arora

Samir Arora

Founder – Helios Capital

Samir Arora is the main founder & fund manager at Helios Capital. From 1998 to 2003, he was the Head of Asian Emerging Markets at Alliance Capital Management in Singapore (both fund management and research, covering 9 markets). From 1993 to August 2003, Samir was the Chief Investment Officer of Alliance Capital’s Indian mutual fund business and, along with managing Alliance Capital’s Asian Emerging Markets mandates, managed all of Alliance Capital’s India-dedicated equity funds.

In 1993, Samir relocated to Mumbai from New York as Alliance Capital’s first employee in India to help start its Indian mutual fund business. He also managed ACM India Liberalization Fund an India-dedicated offshore fund from its inception in 1993 till August 2003. Prior to 1993, he worked with Alliance Capital in New York as a research analyst.

At Alliance Capital, India-dedicated mutual funds managed by Samir received over 15 awards during his tenure, including AAA rating from Standard and Poor’s Micropal for four years in a row (1999 to 2003) for the India Liberalization Fund. In 2002, he was voted as the most astute equity investor in Singapore (rank: 1st) in a poll conducted by The Asset magazine. More recently Helios Strategic Fund has been nominated for the Best India Fund by Eurekehedge in 2006, 2007, 2008, 2010, 2011, 2013, 2015, 2016, 2018 & 2020 and has won the award four times. Helios Strategic Fund has also received the AsiaHedge Award 2018 for its long-term (five years) performance.

Samir Arora received his undergraduate degree in engineering from the Indian Institute of Technology, New Delhi in 1983 and his MBA (gold medalist) from the Indian Institute of Management, Calcutta in 1985. He also received a master’s degree in finance from the Wharton School of the University of Pennsylvania in 1992 and was a recipient of the Dean’s scholarship for distinguished merit while at Wharton.

He likes to read books (not on kindle though), watch movies and attend live sporting events. Samir has total investing experience of 29 years. At PMS AIF WORLD, we have interacted a few times with Mr. Arora and his wise insights have always helped our audience navigate challenging market periods.

Hiren Ved Portfolio

Hiren Ved

Co-founder and CIO – Alchemy Capital

Hiren Ved, an equity market veteran, serves as the Whole-Time Director and CIO at Alchemy Capital Management where he has been leading the firm’s Asset Management business. With over 30 years of experience in the Indian equities market, Hiren has developed a sustainable long-term investment philosophy based on fundamental research. He is known for his deep sector knowledge, bottom-up research skills and stock picking abilities. Hiren manages and advises funds over USD 931 million (as on June 30, 2023) across domestic PMS and offshore institutional mandates for Alchemy Capital. He holds a graduate degree in Accounting from Mumbai University and a post-graduation in Management & Cost Accounting from The Institute of Cost Accountants of India

Karan Bhagat Portfolio – IIFL Wealth

Karan Bhagat

Founder, MD & CEO – IIFL Wealth

Karan Bhagat is the Founder, Managing Director, and Chief Executive Officer of IIFL Wealth & Asset Management. Karan joined IIFL Holdings Ltd. (formerly India Infoline) to set up IIFL Wealth & Asset Management in 2008.

Karan has more than two decades of experience in the financial services industry. He is responsible for providing direction and leadership towards the achievement of the organization’s philosophy, mission, vision and its strategic goals and objectives. He has built a team of experienced and talented professionals, who manage some of the most distinguished families in India & abroad.

Under his able leadership, IIFL Wealth & Asset Management has grown from its humble beginnings to one of the leading wealth management companies in India managing more than USD25 billion in client assets.

He featured in Fortune India’s ‘40 under 40’ list in 2016 and 2017 and The Economic Times ‘40 under Forty’ list in 2017. He has received the URS Asia One Global Indian of the Year award in 2018. Karan holds an MBA in Finance from the Indian Institute of Management, Bangalore and acquired his bachelor’s degree in Commerce from St. Xavier’s College, Kolkata.

Sunil Singhania

Sunil Singhania

Founder – Abakkus Asset Management

Sunil Singhania, CFA, is the Founder of Abakkus Asset Management, LLP, an India-focused Asset Management Company he established in 2018. Prior to this, in his role as Global Head – Equities at Reliance Capital Ltd., he oversaw equity assets and provided strategic inputs across Reliance Capital Group of companies including asset management, insurance, AIF and offshore assets. And as CIO – Equities, Singhania led Reliance Mutual Fund (now Nippon India Mutual Fund), equity schemes to be rated amongst the best. Reliance Growth Fund (now Nippon India Growth Fund) grew over 100 times in less than 22 years under Singhania’s leadership. Furthermore, he led Reliance Asset Management (now Nippon Life Asset Management) Ltd.’s international efforts and was instrumental in launching India funds in Japan, South Korea, and the UK, besides managing mandates from institutional investors based in the US, Singapore, and other countries. In this capacity, he provided strategic insights and managed equity assets across the Reliance Capital Group, encompassing asset management, insurance, AIF, and offshore assets.

Sunil Singhania, a highly acclaimed figure in the world of finance, has a distinguished career that spans over several decades. His remarkable achievements have solidified his position as a prominent fund manager and industry leader.

Recognized as one of the Best fund managers by Outlook Business in 2016 and 2017, Sunil’s excellence extends over a 10-year timeframe. He achieved a significant milestone by becoming the first Indian to be appointed to the Global Board of the CFA Institute, USA, a position he held from 2013 to 2019. Furthermore, Sunil Singhania currently stands as the sole Indian appointed to the IFRS Capital Market Advisory Committee (CMAC) from 2020 to 2023.

Beyond his impressive career, Sunil Singhania actively contributed to the finance community. He served as the Promoter of The Association of NSE Members of India, representing stock brokers. Sunil’s commitment to advancing the industry led to historic achievements, such as being the first individual from India to be elected as a member of the CFA Institute Board of Governors. His significant roles within the CFA Institute include Chair of the Investment Committee and a member of the Nominating Committee. Moreover, he served on CFA Institute’s Standards of Practice Council for a substantial six-year term. Sunil Singhania was instrumental in founding the Indian Association of Investment Professionals, now recognized as CFA Society India, and held the position of its President for eight years.

Sunil Singhania embarked on his educational journey by graduating in commerce from Bombay University. He solidified his expertise by completing his Chartered Accountancy from the ICAI, Delhi, earning an all India rank. Additionally, he holds the prestigious Chartered Financial Analyst designation conferred by CFA Institute. Sunil’s global perspective was enriched through extensive international travel and participation in numerous global investment conferences and seminars.

Notably, Sunil Singhania was a key member of the 15-member international committee responsible for rewriting the Code of Ethics handbook of the CFA Institute. His substantial contributions within the finance sector have left an indelible mark on the industry.

Samit Vartak

Samit Vartak

Founding Partner and CIO, SageOne Investment Managers

Samit Vartak, Founding Partner and Chief Investment Officer of SageOne Investment Managers LLP

Samit has worked closely with various companies in the US and India, advising them on business strategy, profit optimization, growth and valuation. This experience forms the backbone that helps him better understand businesses and their fair value. He has been early in identifying and investing in multiple businesses across industries before they catch market attention. Samit actively shares his knowledge and learnings through widely followed investor newsletters, lectures at CFA society/industry forums/business schools and media interviews. Samit returned to India in 2006 after spending a decade in the USA working initially in corporate strategy with Gap Inc. and PwC Consulting, and then with Deloitte and Ernst & Young advising companies on business valuation and M&A. Samit is a CFA® charter holder, an MBA from Olin School of Business of the Washington University in St. Louis and holds a Bachelor of Engineering degree with Honors from Sardar Patel College of Engineering (SPCE), Mumbai University.

Anup Maheshwari Portfolio – 360 One Asset

Anup Maheshwari

Chief Investment Officer and Joint – Chief Executive Officer, 360 One Asset

Anup Maheshwari is the Chief Investment Officer and Joint – Chief Executive Officer of 360 One Asset. Anup is responsible for the investment and strategy for 360 One AMC’s business including mutual funds and Alternative Investment Funds (AIFs). He plays a key role in meeting the company’s aggressive growth goals as well as product development and devising an innovative investment strategy.

An alumnus of the Indian Institute of Management, Lucknow, he has over 25 years of work experience in the financial services sector. Prior to joining 360 One Asset , he has been associated with DSP Investment Managers Private Limited (formerly known as DSP BlackRock Investment Managers Private Limited) for over 21 years as an Executive Vice President & Chief Investment Officer. He was also associated with HSBC Asset Management (India) Private Limited & Merrill Lynch India Equities Fund (Mauritius) Limited.

Anup was the chief investment officer at HSBC Asset Management between December 2005 and May 2006 before returning to DSP Investment Managers. Prior to joining DSP Investment Managers, he had worked for Chescor, a British fund management firm that used to run three offshore funds investing in Indian equities.

Harish Nair Portfolio – Consulting, CBRE South Asia Pvt Ltd

Harish Nair

Executive Director – Consulting, CBRE South Asia Pvt Ltd

Harish Nair is an Executive Director with the Consulting Team of CBRE South Asia Pvt Ltd and is heading the Consulting business for CBRE in India. He has been with CBRE for over 18 years. Harish has been instrumental in building this business and adding value to variety of clientele in the Indian sub-continent & International Markets.

During his tenure with the CBRE, Harish has been extensively involved in provision of advisory solutions for large scale integrated projects across various domains including residential townships, commercial land utilization of airports, integrated mixed-use developments, hospitality related projects, educational institutes, senior living developments, privatization mandates, industrial development consultancy, etc.

Rahul Rathi Portfolio – Purnartha PMS

Rahul Rathi

Chairman & Fund Manager, Purnartha Investment Advisers

Rahul Rathi is the Chairman and Fund Manager at Purnartha Investment Advisers (Purnartha) Private Limited. He has over 20 years of investment and risk management experience gained from working with global financial institutions in New York, London and Asia.

For over 10 years, Rahul has designed and driven the Purnartha Investment philosophy of long-term wealth generation and has an audited, stellar performance track record. This sustained performance is largely attributed to Rahul’s experience and investment in people, processes and data which he has built from ground up.

He serves on the board of directors at Onward Technologies Limited and Plastiblends India Limited. He has equity ownership in Capital Metrics and Risk Solutions and is also a partner in Beharay Rathi Group of companies. Rahul is an active contributor in society and is a trustee on Pune Blind Men’s Associations H.V Desai Eye Hospital and Laxminarayan Devasthan trusts. He is an academic expert on Kaveri group of Institute’s College. Rahul has a Master’s in Industrial Administration from the Carnegie Mellon University and BE in Polymer Engineering from the University of Pune

Kenneth Andrade Portfolio – PMS AIF WORLD

Kenneth Andrade

Founder & CIO – Old Bridge Capital Management

Kenneth Andrade is the Founder and Chief Investment Officer of Old Bridge Capital Management. He manages the investment process and leads investment ideation for inclusion of stocks within the investment portfolio at Old Bridge. Kenneth has over 30 years of experience in Indian Capital Markets in portfolio management and investment research.

Prior to founding Old Bridge Capital Management in December 2015, Kenneth was Chief Investment Officer at IDFC Asset Management, where he was responsible for building the firm’s equity franchise and managed one of India’s largest equity funds by AUM. He overlooked a corpus of US$ 8 billion.

Dinshaw Irani Portfolio

Dinshaw Irani

Chief Investment Officer, Helios India

Dinshaw Irani is the Chief Investment Officer of Helios India. Prior to this, he was Executive Director at Artemis Advisors (exclusive research advisors to Helios Singapore) for over 14 years. As the head of Artemis Advisors, Dinshaw led the research process, from industry outlook and idea generation to final recommendation. Prior to joining Artemis in 2005, he was the Principal Portfolio Manager at Sharekhan during 2003-04, setting up their portfolio management services division. Prior to his stint at Sharekhan, Dinshaw was Vice President in the Asian Emerging Markets team for Alliance Capital in Mumbai for over 3 years covering the consumer and pharmaceutical sectors. Before Alliance, Dinshaw has worked at Sun F&C Mutual Fund and at Lloyd Securities. Dinshaw enjoys traveling to new places where he can spend time outdoors on hiking trails and in nature parks. Dinshaw is a graduate in Commerce (Hons.) and holds a post-graduate diploma in Rural Management from the Institute of Rural Management, Anand. Dinshaw has total investing experience of 28 years.

Navin Agarwal Portfolio – Motilal Oswal

Navin Agarwal

CEO – Motilal Oswal Asset Management Company

Mr. Navin Agarwal is the Managing Director and Chief Executive Officer of Motilal Oswal Asset Management Company Limited (MOAMC). Prior to joining MOAMC, he was Managing Director of Motilal Oswal Financial Services Limited. He started his career as an Analyst in 1994, went on to be Head of Research and managed Portfolios till 2000.

He joined Motilal Oswal Group in 2000 and has been responsible for building as well as running various businesses over the last two decades. He is a part of the Executive Board that drives business strategy and reviews for all businesses besides capital allocation of the group.

HMr. Navin Agarwal is affiliated with prestigious organizations like Institute of Chartered Accountants of India, Institute of Cost and Works Accountant of India, Institute of Company Secretaries of India and CFA Institute, Virginia. He has co-authored a book on stock markets “India`s Money Monarchs”.

Aashish P Somaiyaa Portfolio – White Oak Capital Management

Aashish P Somaiyaa,

CEO – White Oak Capital Management

At White Oak, Aashish Sommaiya is responsible for managing and growing its operations. Aashish is an experienced professional and has experience in scaling up and managing relations across well-known AMCs like Motilal Oswal AMC and ICICI Pru AMC.

Master in Finance and Bachelors in Science, brings two decades of industry experience. He was responsible for strategizing, growing, and managing the operations of Motilal Oswal AMC – a niche, focused, expert equity boutique based on its time tested BUY RIGHT: SIT TIGHT investing style. He has been responsible in the past for sales and distribution of one of India’s largest AMCs; ICICI Prudential AMC for their MF, PMS, and Real Estate offerings through multiple distribution channels across India and the Middle East. Led new product development, product management, communication, and distribution channel delivery over a number of years. Aashish is passionate about Investing, Reading, Sales, Marketing, Communication, Training, Teaching, Writing, and Public Speaking. He loves traveling to meet new people.

Rajesh Kothari

Rajesh Kothari

Founder & MD, AlfAccurate

Mr. Rajesh Kothari, Founder and Managing Director of AlfAccurate Advisors, is the visionary behind the customer-driven and excellence based approach. A CWA and an MBA by qualification, he has a rich experience of more than 20 years in the Indian Capital Markets and has handled several investment projects in premier investment institutions.

During his tenure as a Fund Manager at DSP Merrill Lynch Fund Managers (now DSP BlackRock Investment Managers), the equity assets under management flourished from USD 100mn to USD 1.5bn. All through this period of five years, the equity schemes often ranked in its 1st ‘Quartile Ranking’ by CRISIL, a Standard & Poor’s affiliate. This is a testimony to Mr. Kothari’s financial acumen and vast knowledge of investments. He is the recipient of several awards for delivering superior and consistent risk-adjusted returns.

During his tenure as Director of Voyager Investment Advisors, a USA based India dedicated fund, the fund outperformed the benchmark indices significantly. Not surprisingly, CNBC, CRISIL, MyIris and others recognized his performance and awarded him for delivering unrivaled risk-adjusted returns. Economic Times also recognized his performance and awarded him as a ‘Platinum Fund Manager’. Additionally, he won the CRISIL Mutual Fund of the Year Award in 2006 for DSP Merrill Lynch Equity Fund. During his tenure, the fund house also received the Lipper India Fund award for the Best Equity Fund Group for three years. Moreover, he has also been a keynote speaker at several international conferences/summits like Maharashtra Economic Summit, Institute of Directors, TradeTech Asia conference and The World Council for Corporate Governance.

He is also actively involved with ‘Arham Yuva Seva Group’ – a philanthropic initiative with several significant programmes for a better world for the youth.

Amit Jeswani

Amit Jeswani

Founder & Fund Manager , Stallion Asset

Mr Amit Jeswani is a Double Charter, has successfully completed his Chartered Financial Analyst (Virginia, USA) and Chartered Market Technician (New York, USA). He graduated in Business with finance from Kingston University London. He has been investing in capital markets from last 14 years. He started at a tender age of 16 as his father was a Stock Broker and has worked with various financial giants. He is an active member with the Association of Technical Market Analyst and Indian Association of Investment Professionals.

Vikaas M Sachdeva Portfolio – Emkay Investment Managers

Vikaas M Sachdeva

Chief Executive Officer, Emkay Investment Managers Ltd.

Vikaas is an industry veteran with over two decades of experience. In the course of his career, he has held several influential and senior management positions across marquee financial service organizations. He has a broad range of interests across functions like sales, distribution, marketing, Investment banking, product, and customer service.

Vikaas was the CEO of Edelweiss Asset Management Ltd, successfully turning around the business culminating in the acquisition of JP Morgan MF and was also the Global CEO of Enam Asset Management Ltd, where he oversaw both global and domestic side of the business. He has also worked with Birla Sun Life International AMC Ltd., and ING Investment Management (India) Ltd. His industry affiliations include a seat at the Mutual Fund Advisory Committee (MFAC), a special committee of industry professionals selected by SEBI to advise them on governing the MF industry and he was also on the board of the Association of Mutual Funds of India (AMFI), heading the ETF and indexing committee, which submitted the first white paper on ETFs to SEBI.

Trideep Bhattacharya Portfolio – Brand Equity

Trideep Bhattacharya

Senior Portfolio Manager, Brand Equity

Trideep has over 20 years of experience in equities and portfolio management in India and other Asian Emerging Markets as well as developed equity markets. Before joining Axis AMC, he spent a significant time as a portfolio manager at State Street Global Advisors, and with UBS Global Asset Management in London. He has been a well-established stock-picker and sellside analyst in various investor surveys like Institutional Investor and Asia Money.

Saurabh Mukherjea Portfolio – Marcellus PMS

Saurabh Mukherjea, CFA

Founder & CIO, Marcellus

Mr. Saurabh Mukherjea is the Founder and Chief Investment Officer of Marcellus Investment Managers which was incorporated in Aug 2018 and the firm’s application to conduct Portfolio Management Services was approved by SEBI in Oct 2018. He is the former CEO of Ambit Capital and played a key role in Ambit’s rise as a broker and a wealth manager. When Saurabh left Ambit in June 2018, assets under advisory were $800mn.

Balaji Rao Portfolio – Real Estate, Axis AMC

Balaji Rao

Managing Partner – Real Estate, Axis AMC

Balaji Rao is the Managing Partner – Real Estate at Axis AMC. He has joined the company in February 2018 and is responsible for driving the Alternatives Business.

He is a veteran of the real estate industry in India, having over 25 years of in-depth knowledge of the property markets in the country.

Over his career spanning nearly 3 decades, Balaji has undertaken various functional roles and assumed leadership in business development, acquisitions, project execution, funding (both equity and debt) and divestments. Over his career spanning nearly 3 decades, Balaji has worked with several marquee real estate investors including Starwood Capital, Sun Ares, TCG Real Estate, Standard Chartered Bank amongst others.

Balaji is a rank-holding Chartered Accountant and holds an MBA from IIM-Kolkata. He is also a Fellow Member of the Institute of Chartered Accountants of India (ICAI) and Royal Institution of Chartered Surveyors (RICS).

Sachin Shah Portfolio – Emkay Investment Managers Ltd.

Sachin Shah

Fund Manager, Emkay Investment Managers Ltd.

Sachin is a seasoned fund manager with over two decades of experience in the Indian equity markets. By virtue of his extensive research, Sachin realised early-on the need for a framework in which companies with evasively tricky standing needed to be filtered out very objectively, leading to the development of E-Qual Risk, EIML’s proprietary module which helps us to evaluate and compare listed companies on various aspects of governance. Sachin shares his knowledge and insights through various media interactions across print and digital platforms.

Vaibhav Sanghavi Portfolio – Avendus Capital

Vaibhav Sanghavi

Co-CEO & Portfolio Manager, Avendus Capital Alternate Strategies

Vaibhav Sanghavi has over 17 years of experience in managing funds across leading financial institutions. He joined Avendus in December 2016 as Co-CEO of Avendus Capital Public Markets Alternate Strategies LLP.

Prior to Avendus, he was part of Ambit Investment Advisors. Ltd from October 2008 to September 2016. His fund management experience prior to Ambit, was with DSP Merrill Lynch from October 2005 to September 2008, where he was instrumental in building the Proprietary Trading team, managing and advising over USD $1 bn of capital. He has also worked with HDFC Bank, as part of treasury, managing proprietary investments in equities – from 2001 to 2005, with a larger focus on Long/Short.

Vaibhav Sanghavi Portfolio – Avendus Capital

Co-CEO, Avendus Capital Public Markets Alternate Strategies LLP

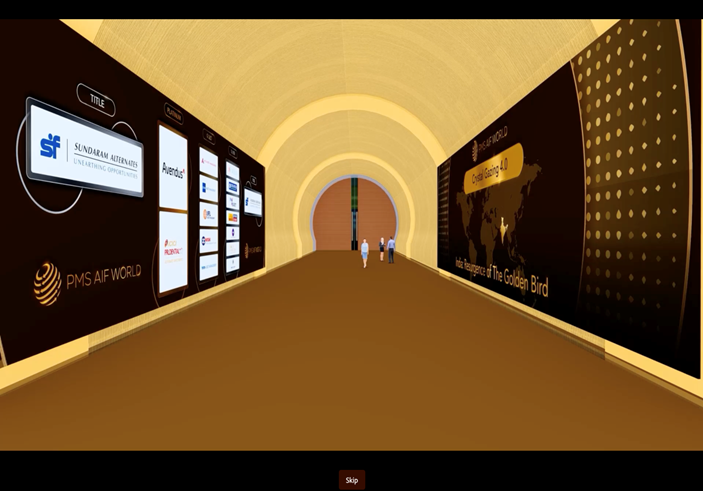

Madanagopal Ramu

Madanagopal Ramu

Head – Equity and Fund Manager,

Sundaram Alternates

Mr. Madanagopal Ramu is the Fund Manager for PMS with around 14 years of experience in the Indian Financial Markets. He currently manages an AUM of Rs. 3100+ crores and has over 4 years of experience in managing funds. He joined Sundaram Mutual fund in 2010 as a Research Analyst from Centrum Broking and has made rapid progress during his tenure in Sundaram AMC. He became Head of Research in April 2015 and started actively managing funds from January 2016. Madan comes with strong academic qualifications. He is a qualified Cost Accountant and has a Management degree from BIM Trichy.

Vikas Khemani

Vikas Khemani, CA, CFA, CS

Founder – Carnelian Asset Advisors

Vikas has ~23 years of capital markets experience, most recently as the CEO of Edelweiss Securities Ltd, where he spent 17 years incubating & building several businesses to leadership position including Institutional Equities and Equity Research.

With a strong business acumen & deep understanding of the Capital Markets, he enjoys strong relationships with Corporate India and is associated with several Industry bodies & committees including the CII National Council on Corporate Governance, FICCI Capital Markets Committee, Executive Council of Bombay Management Association.

He is also a member of Young Presidents Organization (YPO), a global forum for entrepreneurs and CEOs and was awarded Young Professional Achievers Award for the service sector by the ICAI in 2014.

Bhautik Ambani

Bhautik Ambani,

CEO, AlphaGrep

As Chief Executive Officer of AlphaGrep Investment Management, Bhautik will be responsible for

driving business growth, strengthening and expanding the firm’s domestic presence, and enhancing

customer experience. Under his leadership, the company has launched AlphaGrep’s maiden

AlphaMine Absolute Return Fund – Category III AIF (Alternative Investment Fund). He has over 18

years of industry experience.

Prior to joining AlphaGrep, Bhautik was the Executive Director at Avendus Capital Public Markets

Alternate Strategies LLP. Being a founding member of the team, he was responsible for fund raising

and strategy. At Avendus he was instrumental in growing the business to the largest onshore hedge

funds in India. He was also associated with Ambit Capital, Kotak Wealth Management, and Mirae

Asset, in various capacities and positions of leadership.

Bhautik is an M.B.A. in Finance from SP Jain Institute of Management

Karthik Kumar Portfolio – Axis AMC

Karthik Kumar

Portfolio Manager, Axis AMC

Karthik has over 10 years of experience in building and managing Quantitative strategies for India and or the Asia Pacific region. Prior to joining Axis AMC, he was based out of Hong Kong and served as a Portfolio Manager at SilverTree and Asiya Investments. While at Asiya Investments, he helped manage USD 750 million across long-only and long-short strategies for clients including Sovereign Wealth Funds.

He is an MBA from Purdue University, USA; B.E. in Mechanical Engineering and a CFA Charter holder.

Anand Sharma Portfolio – PMS, ICICI Prudential AMC

Anand Sharma

Portfolio Manager – PMS, ICICI Prudential AMC

Anand joined IPAMC in April 2014. In his current role, Anand is a portfolio manager for two of IPAMC’s PMS Strategies – ICICI Prudential PMS Flexicap Strategy and ICICI Prudential PMS Wellness Strategy. He has also covered Pharmaceuticals, Healthcare, Metals, Mining, Sugar and Textiles space as a Research Analyst.

He has a total work experience of over 7 years. Prior to joining IPAMC, he was associated with Oracle Financial Services Software Limited. He has completed his Masters in Management Studies (MMS) in Finance from K.J. Somaiya Institute of Management Studies and Research, Mumbai and B.E. (Computers) from Thadomal Shahani Engineering College, Mumbai.

Amit Ratanpal

Amit Ratanpal

Founder & Managing Director, BLinC Invest

Amit has over 20 years of experience across private equity, capital markets, asset management and investment banking. He has been instrumental in setting up various domestic and global funds and has invested and managed ~₹300Cr across 21 companies out of which 6 companies have achieved exit till date. He has been on the advisory board and investment committee of various funds. At ICICI, Amit set up and led the Private Equity (Fund of Funds) businesses and was an integral part of the International Banking Group. At Birla Sun Life, he was part of the treasury solutions team and led the E-Broking network. He is a Chartered Accountant, holds an Executive MBA from Narsee Monjee Institute of Management Studies and has completed the General Management Program from Harvard Business School.

Dhiraj Sachdev Portfolio – Roha Asset Managers LLP

Dhiraj Sachdev,

Managing Partner CIO,

Roha Asset Managers LLP

Ranked among India’s best fund managers by Outlook Business; Value Research in 2017, Dhiraj Sachdev was a Senior Fund Manager at HSBC Global Asset Management. Prior equity fund management, experience include ASK Investments and HDFC Bank. A leader who leads by example, his 23 years long industry experience saw glory when he delivered long term performance of 29% CAGR for 6 years for HSBC Mid & Small Cap Fund. Dhiraj holds a degree in Commerce (B.com) from Mumbai University, is a qualified Chartered Accountant (ACA) from ICAI and a Cost & Management Accountant (CMA) from ICMAI Institute along-with Diploma in Foreign Trade Management (DFTM) from Mumbai University. Currently he manages AIF and PMS Funds at Roha Asset Managers with a strong track record.

Mitul Patel

Mitul Patel,

Senior Executive Vice President, 360 ONE Asset

Mitul has an overall experience of 14 years across areas of research, fund management, private equity advisory and investment banking. Prior to joining HDFC AMC, he was managing the strategies of Portfolio Management Services offered by IIFL AMC. He also headed the research for listed equities and is responsible for generating investment ideas across sectors and market capitalizations. He has been instrumental in setting up the research desk at IIFL AMC and also directly tracked companies in the chemicals, auto and pharma sectors.

Anunaya Kumar

Anunaya Kumar

Senior Executive Vice President- National Sales Head, 360 ONE Asset

Anunaya Kumar is Senior Executive Vice President & National Sales Head at IIFL Wealth & Asset Management. In this role, his focus is to build a profitable retail franchise and ensure that IIFL AMC becomes the foremost choice for investors and distributors across asset categories. During his professional journey of more than 2 decades, he has held several Senior Leadership Positions with banks and asset management companies and has managed relationships across B2B and B2C verticals. He has successfully managed the corporate banking, retail banking and wealth management profiles for banks before joining asset management companies and heading their Strategies and Sales vertical.

Prior to joining IIFL Wealth, he was associated with Invesco Mutual Fund as Director and Head of Sales. During his professional journey, he has also worked with DSP Blackrock Investment Managers, Royal Bank of Scotland (erstwhile ABN Amro Bank), Citibank N.A. and IDBI Bank Ltd. He is an MBA in Finance and is a Commerce Graduate from Punjab University.

Rajesh Bhatia Portfolio – ITI Long Short Equity Fund

Rajesh Bhatia,

Managing Director & CIO,

ITI Long Short Equity Fund

– 30+ years of investment experience in Indian equities; Last 14 years in Alternative Investments (Long-Short fund management)

– Last assignment: CIO, Simto Investments, a subsidiary of Tata Investments; proprietary book

– Co-founder & CIO, Heritage India Advisors, Indian advisor to New York based, Heritage Capital, an India long-short equity fund; The Heritage Fund was nominated as among the Top 5 funds in India for its performance in 2010, by Eureka Hedge, an independent international data provider and alternate research firm

– Senior VP & Head, Portfolio Management Services (PMS), Reliance Capital Asset Management; started the business unit for the firm in 2004

– Other Assignments : Corporate Database, SBC Warburg and IL&FS Private Equity

– Education : Commerce graduate, H.R. College of Commerce & Economics; ACMA (cost and management accounting); Completed the CFA program conducted by CFA Institute, USA.

Rajesh Bhatia Portfolio – ITI Long Short Equity Fund

Managing Director & CIO, ITI Long Short Equity FundEvent Schedule

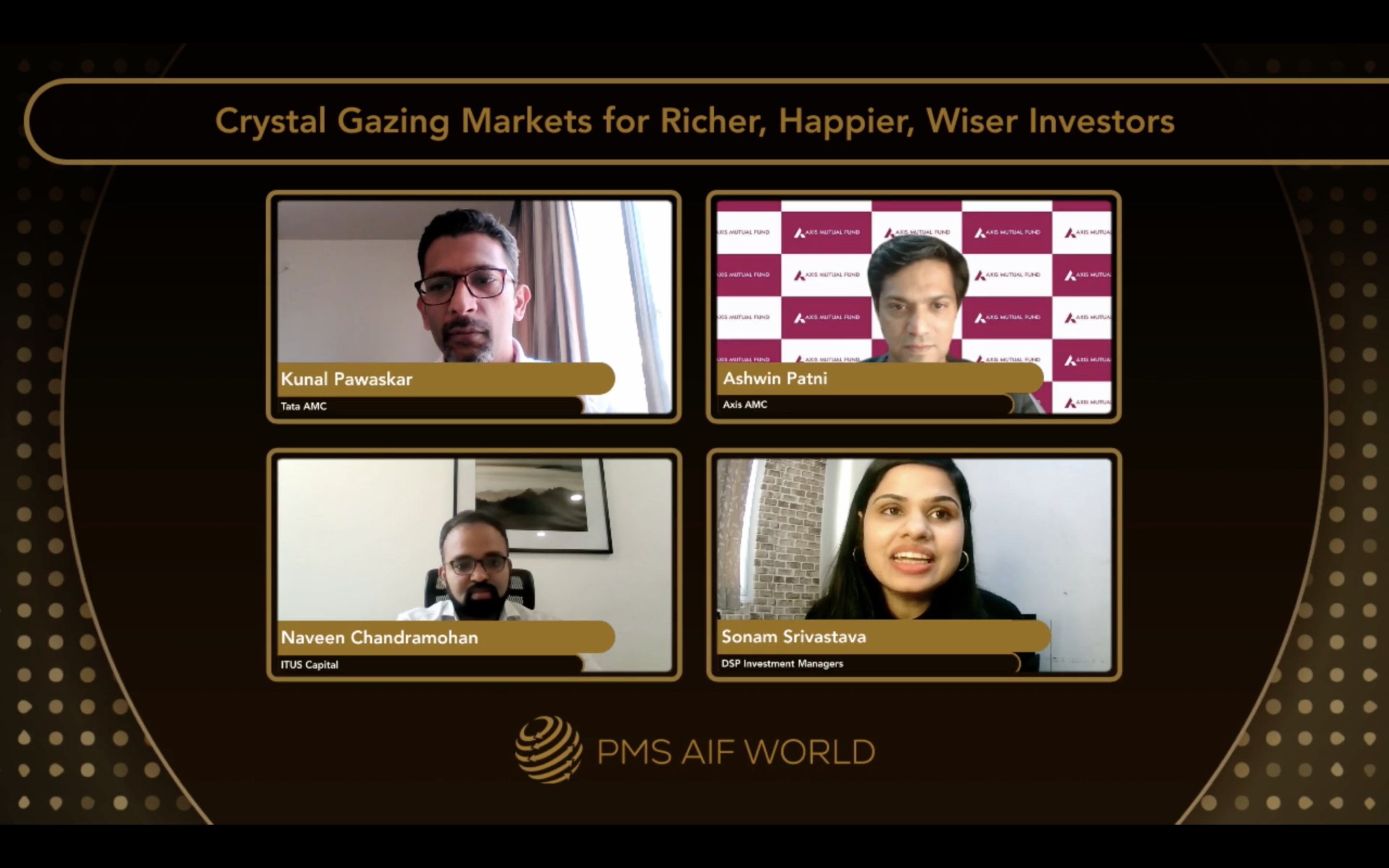

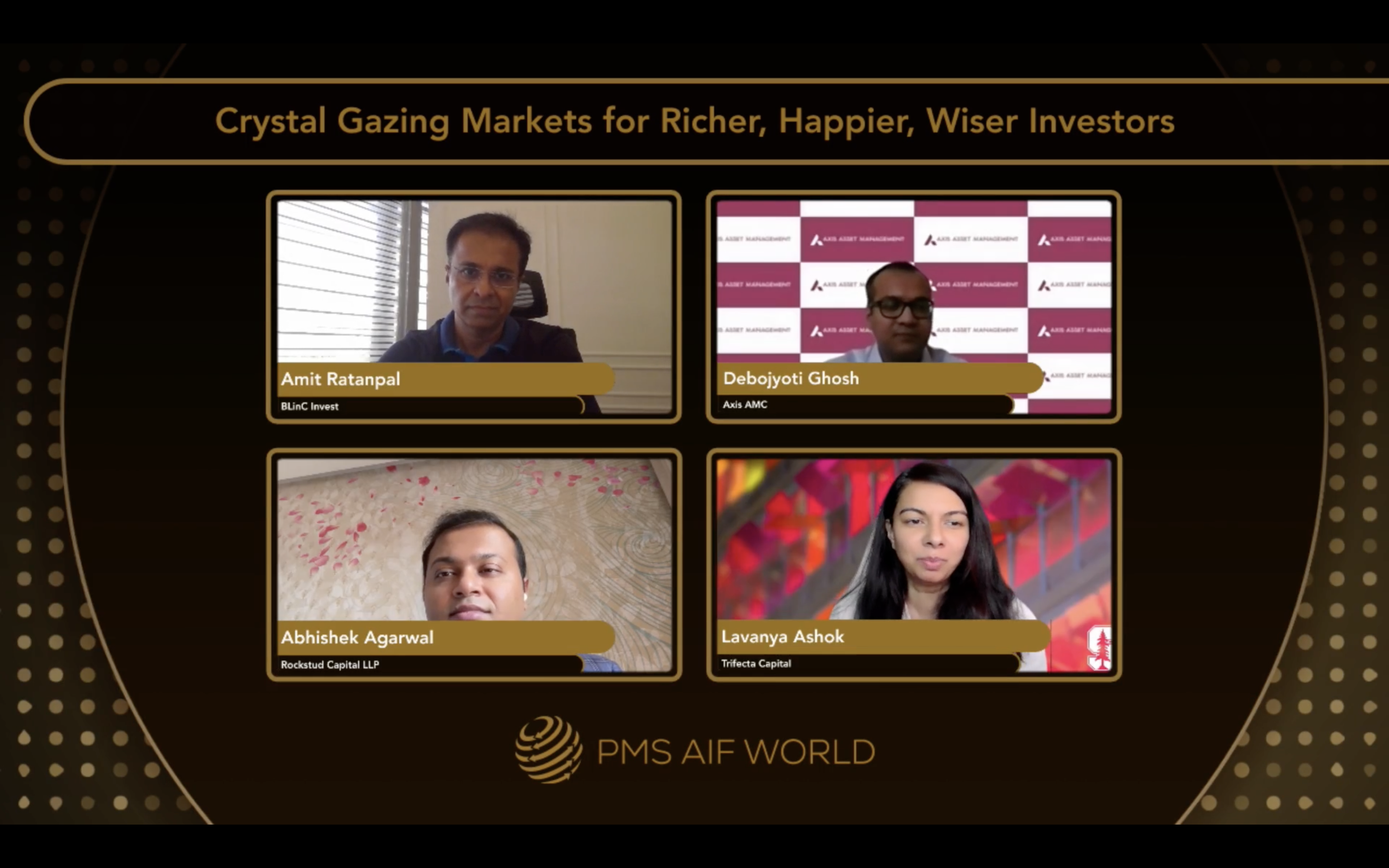

Convergence of Ideas

Day 1 | 5 February 2021

Team PMS AIF WORLD

Welcome Note

Prashant Khemka

How to steer the portfolio towards continued wealth creation through the path crowded with high valuations?

Raamdeo Agrawal | Samir Arora

What do you make out from the behavior of markets in 2020 and how does one apply Buffettology in the new post covid world of Equities?

Vaibhav Sanghavi

Role of alternative investment strategies for better risk-adjusted returns in 2021 and the decade ahead

Mitul Patel | Trideep Bhattacharya | Madanagopal Ramu | Sachin Shah

What philosophy will create more wealth over the next decade: Growth at a reasonable price or Growth at any price or Value investing?

Samit Vartak | Sunil Singhania | Rajesh Kothari | Rahul Rathi

Building Winning Equity Portfolio Aimed At 10x Returns over next 10 Years

Anand Sharma | Karthik Kumar | Amit Jeswani

Philosophy based Vs Quant based asset management for alpha generation over the next decade

Team PMS AIF WORLD

Vote of thanks and context for next day

Day 2 | 6 February 2021

Saurabh Mukherjea | Team PMS AIF WORLD

Spotting Wealth Creation Opportunities for the Next Decade

Prashant Khemka | Kenneth Andrade | Andrew Holland | Hiren Ved

Are we heading towards an asset bubble or the best decade in our lifetime for wealth creation?

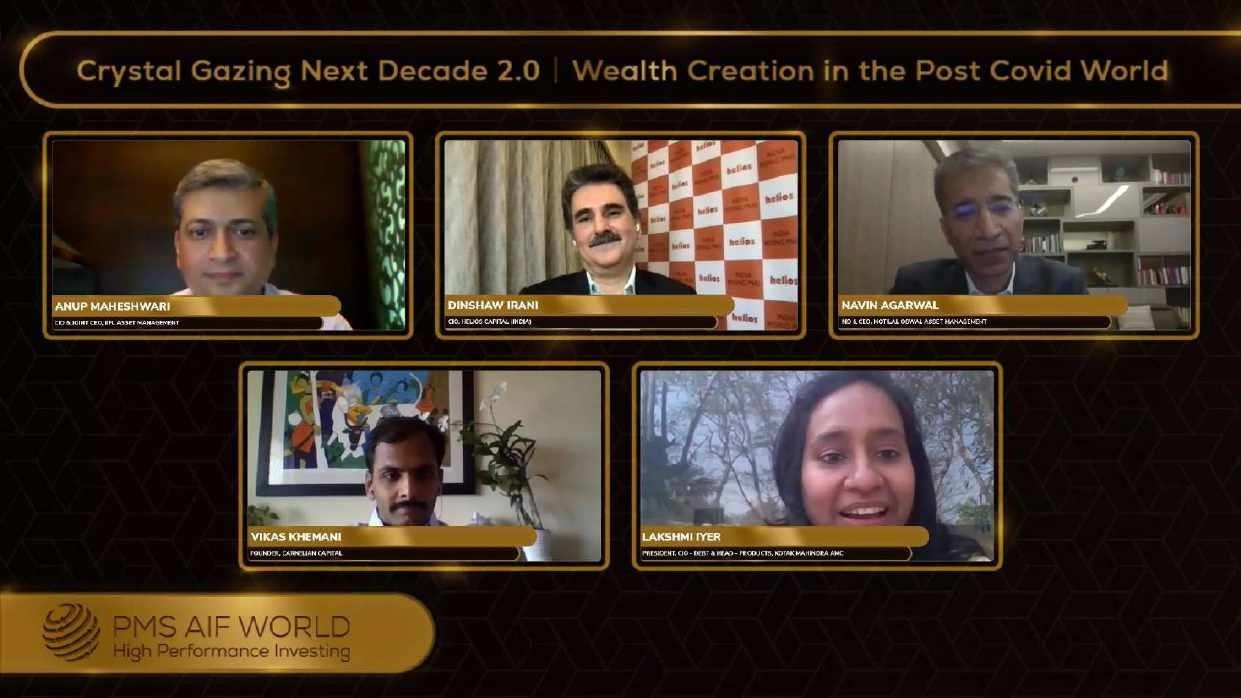

Anup Maheshwari | Dinshaw Irani | Navin Agarwal | Vikas Khemani

India Over 2020 - 2030 presents once in a life time opportunity for wealth creation, but for those who see it through the right lens

Aashish Sommaiyaa | Vikaas Sachdeva | Bhautik Ambani

Need & Projected Growth of Alternates Over Next Decade

Harish Nair | Balaji Rao

Opportunities and challenges for Real Estate in the new virtual world that is learning to work from home?

Karan Bhagat

Disruptive trends and future of the Wealth Management Industry over the next decade

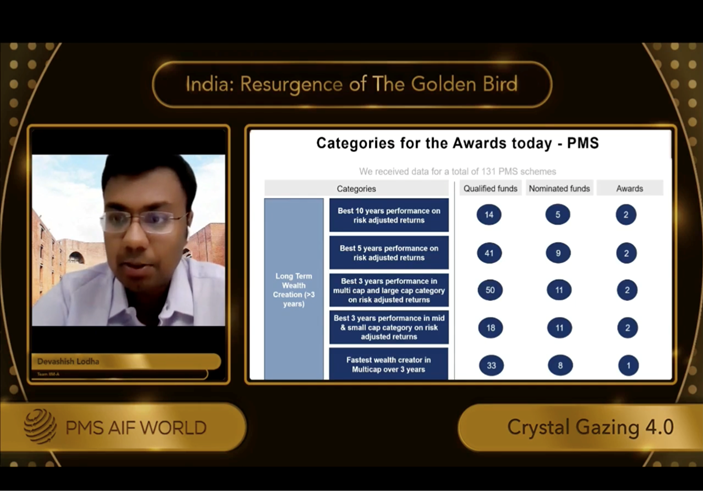

Awards Ceremony

Recognizing the top PMS and AIF