Date & Time: 03rd November 2021, 04:30 PM – 05:30 PM IST

Speaker: Samir Arora– Founder, Helios Capital

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

PMS AIF WORLD, which is India’s most trusted, alternates focused investment services firm lead by its Founder & CEO, Kamal Manocha, conducted an intuitive webinar with Mr. Samir Arora, Founder of Helios Capital.

Samir Arora, who brings a global investing experience of over 3 decades, shared his learnings over the years with insightful examples and meaningful data points.

In recent times, we are observing an investor shift from Mutual Funds to the space of Alternates. With different fund managers giving focus to either Growth Investing or Value Investing, at Helios Capital, Mr. Samir Arora believes that there is no stringent formula that works in the markets forever. One has to be very flexible and follow an approach that runs in tandem with the various moods & cycles of the markets.

Keeping the change in market trends in mind, this webinar shed light on the fact that Alpha lies in understanding this underlying change.

The general statement is that Equities do well over a long period of time. If we look at data, we’ll notice that Indian equity markets have given a return of around 14% p.a over the last 25 years (1996-2021), 15% p.a. over the last 5 years, 21% p.a. over the last 3 years, and the return has been around 50% p.a. over the last 1 year from now. The point is that this year’s returns look high because the previous years’ have been very low so no one can actually give a concrete perspective of where the markets are headed in the short term.

If the short-term rally is very high, the short-term correction can also be very high.

The Equity Risk Premium (difference between the money one makes in equities and the money one makes by investing in the same country’s government 10-year T-Bill) has been at around 6-7% annualized, over time.

Everybody now knows and acknowledges that right investment in equities create wealth over a long period of time. But the question is about the timing to enter the market. He agrees that though now is not the “best time” to enter the markets (as in theory, the best time was March 2020), it is not a bad time either as he assures investors that on a broader level, markets are doing good.

Moving on to the changes in trend, the first thing that investors should understand today is that the ‘big rally’ is now over. The markets are in a fair range, and to treat money well, one should keep on investing as and when they earn rather than waiting for the right opportunity.

It is observed that over the last few years the same companies have been rated higher and higher (for example in consumers, Asian Paints, Pidilite, etc) because of low earnings growth— earnings growing at 10-12% annually but valuations touching 50-70x. The change that is being observed in the current trend is that these highly expensive stocks are no longer being rewarded with a higher price. For instance, post D-Mart’s recent phenomenal Q2 results, the stock opened at Upper circuit price but closed down 8.5% from there. Keeping these points in mind, Mr. Samir Arora mentioned that at Helios Capital, they’ve cut down on such stocks and have increased their exposure towards Financials primarily because overall economic recovery is high, and the markets are widening. He asserts that for banks like Kotak Bank, HDFC Bank, results have been so consistent that in tandem with that, their valuations have not gone up (both earnings & stock prices have been growing at the same levels).

Talking about unreasonable valuations, there was a mention about IPOs as well. He believes that some of the upcoming “biggest IPOs” of India will be below par (the webinar was held on 03rd November ’21 and Paytm, India’s biggest IPO so far, got listed on the exchanges on 18th November ‘21 at a discount and hit a lower circuit on the listing day itself). The main debate against this argument is that $3 bn is too big an IPO size for a country like India.

Auto sector is not amongst the favourites of Mr. Samir Arora as he feels that this sector has been disrupted. With the transition towards EVs, all auto companies around the world are injecting billions of dollars to make EVs (leading auto companies like GM, VW, are spending a minimum of $25 bn as capex into EV projects). There is no guarantee that going ahead the number of cars sold will increase and this leaves with a probability that the market share for each company will remain the same, the difference being the cars sold will be both IC Engine cars as well as EVs. But nobody knows which side the balances will tilt and whose favour will the supply turn. Secondly, new players have entered the market wanting to sell EVs diluting the sector completely.

Moving to the Infrastructure sector, naming a few companies like Jai Prakash, Unitech, Reliance Infra, GVK, GMR, HCC, and some other road construction companies as well— all these companies faced the same problem— their customer was the Government of India. Any company dependent on one project, one approval or one customer in this government system, it’s really difficult to garner returns from such a business.

Infrastructure sector is to be enjoyed as and when India grows but the only stock we cover is L&T.

Mr. Samir Arora says that at Helios, they like certain secular themes on a specific basis and not necessarily the sector on a general basis. To put the above statement into perspective, he mentions that they don’t like PSUs but Helios’ current 3rd largest holding is SBI; despite not favouring commodities as a sector, they hold Tata Stell & Hindalco. So this is purely on the basis of long-term conviction that will work and if things don’t fit into the long-term thinking, there should be no hesitation in stepping back.

Real growth is created where the visibility is very high and where secular growth can be there. Regular long-term secular sectors where one can bet are Financials, Middle-class consumer companies, IT, Pharma, Speciality Chemicals, and so on.

Apart from Financials, he is looking at a bright picture in Consumers & Services as well. Despite inflation going up, people are willing to spend now and with the ease in lockdown restrictions and dimming of Covid related fears, consumers are looking to step out of their homes, travel, eat at fancy restaurants, go to the movies, and much more. Westlife Development, Jubiliant, etc are some of his picks in these sectors.

Instead of buying companies that are being negatively affected by inflation, buy companies that are creating the inflation.

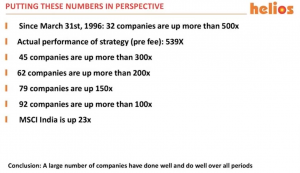

Having discussed views on sectors, Mr. Kamal Manocha, our founder & CEO, hit the chord of generating wealth. Having faced this question from many investors, he asked Mr. Samir Arora his views on what should an investor do— should one invest in Index funds & ETFs and sit with them or should one go a step ahead and invest into PMSs where the fund managers actively selects the stocks based on ongoing trends and cycles. The speaker answered this very diplomatically as he said that it ultimately depends on how the Portfolio Manager is performing. If he can convince the investor, with his selection of stocks and performance, that his fund can outperform the index, the investor can then do his due-diligence and park money accordingly. He goes on to say that every year there are 90-100 companies that do so well that even if one buys the 100th company in that list at the onset, its returns will outperform the index by 10%. Talking on these lines, battled between consistency of returns v/s Alpha, Mr. Samir Arora chose consistency stating that regular outperformance is better.

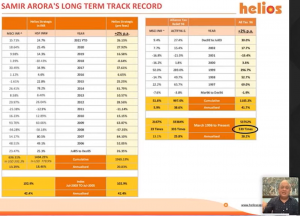

To concur to the above statement, one can look at Mr. Samir Arora’s Track Record:

The above tables portray a track record till September 2021. Over this period stated above, the markets were up 23 times and his NAV was up 335 times (with no assumptions). Adding just 2% p.a. annually allowing for what the strategy could extract, that resulted in NAV being up 539 times.

Lastly, it is also important that investors should diversify their investments across seas as well (in the US Markets as well, to be specific). Having said that, the webinar was summed up on a positive outlook ahead that Indian markets in a year’s time should deliver fairly well about 14-15% returns and earnings for the next 4 quarters is also expected to be high so investors should sit tight and be patient, for wealth is only created in the long-term if right selection in equities is done. And we, at PMS AIF WORLD, are here to help you make the right selection.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION