India, a developing, democratic & demographically diverse nation with a vibrant stock market representing both old and new economy stocks currently riding the $2 Trillion to $5 trillion journey is dream place to be for any investor.

If you ponder on every word in the above statement, you will realize that such a combination is not available anywhere else in the world. The importance of democracy highlights the importance of management is well highlighted because of the premium.

Markets for stocks fluctuate in cycles that alternate between equities from the old and new economies.

We, at INVasset, have made an effort to illustrate how we view the market cycles over the past four decades in this table.

| Time Period | Event Ending the Run | Market Topping Out Month | Sectoral Leadership | Stock Type |

| Decade 1

(1980-1990) |

Harshad Mehta Bubble Burst | March 1992 | Materials

Industrials |

Old Economy |

| Decade 2

(1990-2000) |

Dot Com Bubble Burst | Jan 2000 | Information Tech

Pharma FMCG |

New Economy |

| Decade 3

(2000-2010) |

Financial Crisis | Jan 2008 | Real Estate

Capital Goods Metals |

Old Economy |

| Decade 4

(2010-2020) |

Covid 19 | Jan 2020 | Information Tech

Financials Pharma FMCG Consumer Durables |

New Economy |

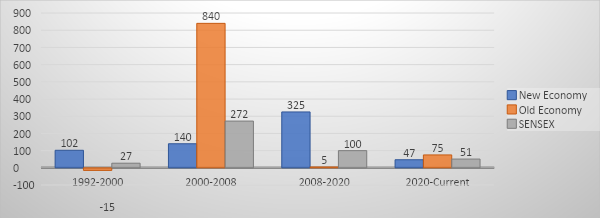

Here is a graph that compares the performance of the BSE Sensex’s Old Economy and New Economy components over the course of the previous three bull runs.

As you can see, the New Economy has exceeded the benchmark by around three times during the course of both New Economy Runs, but underperformed during the Old Economy Run from 2000 to 2008.

In contrast, the Old Economy underperformed the BSE Sensex with practically NIL returns in the 1990s and 2010 decades but provided 8x gains in the middle 8 years.

Old economy performance decisively outperformed the benchmark and the New Economy in the Current Run, laying the groundwork for an Old Economy Run.

One needs to ask himself a straightforward question, “What sort of Investor am I?”, if they want to get the most out of this idea.

If your response is “I want reliable returns that are always higher than the risk-free rate of returns, and I can live with outperformance of the index and other stocks for a few years,” then your portfolio should include quality-focused new economy stocks, which include both stable and growing industries like FMCG and pharmaceuticals and information technology.

Such an investing approach, in our opinion, does not necessitate active fund management.

However, if you believe that your portfolio should consistently surpass the benchmarks in all market conditions, you should switch to a fund manager that can oversee your funds and alternate to sectors that will do so in the next two to three years .This change is more difficult to implement than it seems and calls for thorough understanding of market cycles as well as a disciplined attitude that forbids giving in to sentiments of fear and greed.

If this hypothesis is correct, CAPEX-oriented old economy industries including Defense, PSU’s, Capital goods, Engineering Construction, Public sector banks, and maybe even commodities, should be on the lookout in the current market.

During the half year ended, April-September 2022, capital expenditure reached Rs 3.42 lakh crore compared to Rs 2.29 lakh crore in the corresponding period last year. The government’s intention to boost the CAPEX was evident when it revised the CAPEX target sharply by 35.4% from Rs 5.54 lakh cr. in FY22 to Rs 7.50 lakh cr. in the FY23 Union Budget. In TTM, the total government capital expenditures (state and centre) have increased to 12.3 lakh crore. CAPEX budget works out to 19.02 per cent of the total expenditure of Rs 39.45 lakh cr. The last time that the capital expenditure share touched a similar figure was when it came in at 19.32 per cent for the financial year 2004-05 (FY05), leading to a massive rally in the BSE Capital Goods Index of 40%+ in FY05 and 150%+ in FY06.

According to leading global financial house, By 2031, manufacturing’s contribution to India’s GDP might rise from 15.6% to 21%, doubling the country’s export market share. With the required push by the Union Government in terms of corporate tax cuts, the introduction of PLI Schemes and Aatma Nirbhar Bharat Abhiyan, Manufacturing will be the second theme to watch out for in the coming years.

At INVasset, we also think that during the next three years, the markets will underperform in the areas of information technology, pharmaceuticals, fast-moving consumer goods, and consumer durables.