Date & Time: 20th May, 2022 | 04:00 PM IST

Speakers:

Mr. Karthik Athreya, Head – Product & Strategy, Sundaram Alternates

Mr. Chandan Kumar, Fund Manager, Sundaram Alternates

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Karthik Athreya, Head – Product & Strategy, Sundaram Alternates & Mr. Chandan Kumar, Fund Manager, Sundaram Alternates about the Emerging Corporate Credit Opportunities Fund that is launched by Sundaram Alternates.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profiles

Mr. Karthik Athreya, Director and Head of Strategy for Alternative Credit, is a financial services professional with over 22 years of experience across principal investing, funds management, investment banking, corporate finance, assurance and transaction diligence services. He heads Sundaram Alternates’ (SA) private credit team which manages assets over $170 million across real estate and private credit.

Mr. Chandan Kumar is a finance professional with over 12 years of experience in structured finance, debt advisory, special situation assets and fund structuring. Prior to this, he was an Associate Director of InCred Capital, an NBFC for 4 years and Senior Vice President of Yes Bank Limited. He holds an MBA from XLRI Jamshedpur.

Webinar Overview

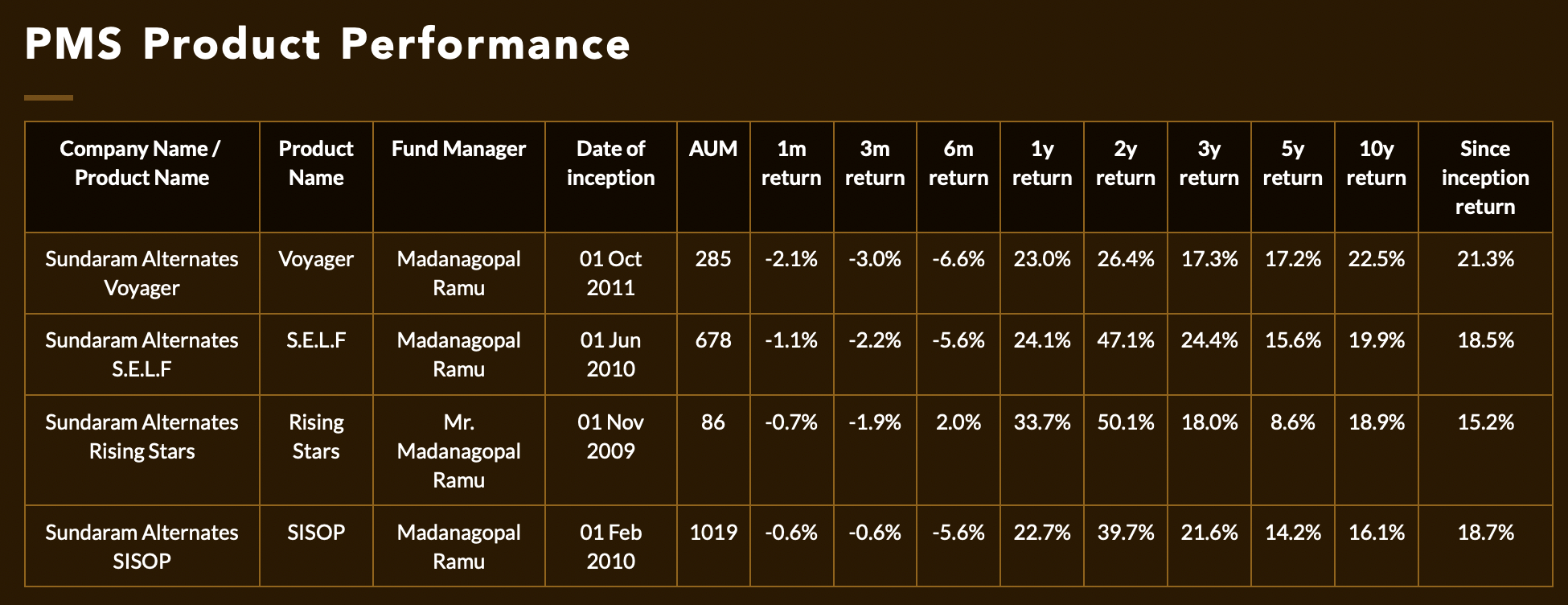

Sundaram Alternates boasts for offering not only good returns through its equity PMS and AIF products over last more than a decade, but also for doing equally great work through its debt focused AIFs (Alternative Investment Funds). The historical performance of Sundaram Alternates’ Equity PMSs is mentioned below:

Sundaram alternates follows an all-weather approach to equities, so that its portfolio generates good returns in all phases of markets, and that is why though its products may not generate highest returns in rising phase, but still it’s investor clients are mostly happy with returns as portfolio managers aim lower drawdowns in the falling market phase. Sundaram Alternates’ Team of PMS & AIF products have recently launched 2 AIFs, one equity AIF by the name ATLAS, and second, a debt AIF named – Emerging Corporate Credit Opportunities Fund – Series 1.

Sundaram alternates follows an all-weather approach to equities, so that its portfolio generates good returns in all phases of markets, and that is why though its products may not generate highest returns in rising phase, but still it’s investor clients are mostly happy with returns as portfolio managers aim lower drawdowns in the falling market phase. Sundaram Alternates’ Team of PMS & AIF products have recently launched 2 AIFs, one equity AIF by the name ATLAS, and second, a debt AIF named – Emerging Corporate Credit Opportunities Fund – Series 1.

This blog article describes the webinar done with Sundaram AIF’s debt team with an aim to understand the newly launched debt AIF which revolves around the theme of Corporate Credit. Before this, Sundaram Alternates has successfully been running 3 real estate focused credit opportunities funds, and the real estate credit has been enriching and fruitful for the fund house where it has consistently beaten the benchmark. This new debt AIF fund that has been launched by Sundaram Alternates will try to mimic the real estate performance, however, on the commercial credit side.

A combination of manufacturing and service businesses are being targeted through the fund largely in the small and mid-cap space. Bridge financing deals are also on the lookout by the fund house where the bridge is to a capital event, a material corporate reorganization and financing growing enterprises by correcting the balance sheets in the most fruitful way.

Sundaram Alternates’ Emerging Corporate Credit Opportunities Fund – Series 1 AIF will provide credit for India Inc and aim strong risk management. Effective de-risking takes place with cashflows starting to be returned to investors.

There is a distinct gap with the MSME and SME credit off take leaving a huge opportunity for NBFCs to up their game. And, thus, there is a huge opportunity for capital investments in India with the Emerging Corporate Credit Opportunities Fund – Series 1 being launched to exploit the same.

Source: Preqin, EY, SA estimates

Source: Preqin, EY, SA estimates

As Investor landscape has changed over the last 3-5 years; structured credit providers have changed as well

Sundaram Alternates’ Emerging Corporate Credit Opportunities Fund – Series 1 AIF plans to provide capital for a tenure of 4-5 years with the credit ranging from BB and A. It also aims to target an IRR of 17-18% for investors with sufficient cashflow generation. They will focus on hard asset backed deals and small corporates looking for a last mile capex for growth. It is ideal to look for sustainable businesses over the course of the lending period with reasonably strong counter parties.

The investment commitment comes from the Sundaram ecosystem that commits 15-20% as sponsor to every private credit fund. Similarly, investments from the group bring substantial synergies to the fund. The goal is to raise ₹750 cr and within that ₹150 cr is already committed by Sundaram Finance.

The investment commitment comes from the Sundaram ecosystem that commits 15-20% as sponsor to every private credit fund. Similarly, investments from the group bring substantial synergies to the fund. The goal is to raise ₹750 cr and within that ₹150 cr is already committed by Sundaram Finance.

The indicative pipeline for the fund suggests a diversified investment where sectors like textile, pharma, financial inclusion, hospitality and healthcare are included. A large pharma player plans to overtake an API in the supply chain by touching upon the manufacturing business. The funding will be provided through ECCO-1 as the term sheet has been signed and due diligence is underway.

Similarly, another company that provides services to an insurance company plans to acquire a business and Sundaram Alternates will aid the funding process. The underlying business is capital light and has a negative working capital cycle. Established promoters running the business and good asset cover make it an ideal investment choice.

Sustainability, debt/EBITDA and the nature of the underlying business are key pointers that are kept in mind at Sundaram Alternates before initiating the investment process. The blended portfolio return currently stands at 17-18%. The fund life will span 6 years in the CAT II AIF, where the first drawdown will be 25% of the capital commitment and subsequent drawdowns on an as needed basis. The hurdle rate stands at a competitive 12% when compared to peers in the industry and the performance fee at 20%.

This AIF, being offered by Sundaram Alternates aims to make quarterly distributions to investors and capital repayments for 4-6 years.

It is an interesting opportunity to beat a typical corporate credit from a debt allocation perspective where typically you’re looking at anywhere between five to seven percent yields, but the goal is to try and beat that and try and get to around 12-13%.

The fund follows a certain process and a collateral that it adheres to which helps mitigate several risks. Banks are unable to process future corporate finance events due to regulations set by the RBI. There are situations where premium is provided for offering liquidity in the market and Sundaram Alternates dives deep to take full advantage of such situations.

The due diligence done by the team at Sundaram Alternates takes months to complete and reach a particular conclusion in terms of sustainability and revenue history. It is ideal to recover the capital at the end of three years on a 6-year life of a fund. The promoter will remove us from the balance sheet once the corporate event is over and subsequent returns to the investors can be made.

The twin security structure offered by Sundaram Alternates’ Emerging Corporate Credit Opportunities Fund – Series 1 helps the fund to stay afloat and manage difficult times. It is not a bullet proof business, leading to a significant risk-reward ratio. The fund is available not only for domestic clients but also for NRIs that wish to enter the space.

A horizon of 4-5 years makes it sufficient to make decent returns in the debt space. The risk mitigating mechanism is executed very well by Sundaram Alternates and is an ideal product for HNI clients. The product adds a lot of value to an investors’ overall portfolio and should be studied in great depth before taking a plunge in it.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION