Date & Time: 10th December 2021, 05:30 PM – 06:30 PM IS

Speaker: Nalin Moniz, CIO- Alternative Equities, Edelweiss AMC

Moderated by: Kamal Manocha- Founder & CEO, PMS AIF WORLD

In this current scenario, where investors are wondering what to make out of the current high valuations and whether or not to invest right now, PMS AIF WORLD conducted an intuitive webinar on learning the space of hedge funds in India to understand if it makes sense to invest in Long-Short AIFs in the current market scenario, even if one has a long-term horizon of 5 years.

The guest speaker for this webinar Mr. Nalin Moniz, is a CIO- Alternative Equities, Edelweiss AMC.

Nalin was Born in India and moved to United States for pursuing higher studies at University of Pennsylvania on a scholarship. He graduated with degrees in finance, statistics, and computer science in 2005. Started his career with Goldman Sachs to work in their asset management business.

First three years into his career, and the world was hit with the 2008 financial crisis. Seeing opportunity in the challenge, Nalin left his job at Goldman Sachs in 2009 and with just a single investor backing him, started Forefront Capital and started the first licensed domestic hedge fund in India (received license for AIF CAT-III), which later in 2014 was acquired by Edelweiss.

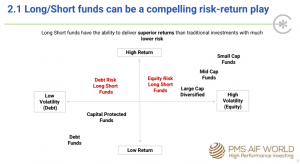

Alternative Equity Investments have gained popularity in the recent times. This is because investors today, are looking at investing in equities but high valuations, and a possible third wave or any unpredictable event keeps them concerned. Long-short funds tend to make the equity investing experience smoother as Long only portfolio is hedged with long short portion of the portfolio and aim to offer investors enhanced experience of investing in equities!

Any Long-Short fund can be broken down into these 4 components: Longs, Shorts, Non-market linked opportunities, and Dynamic Asset Allocation.

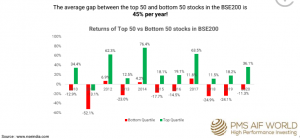

The Indian Stock market is ideally suited for Long-Short funds as every year, we observe that there is a huge dispersion between winners & losers amidst the constituents of the stock market.

The above data shows that for the past few years the average gap between the top 50 & bottom 50 stocks in the BSE 200 is a staggering 45% per year, a number far higher than what one can experience in international markets.

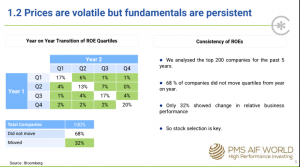

While prices are volatile, fundamentals are not. And here lies the opportunity for Long Short Style of fund management.

To concur to the above statement, Mr. Nalin Moniz presented a study carried out by Edelweiss Asset Management. From the BSE 200 Universe, the top 200 companies for the past 5 years were taken and broken down into 4 quartiles based on ROEs (Quartile 1 representing the 50 companies with the highest ROEs and Q4 representing the last 50). This was done on a Y-o-Y basis for the subsequent year as well and it was observed that 68% of the companies did not move quartiles Y-o-Y, which conveys that only 32% companies showed change in relative business performance. This framework, if followed religiously, can help a portfolio manager identify both good longs as well as good shorts.

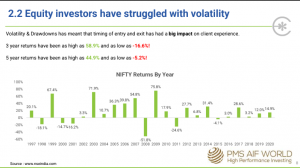

Long only equity investments have shown wide range of Volatility & Drawdowns. And this has meant that timing of entry and exit has had a big impact on investor experience.

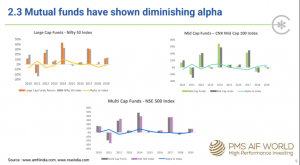

As Mutual Funds are struggling to outperform the benchmarks and showing diminishing Alpha, investors are now making a pivotal shift towards Long-short funds for equity investments.

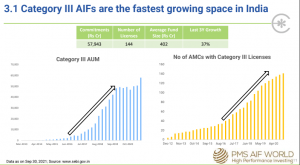

Mr. Nalin Moniz mentioned that the Cat III is the growing fast and this category today, has a cumulative AUM of about ₹57,943 Cr with about 144 players in the market. The average fund size is somewhere around ₹400 Cr, and the industry has witnessed a growth of 37% in the last 3 years.

Apart from Edelweiss AMC, some of the other prominent long short alternative investments funds are being offered by AMCs like: Avendus, ICICI Prudential, DSP, Tata AMC, The Investment Trust of India (ITI), IDFC, True beacon, Helios Capital, Alpha Alternatives, and Dolat Capital.

Long-Short funds are bifurcated into two types: Debt-risk Long-Short funds (funds like Arbitrage funds or Debt mutual funds) and Equity-risk Long-Short funds (funds that tend to give equity-like returns but with lower drawdowns).

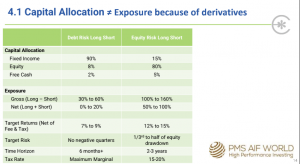

Both types of Cat III AIFs have different approaches towards capital allocation, and it is important for investors to understand that capital allocation ≠ total exposure, thanks to the presence of derivatives in these funds.

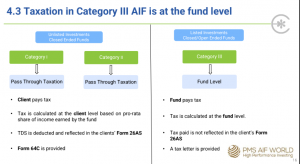

Regarding taxation aspect of Cat III AIFs, Mr. Nalin brought this to the knowledge of the audience that unlike Cat I & II AIFs where the client pays the tax (Pass through Taxation), here, in Cat III AIFs, the fund pays the taxes (Fund level taxation). While the tax rate varies from fund to fund depending upon fund’ structure and allocation between asset classes, it is very important for portfolio managers to manage the portfolio in a tax-aware manner.

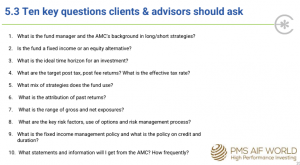

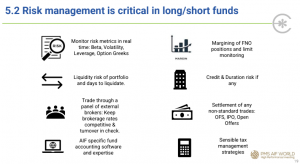

Apart from taxation aspect, which is important as investors who are keen to explore long short AIF should look at some other parameters also to evaluate these funds properly. For instance, what is the investment strategy? (is it a top-down approach, or a bottoms-up one), What is the portfolio manager looking at? (fundamentals or technical), and so on. Not only this, but a detailed review on underlying risk attributes should also definitely be carried out by the investor as one of the foremost reasons of opting for Long short category against Long only category of funds is better risk management of capital. This can be assessed by understanding the drawdown pattern shown by the fund in various time periods, and those rare funds that generate Alpha both on the downtrend as well as an uptrend deserve next level deep diving.

Keeping the above in mind, Mr. Kamal Manocha, Founder & CEO, PMS AIF WORLD, asked Mr. Nalin Moniz to throw some light on how Edelweiss AMC’s Alternative Equity fund manages the volatility & risk factors and how does it promise to consistently beat the benchmark.

Mr. Nalin Moniz, the pioneer of this fund type, explained that since the launch of the fund (in 2014), most of the investors have chosen to remain invested in this fund because this category of fund navigates volatility very well. As far as Edelweiss Alternative Equity Fund, Nalin mentioned that fund goes long on businesses that have been consistently compounding @ 15-18% p.a. and go short on worst businesses in the worst sectors. This philosophy has helped the fund generate a CAGR of 18.5% SI (net of fees) v/s Nifty’s 13%, and Beta stands at 0.6 with max drawdowns at about 60% of the index. Nalin also added that there are 2 components to his Edelweiss Alternative Equity Long short fund, one is Long-Short and the second is Special Situations, so this combination makes it unique. But, he added, it is important to understand that Long-Short funds do not resolve all problems & requirements in any investor’s portfolio, so it is very important to understand one’s portfolio & investment objective before investing in this product type.

To the question on “What is the most conducive market timing for investing in the long short fund type that Nalin manages,” Nalin replied that last 2 years and the present time has been best because, what Covid has done is that in almost every sector, it has strengthened the strong players and weakened the weak players. So, it was never as clear – where to go long and where to short, as it has been over 2 years.

With more than 100 CAT 3 AIFs, the identification of right and suitable product to investors unique risk-return investment objectives, is extremely important, and PMS AIF WORLD’s data, analysis based educative approach helps investors select the best and avoid the not so good ones. On that note, the webinar was wrapped up stating that Cat III AIFs have stood the test of time bringing some of the best global investing practises to India and this asset class has a promising future ahead in times to come; and one must make well, informed investment decisions.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION