Dear Investors,

The all-important market event for the year has finally concluded with the BJP-led-NDA forming a new coalition government. The largest democracy has created history with the same PM coming in for a third term.

The Budget (expected) in July is the next event we’re going to look out for.

In May 2024 – While DIIs chose to contradict it, FIIs acted upon the “Sell in May and go away” adage – a phrase that suggests investors to sell stocks during the summer and reinvest later, in the fall.

However, we are not a fan of seasonal investment strategies and do not believe that new market highs should necessarily be feared – if you are making informed investments.

Apart from the fact that while most nations face the brunt of recession, India is poised to grow at a minimum of 8%; here are 3 strong reasons why I’m confident that stocks can move higher from here:

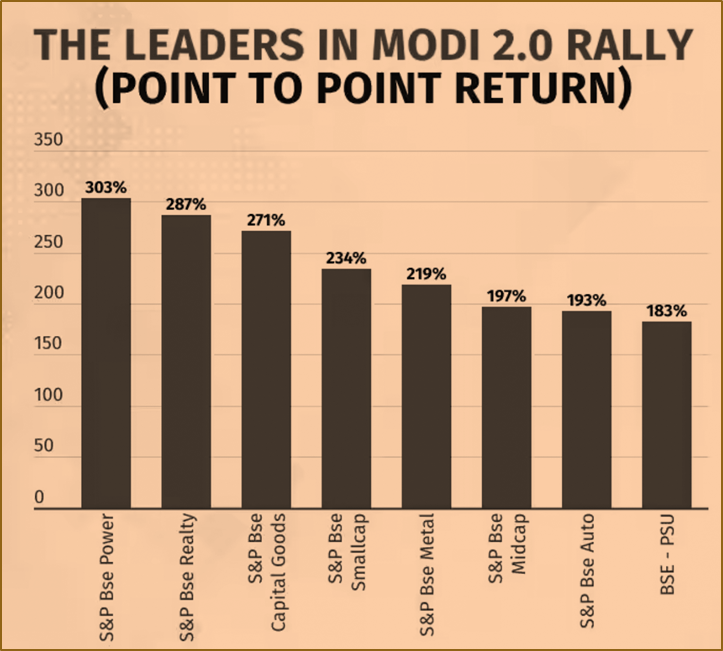

1. MODI 3.0

Setting aside any heightened emotions, it’s important to recognize that, like many previous market-shifting events, this too shall pass and will soon become a non-event. But what will remain consistent is that with the BJP-led-NDA govt in picture, economic & policy reforms will continue to ensure doubling the valuation of the Indian stock market from its recent peak of $5 trillion (currently at $4.95 trillion) to $10 trillion over the next four to five years.

The recent election outcome is also expected to enhance Foreign Institutional Investor (FII) flows into India which would not only be positive for Capex stocks, but Infra & Pvt. Banks as well!

Source: Moneycontrol

2. EARNINGS GROWTH

In Q4 FY24, India Inc’s aggregate revenue growth for [reported] 1,084 listed companies improved sequentially to 10.6% year-on-year in Q4 FY24, up from 10.1% in Q3 and 7.9% in the first two quarters, indicating an improvement in the demand environment. Within this, the Nifty 50 earnings grew a healthy 25%in FY24 and domestic cyclicals were key drivers of earnings. Although net profit growth slowed to 16.5% from the previous quarters, it remained robust given the high base effect.

Operating profit margins held steady despite elevated power and fuel costs, and non-financial firms improved their interest cover to over five times, demonstrating resilience in debt servicing ability.

Looking ahead, the outlook appears promising. Financial firms played a key role in lifting both revenue and profit growth, suggesting a bright future for credit-fueled consumption and industrial activity. Demand growth showed signs of broadening, with significant contributions from both goods and services sectors, including consumer durables, e-commerce, automobiles, real estate, hotels, financial services, and entertainment. The end of political uncertainty will also spur further capex and infrastructure investments.

An overall profit growth of 12-18% appears feasible for FY25, indicating a positive sentiment for the future. The constant positive re-ratings by esteemed agencies just accelerate this sentiment.

3. INCREASE IN OVERALL CONSUMPTION & INFRA

We’ve been witnessing a muted consumption since the past 18 months. Now, with the election spending that’s happened and the potential new structural policies & reforms that will be announced, both Infra & Consumption will get a boost.

Additionally, a favourable outlook towards the upcoming monsoon in India is also set to give a boost to Consumption. As the economy grows, individuals’ purchasing power increases, driving demand for various goods and services.

Domestic consumption has been a key theme in emerging markets over the past decade. Easily accessible information has made people more aspirational, fueling growth in sectors such as consumer durables, retail, auto, healthcare, telecom, media, entertainment, tourism, paints, and consumer electricals, alongside FMCG, highlighting the potential for returns on consumption-based investing.

MARKET OUTLOOK

The whispers for higher capital gains tax on equities, the nature of upcoming reforms, the outcome of the monsoon, and the practicality of the Union budget will be crucial factors influencing market movements, going forward.

Therefore, while we remain confident about the overall market direction, a few curves in the journey of the Indian Indices can be possible.

Investors can enhance their return expectations by buying during market corrections rather than chasing rallies.

We always strive to make investors optimistic, as this is the starting point of wealth creation through equity investments.

We also declutter investors’ concerns through objective evaluation of markets and assure you of the best investment services, backed by in-depth knowledge, driven by content, and analytics.

At PMS AIF WORLD, we understand the gravity of investment decisions, so we offer a well-informed experience and bespoke Wealth Management Services.

We are a New Age Investment Services Company, committed to delivering an analytics-driven, high-quality investing experience.

Our mission is to foster Wealth Creation and Prosperity for our clients.

We are driven by a dedication to excellence and meticulously offer the best Alpha-focused products.

Our suite of investment products spans a diverse range from listed to unlisted, encompassing Pre-IPO, Private Equity, and Venture Capital funds.

With us, you invest in the best.

JOIN US ON A JOURNEY WHERE TRADITION MEETS INNOVATION, AND WHERE THE FOCUS IS ON ALPHA.

For a detailed analysis and insights on around 200+ PMS and AIF Strategies, login to our analytics portal. Login to Learn – Compare – Select from the universe of professionally managed focussed investment portfolios.

Login to Our Analytics Portal

Database of all stocks / sectors & returns / risk matrices & insights of PMS & AIF

Our endeavors are to determine the Quality, Risk, and Consistency attributes (QRC). We present all data and analytics with an endeavor and the aim of informed investment decisions. If you are looking to invest and are not able to decide between PMS and Mutual Funds, or between PMS and Alternative investment funds, Book A Video Call with our experts.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION