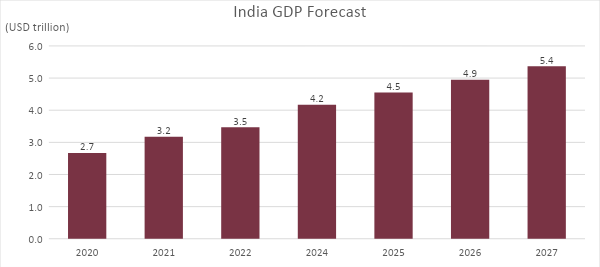

India is on a path to witnessing one of its most extraordinary decades in terms of economic achievement since the country’s Independence. In this decade India has crossed USD 3 trillion in GDP in FY22 to reach USD 3.2 trillion

IMF has forecasted that India will cross USD 4 trillion in GDP in 2024 to reach USD 4.2 trillion and cross USD 5 trillion in 2027 to reach USD 5.4 trillion.

Source: IMF World Economic Outlook Database, Gross domestic product is in terms of current prices

India’s Ministry of Finance, Govt. of India has also a similar forecast of India crossing USD 5 trillion in GDP in FY27. These are extraordinary milestones for any country and India may witness sharp improvement in per capita GDP and per capita disposable income by the end of this decade.

It is critical to understand however that India’s GDP growth since the beginning of this millennia and especially since crossing USD 1 trillion for the first time in 2006 is different in composition.

To elaborate, India’s GDP growth from the early 2000s has been driven by those industries that require know-how, technology and intellectual property for growth. India’s Information Technology (IT Industry) reached about USD 227 billion in 2022. The story of the IT revolution around the world is well documented and India’s role as an IT outsourcing partner to large North American, European, and ROW organisations has been acknowledged. Indian IT leaders such as TCS, Infosys and Wipro have grown to become global players in terms of the size and the market capitalisation that they have achieved. Today, India’s IT industry accounts for 7.4% of India’s GDP (In FY22) and is expected to contribute 10% of India’s GDP by FY25.

It was at the turn of the 20th century, in the early 1900s that the world for the first time saw and witnessed a vehicular movement driven by internal combustion engines. The advent of Automotive industries in the early 1900s ushered in a mobility revolution in the world. The movement of people and goods became a lot easier and cost-efficient, thereby laying a deep foundation of sustained economic growth as more people and regions could connect and trade with each other.

The world is witnessing a monumental shift of a similar magnitude more than a century later than the first time. Electrical vehicles (EVs) are making rapid strides in gaining handsome incremental market share gains in automotive purchases driven by powerful factors such as response to climate change, improvement in EV technologies (vehicle, battery, charging infrastructure etc.) and shifting consumer preference.

As per the Automotive Mission plan, India’s automotive industry which accounts for 7% of GDP currently will rise in contribution to 12% of GDP by the year 2026. Almost all of India’s vehicle manufacturers have laid out their plans to have a higher number of EV models in their product offerings. The government of India has announced the FAME scheme to subsidise EV purchases while many state governments have also put out incentive programs in place to promote the purchase of EVs. To accelerate this megatrend, the Government of India has also announced PLI schemes (Production linked incentives schemes) to support the growth of local manufacturing. It is important to note that the rise in India’s automotive industries will have at least commensurate growth in the Auto Ancillary industry.

The size of India’s Pharmaceutical industry is expected to triple to reach 130 bn by 2030 from USD 42 bn in 2021. From, manufacturing generic versions off-patent drugs and APIs, Indian pharma/biotech industries have made R&D investments, unleashed strong M&A programs and partnered with in-licensing and out-licensing of new-generation molecules to drive growth. India has the second-highest number of FDA-approved plants outside the USA5. These advanced manufacturing facilities serve the advanced markets and also middle-income countries around the world.

Similar to IT, Automotive and Pharma/Biotech India’s growth in the current decade will also be driven by industries such as the Internet and E-commerce, Omni-channel retail, chemicals/speciality chemicals and Fintech. A common thread is industries that are driven by know-how, IP and technologies. Since Independence, India’s democracy, Judicial system and stable law and order position have allowed the country to build a USD 3 trillion economy which is the fifth largest in the world. India has invested in Advanced Education by establishing prestigious educational Institutions. On this powerful bedrock, India is well positioned to grow at a leading pace and to rise to the top three economies of the world in less than a decade.

Along with India’s rising GDP, corporate profits and overall market capitalization are also expected to pick up. Currently, the corporate profits to GDP ratio in India stand approximately at 4%. A healthy growth outlook in GDP through the remainder of the 2020s, and a possibility of expansion in profitability with a higher scale – leads us to believe that Indian equity markets will also have a healthy return trajectory in the coming 5-7 years.

Source: nasscom, ibef.org, cii.in, pharmaceuticals.gov.in

Disclaimer: Securities investments are subject to market risks and there is no assurance or guarantee that the objective of the investments will be achieved. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.