Date & Time: 08th April 2022, 04:00 PM IST

Speakers:

Naveen Chandramohan, Founder & Portfolio Manager, ITUS Capital, and

Bhavin Shah, Portfolio Manager, Sameeksha Capital

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Naveen Chandramohan, Founder & Portfolio Manager, ITUS Capital & Mr. Bhavin Shah, Portfolio Manager, Sameeksha Capital as far as growth investing for alpha is concerned over the next 5 years.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profiles

Mr. Naveen Chandramohan, ITUS Capital’s Founder & Portfolio Manager, runs a growth strategy investing in cash-flow based growth which provides portfolio downside protection across cycles. He has received many accolades and achievements in his 12 years of career so far and has been ranked the best fund manager between 2012-14 by Asia Hedge in Hong Kong.

Mr. Bhavin Shah, Sameeksha Capital’s Portfolio Manager, has more than 20 years of experience building top research franchises. He built a very profitable and award winning Indian equity business at Equirus from scratch on a tiny budget; achieved number two ranking in Asia for idea performance. He jointly holds two US patents for his work experience of designing the world’s fastest microprocessors. He is rated the #1 technology sector analyst in Institutional Investors polls for a decade.

Webinar Overview

The evolving process followed at Sameeksha Capital has helped them avoid major errors in the last 7 years of its existence. It is the experience of Mr. Bhavin Shah that has set the premise straight for the firm. The firm may have missed out on many opportunities, but Bhavin Shah proudly states that their experience and approach has helped them avoid blunders as well.

The investment ideology followed at Sameeksha Capital is very simple – i.e. Invest in growth at the right price. But it’s the process that sets Sameeksha Capital apart from others.

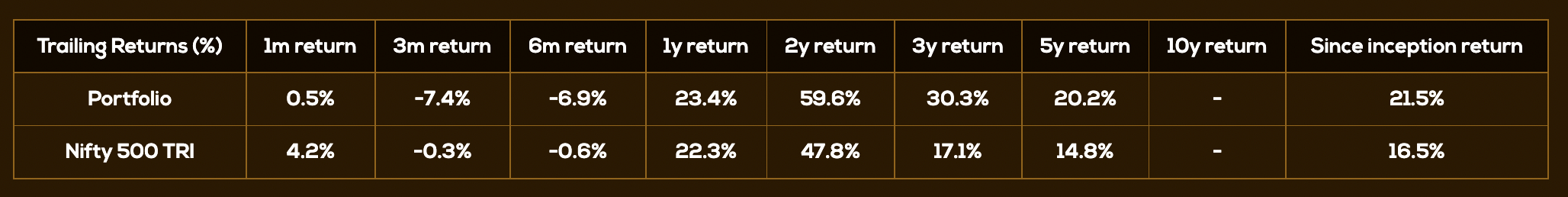

In the space of Portfolio Management Services, Sameeksha Capital offers 1 PMS, which is the Sameeksha Capital Equity Portfolio. The Portfolio follows a Multi Cap approach which (as of 31.03.2022) has a market cap allocation of about 48% into Large Caps, 9% in Mid Caps, 38% in Small Caps, and the remaining in cash. Since its inception in April 2016, Sameeksha Capital Equity PMS has delivered the following returns (data as of 31.03.2022):

Sameeksha Capital Equity PMS follows the model portfolio approach as they believe that a customized experience for each investor is important. Moreover, the PMS also doesn’t shy away from taking cash call if portfolio manager thinks so.

While ITUS Capital also follows an investing ideology of Growth at reasonable price, it particularly follows the cash flow growth, and believes that EPS growth is not the same as cash flow growth, as said Mr. Naveen Chandramohan of ITUS Capital, during the webinar.

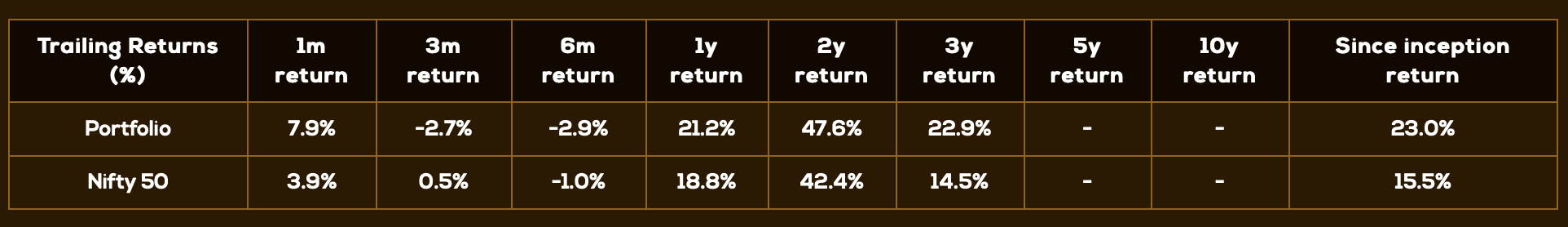

In the space of Portfolio Management Services, ITUS Capital offers 1 PMS, which is the ITUS Capital Fundamental Value PMS. The Portfolio follows a Multi Cap approach which (as of 31.03.2022) has a market cap allocation of about 24% into Large Caps, 37.50% in Mid Caps, 29% in Small Caps, and the remaining in cash. Since its inception in April 2016, ITUS Capital Fundamental Value PMS has delivered the following returns (data as of 31.03.2022):

The concept of incremental returns stems from the fact that a company reinvests its cash flows. CFs are difficult to manipulate when compared with the numbers in the P&L statement. A sufficient amount of cash flow today does not indicate that the firm will remain profitable in the future. Searching for companies that reinvest their cash flows has been the motto at ITUS Capital.

Incremental reinvesting of cash flows of at least 20% and companies that continue to gain market share is also a part of the framework at ITUS Capital. The concentrated multi-cap portfolio continues to search for growth investing and generate substantial alpha for investors. Mr. Naveen Chandramohan’s experience at Lehman Brothers has been unforgettable as he understood the definition of risk when the firm went bankrupt.

Wealth creation and longevity go hand-in-hand as it takes time to build a sustainable portfolio. The promoters and employees have contributed 9.5% to the total AUM of ₹720 crore that proves they have their skin in the game.

Talking about growth at a particular price, Avenue Supermart has changed the retail business in India with zero-debt on the balance sheet and is adding its own stores in the market as well. It currently trades at a high PE of 100, an excellent foundation has been formed by the strong management and hence will compound wealth in the future.

Radhakishan Damani, the self-made billionaire from Mumbai and the founder of DMart, has exclaimed in 2003 that he cannot continue to sell onion and potatoes at ₹18 a kilo and pay a rent of ₹150 per sqft. It summarizes the business model of the retail king in India has the company is also into the real estate business today.

It is important to look at a business from the downside rather than the upside. It will help the investor gauge its risks and concerns subsequently. At ITUS Capital, equity management is all about risk management from the downside rather than focusing on the gains from the upside.

The retail business is predominantly divided into categories, where the first one is buying a property cheap in a less developed area, scaling the business and creating demand in the coming years. The value proposition for investors must be the cheapest price and hence the business will thrive. Secondly, buy property on a lease in an upscale market which will lead to filing of bankruptcy eventually,

Investing is hard from a qualitative aspect and not from a quantitative aspect, says Mr. Naveen Chandramohan of ITUS Capital.

Investors need to invest in the fund manager and fund managers need to understand the people to invest in suitable businesses. This has been the motto for ITUS Capital since its inception. Numbers are 10% of the story for Mr. Naveen Chandramohan as the management defines the strategy, execution, and capital allocation at the top.

When the growth in FCF & ROIC stalls and valuations reach their peak, it is a suitable time to exit the investment. If the investment story is successful, then there are less chances of major blunders. It is crucial to gauge the past track record of the management, reach out to ex-employees and the team below the top management and the promoters.

Mr. Naveen Chandramohan urged investors to not have a view on the market but the organization that you are going to invest in. The last two years of uncertainty and macro risks have only led to portfolio companies of ITUS Capital gaining market share. Pricing power, gross profit margin and sustainability will be the areas of focus when we are to have a view on a particular business.

Agreed that inflation is under check but if it slips out of hand then it can be a major problem. The Fed and the RBI are behind the curve and keeping the inflation in control. The monetary policy remains to be easy as the longer-term story for the country remains to be better. The future has been written by the stellar growth of start-ups in the country, as per Mr. Bhavin Shah of Sameeksha Capital.

Given the suitable market view, it is important for investors to reach out to the correct PMS company. They need to study the fund manager’s strategy, the track record, risk management strategies and a sound understanding of the risk adjusted ratios. Understanding the fee structure and the extent of the manager’s skin in the game is also an important metric.

The investable corpus in equities is the money that you don’t need in the next 5 years, says Mr. Bhavin Shah of Sameeksha Capital.

It is important to have a financial advisor to guide you through the investment process and help select a suitable portfolio manager. One invests for tomorrow not based on past numbers but the alpha that is to be generated over the next 5 years. Keeping the drawdowns in check and minimizing the downside is umpteen for investors. The focus should be on risk rather than returns while accepting the former is equally important. An ideal investment horizon could be 500 days where the investor enters and sits tight with the equity holding irrespective of the macros being played out.

Post which, there will be concerns about underperformance with the market and a suitable strategy should be devised. Lastly, sticking to a particular strategy for a longer period is bound to create wealth and maximize returns for all investors.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION