Dear Investors,

In the recent times, global and domestic markets have witnessed a significant drawdown. Last month, the Sensex plunged over 1,400 points, the Nifty hit a 9-month low. US markets are trading at a 6-month low. US treasury yields have surged and jobless claims have risen. India’s Q2 GDP and Q3 earnings data was below expectations, foreign institutional investor (FII) outflows crossed ₹1 lakh crore this year and the sword of tariff hikes in key economies has fueled concerns of an global economic slowdown.

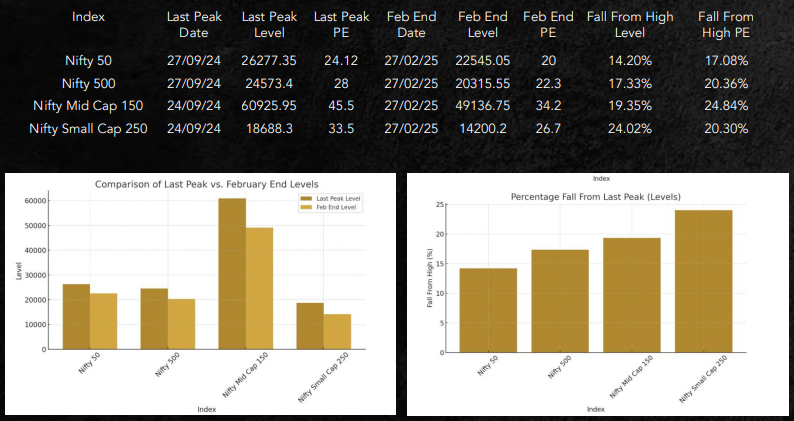

Yet, beneath the turbulence lies opportunity. As depicted in the PE data shown below, there is a decent fall in the valuations across the market caps. And, history suggests that sharp corrections of this nature are often short-lived, typically lasting 6-9 months. Many companies, previously stretched at exorbitant valuations, are now trading at more reasonable multiples of 15-20x earnings. However, with liquidity drying up and valuation reset underway fundamentals matter the most, so, investors should not simply look at price fall of stocks but, the expected growth in business earnings as well.

There is long-held belief that moving into large caps during times like present is a better bet. And, this is because, large caps are seen as more robust in terms of earnings visibility. But, in the present s is correct scenario, when economy is experiencing slower growth, it is important to chase growth than simply Large caps.

This is also because, irrespective of relative slow growth shown by large cap index versus the mid & small cap indices, the claim of large caps being more attractively valued is also not completely correct. This is because, while the PSU companies in the Nifty trade at 8-10x multiples, and private banks at 15-17x, the remaining companies within the index command 35-40x valuations—making these large caps, in some cases, more expensive than even small caps. And, all this with relatively less growth expectations. So, Growth be chased and not Large caps.

For patient investors, this is a unique moment—akin to a “big sale” that comes once every few years. Corrections flush out weak hands, leaving the strongest investors to benefit from long-term value. With India’s GDP growth projected at 6.5% for FY25, strong rural consumption, and domestic institutional investors remaining net buyers, the market setup favours those willing to take a contrarian stance.

Legendary investor Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.” Right now, fear dominates the market, but history has shown that such moments create the greatest investment opportunities for those who act with conviction. Rather than retreating, now is the time to act strategically. Investors should focus on growth businesses with strong fundamentals, which are now available at fairer valuations. With correction intensifying, more & more businesses across the spectrum are offering a rare opportunity for accumulatio. But, those with clear sight for rise in earnings should recover & win foremost and this is where research backed approach followed by fund managers is much better way of investing than buying stocks directly. This is the moment when smart investors lay the foundation for future gains.

With us, you invest in the best.

JOIN US ON A JOURNEY WHERE TRADITION MEETS INNOVATION, AND WHERE THE FOCUS IS ON ALPHA.

For a detailed analysis and insights on around 200+ PMS and AIF Strategies, login to our analytics portal. Login to Learn – Compare – Select from the universe of professionally managed focussed investment portfolios.

Login to Our Analytics Portal

Database of all stocks / sectors & returns / risk matrices & insights of PMS & AIF

Our endeavors are to determine the Quality, Risk, and Consistency attributes (QRC). We present all data and analytics with an endeavor and the aim of informed investment decisions. If you are looking to invest and are not able to decide between PMS and Mutual Funds, or between PMS and Alternative investment funds, Book A Video Call with our experts.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION