Date & Time: 17th May 2021, 05:30 PM – 06:30 PM IST

Speakers:

Mitul Patel– Senior VP & Fund Manager, IIFL Asset Management

Shashi Singh– Senior Partner, IIFL Asset Management

Moderator: Sankalpo Pal – Biz. Development, PMS AIF WORLD

IIFL Phoenix PMS Portfolio to capture current market shift for continued wealth creation

The pandemic, having become a part of our lives, does not look a new phenomenon any longer. While the markets in general, have been doing well despite the pandemic, some businesses which were being ignored for long period of time, have out-performed recently and market is undergoing a dramatic shift. In this article we cover an interesting webinar conducted with Mitul Patel, Fund Manager with IIFL Asset Management to understand the reason for this shift and the way forward to take advantage from this market shift.

Two decades ago, India’s real economy sectors like metals, cap goods, oil & gas, cement, autos used to command much higher weights in the composition of Nifty than today. Things changed over last one decade, as this period was more about consumption lead businesses over capex lead businesses. And, thus, today, weights of core-economy sectors have reduced a lot. Refer the data below to understand this better.

| Change In Nifty Composition | |||

| Sectors | Dec-08 | Apr-21 | % Change |

| Oil & Gas | 27.10% | 11.80% | -15.30% |

| Metals | 8.20% | 3.20% | -5.00% |

| Telecom | 6.30% | 2% | -4.30% |

| PSUs + Banks | 5.80% | 2.10% | -3.70% |

| Healthcare | 6.30% | 3.70% | -2.60% |

| Automobiles | 6.70% | 5.20% | -1.50% |

| Capital Goods | 4% | 2.60% | -1.40% |

| Cement | 2.80% | 2.60% | -0.20% |

| Utilities | 1.90% | 2.10% | 0.20% |

| Technology | 14.50% | 16.50% | 2.00% |

| Consumer | 7.80% | 10.10% | 2.30% |

| NBFCs + Insurance | 2.10% | 11.70% | 9.60% |

| Private Banks | 4.70% | 24% | 19.30% |

| Miscellaneous | 1.800% | 2.40% | 0.60% |

| 100.00% | 100.00% | 0.00% | |

Source : Bloomberg, Motilal

This change seen over last one decade is very logical, as to stock markets what matters most is business cashflows and earnings more than revenues.

Stock market, over last decade became extremely polarized to favoring only those companies which are considered as secular or compounding businesses as these were generating higher cashflows and earnings, despite an economy where GDP and corporate earnings were falling at broader level. Hence, huge valuations divergence got created between these ~2 dozen favorable businesses showing traits of high cashflows and earnings trend and broader markets saw fall in stock prices.

The Covid Year 2020 changed the scenario back in favor of Capex lead businesses, as interest rates worldwide fell to lowest ever in last 4 decades leading to rise in commodity prices. Thus, out-performance in equities over last 1 year has come from cyclicals and value business over seculars and defensive businesses.

Going by macro-economic data points of rise in growth because of continued low interest rates, and also the rise in un-employment because of Covid, it’s evident that on one side, that there is a strong undercurrent in the economy for the real sectors to do well, and on the other side, government should also lay focus on these sectors as they will generate huge employment as these comprise the back bone of India’s economy.

Multiple triggers for ROE expansions and economic growth are real – low interest rates, strong corporate earnings recovery in last 3 quarters, aggressive credit policies etc. Nifty is trading at 17 times forward earnings and price to book of 3.2 times (Long term PE averages are around 21-22 times and the range of price to book is 3 to 4 times).

Historically, the nature of cyclicals are short lived for 12 to 24 months but in short span of 2 year, returns equivalent to 10 years are generated. This time, as the shift has come after a very long Gap, since factors responsible for this shirt are real and meaningful, this change is here to stay for longer.

The IIFL Phoenix PMS as the name conveys is meant to benefit from this Shift.

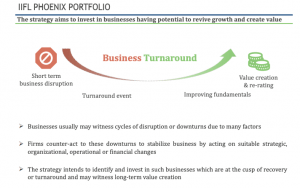

The investment strategy of IIFL Phoenix PMS is to invest in a portfolio following the SCDV framework (Secular, Cyclical, Defensives, Value Trap) wherein it invests in businesses having long-term track record where profitability and growth have been impacted by short term cycles.

The investment manager would target such opportunities having long-term mean reversion capability, having potential for sharp improvement in fundamentals. Portfolio construction shall have higher proportion in the three quadrants, Cyclical, Defensive and Value Trap where portfolio securities may have the trajectory of PAT and ROE growth to move to Secular quadrant.

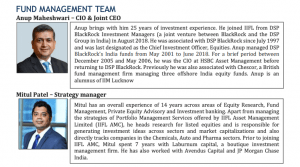

Investment Team of IIFL Phoenix PMS

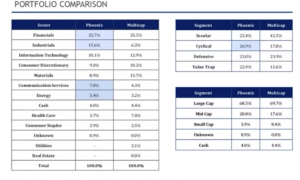

Investment Portfolio of IIFL Phoenix PMS gives more weights to Cyclicals, and Value traps, if compared to IIFL Multicap portfolio ( one of the Best PMS as per 5 year performance )

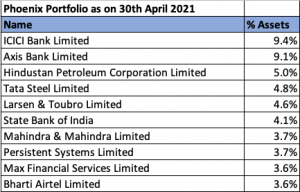

Here are top 10 holdings of IIFL Phoenix PMS, and it’s evident that portfolio is focused on companies that are expected benefit from market shift

PMS AIF WORLD is India’s most trusted new age investment services platform focused towards ALTERNATES. We are performing 2 services extremely well – investment focused wealth service, and two, analytics focused content service.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION