Date & Time: 07th June 2021, 05:30 PM – 06:30 PM IST

Speaker: Abhay Laijawala – MD & Fund Manager, Avendus Capital

Moderator: Kamal Manocha – CEO & Chief Strategist, PMS AIF WORLD

Aiming Alpha in the investment landscape with emergence of new style of investing

For many investors, Environmental (E), Social (S), and Governance (G) risks are getting real and the ESG philosophy is becoming a pillar for many fund managers. In India, many AMCs have realised the importance of the same and thus, this has led to the birth of many ESG related funds. One of them is Avendus Capital’s Avendus India ESG Strategy PMS.

Abhay Laijawala, MD at Avendus, and the Fund Manager of this PMS Strategy, shared his insights on the philosophy in the course of this webinar. ESG was a pretty nascent concept in the beginning of 2019 and today, it stands out in the eyes of investors.

ESG should not be seen as something complex; as an art or science. ESG is primarily a style of investing that assesses risks as well as opportunities— the way you have Value, the way you have Growth, we now have ESG.

This is not just an evaluation of the financial factors. It goes much beyond the analysis of traditional factors and is a 360° analysis. To put it subtly, the analysis looks at the relationship that a company has with all its stakeholders. Conventional investors looked at the financials of the company and projected shareholder returns based on bottom line of the company. This in turn, concluded their investment decisions. But this has changed now— a company is no longer only evaluated on the basis of shareholder returns but on stakeholder returns. Today, we talk not only about profits, but about profits that tags along with a purpose.

It is irrelevant what the company size is. Large or small, every company needs to look at the stakeholder perspective. Mr. Laijawala stressed on the fact that companies are not being evaluated solely on the profits of a business. For e.g., if we are to analyze a small profitable business, we must look into the work culture set by the management, how the day-to-day activities affect the environment and moreover, the corporate governance norms are in place or not. An equal weightage has been given to how a small company embraces the ESG factors. It is imperative to say that these factors will play a crucial role in the sustainability of smaller firms. Organizations embracing socially accepted norms, complying with the environmental policies and standout on the work environment ethics point stand to be re-rated by investors. ESG factors gauge the amount of risk a company can take and subsequently allow investors to place a value over it.

Taking the conversation a step ahead, a question was asked whether ESG norms have a certain degree of effect on the choice of stocks a fund can select. At Avendus India’s ESG PMS, companies are weighed on the materiality basis. The sector an organization functions in plays a key role combined with government regulations that might affect the overall industry. Out of key ESG factors relevant for India, water crisis, air pollution and carbon emissions are 3 prime factors that will shape the fund’s process.

As air pollution is the third highest cause of death in the country and upcoming global regulations in the fossil fuels sector might have serious repercussions in the domestic arena as well. Hence, the fund excludes companies dealing in tobacco, weapons, fossil fuels and alcohol. An important risk parameter could be cyber security with the digitization process underway across all fields in the country. The global regulations and governance by domestic authorities will lead to the exclusion of several stocks. Furthermore, it leads to alpha generation as companies that might be penalised in the future are already excluded by the fund.

The list of exclusions includes companies like ITC, United Breweries, Coal India and BHEL. The fund excludes L&T due to its involvement in weapons but a few clarifications from the company will turn it into a green light. Moreover, Reliance as a company is still excluded by the fund but Mr. Abhay Laijawala believes that separation of entities like Jio and Retail could lead them to invest in such stocks.

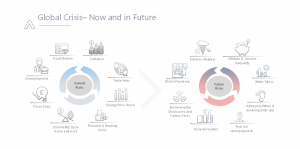

Investors are either spiritually savvy and have strong boundaries as to investing in only those companies that add value to the ecosystem or believe that the quantum of money made is more important to them. The latter comprises 90% of investors as they are chasing money and ignoring the ESG factors. They are poised to miss out some of the best performance in the coming few years. The financial markets, currently, face risk from unemployment, trade wars, financial and banking crisis, fiscal crisis, asset bubble and deflation to name a few.

However, future risks entail a different set of risks like the global pandemic, water crisis, inflation and income inequality, decarbonisation and environmental disclosures. These are significant risks that investors need to factor in before investing or making a long-term decision. The future risks are material as well as carry a financial impact. The global pandemic is a material event but had a massive financial impact greater than the financial crisis of 2008.

You don’t need to be doing a social impact to be investing in ESG. You are investing in ESG because it captures the risks and opportunities that are in the pipeline.

The global food prices have risen due to drastic climate changes that have taken place. It has impacted food production significantly that global GDP could take a hit of 6% per annum. The 360° analysis provided by ESG allows you to take into consideration future risks and opportunities and go beyond the traditional financial risks. Earlier, ESG was used to make impact investing but today it has firmly cemented its place as a source of alpha creation. An investor missing out on the ESG factors may see his portfolio de-rated.

The parameters that guide stock selection to a particular index by NSE or SEBI also have ESG to its list. Moreover, an ESG Index is present in the Nifty and the stakeholders have strong belief that the firms are sustainable and profitable in the near future. Regulations throughout the world are moving towards ESG factors and due importance is being given to it. The USA and Europe are leading countries to adopt business social responsibility policies and India is not far behind in putting her best foot forward.

Having laid the definition of ESG, its importance and risks of avoiding ESG, asset allocation holds the key once the stock is ESG compliant. The IT industry is ESG compliant and Avendus India ESG Strategy includes companies like Infosys, Tech Mahindra, HCL and TCS. Several IT companies have a target of turning carbon neutral by 2050.

On the other hand, TCS has norms in place to encourage gender diversity as women are less prevalent from the mid level management and upwards. TCS had reached out to its ex-employees, that had to leave for various reasons, such as marriage or pregnancy, and requested them to work from home even before the pandemic hit. It lead to increased productivity and loyalty with flexible work environment hours and choice of place. It provided tangible benefits to employees as well as investors who had kept diversity as an investment metric. A fact was stated that the board members in technology companies in India have a strong market value and thus rank higher in the ESG levels.

Once the company ranks higher on the ESG factors, the financials of the company play an improved role in deciding the weights to be given to each stock. The integrated ESG style of investment is to create a sustainable alpha for fund managers and retail investors as well.

There are investors that have termed ESG a marketing gimmick as the pandemic has shown the true side of the whole story. According to a poll, 81% of investors agreed to invest in an ESG portfolio that could lead to alpha generation as well. Investors have become savvy as the trend of ESG investing has picked up pace.

There are questions raised whether platform businesses like India Mart and offshore IT businesses are included in the fund and whether ESG factors will be met with the same. The companies in the platform business have the task to bring the small and medium enterprises to the larger audience and hence they are doing a commendable job. The ESG process entails covering 100-200 variables and looking at the financials only would be a foolish advice for any investor. Global ESG funds include companies like Google, Facebook, Twitter and WhatsApp. Although the tax ramifications might impact investing parameters for the Silicon Valley companies, they rank higher on the ESG parameters for the time being. Moreover, these companies are ESG compliant from their end making it a decent choice to be included in a fund.

The ESG parameters do have a role to play in banking and financial sector as well. When analysing Indian banks, loans given to environmentally negative companies will lead to automatic disqualification from the list. An impact assessment report and effluent post analysis helps in keeping the bank in the portfolio or excluding it. For a bank that provides loan to an entity that builds a coastal road in Mumbai is detrimental on various parameters as sea or tide levels are bound to increase in the near future to climate change. Subsequently, the cyber security is also important for a bank as customer details need to protect come what may. Cyber security should be in the DNA of the bank and the head of the department should be trustworthy and loyal.

A CEO of one of the top three banks in India stated that cyber attacks have given him sleepless nights and he has pulled all the plugs to safeguard the interests of the customers. The bank will be able to mitigate cyber attacks in the future due to its importance given to the social factor in ESG. Gender diversity, overall satisfaction of employees and the attrition rate cover the governance factors. Employee surveys and whistleblower policies impact the bank on multiple grounds. A controversial project that might hurt the Great Barrier Reef in Australia might not receive the necessary funds from a bank as it has assessed the environmental impact and it’s ramifications on the bank itself.

There is a stark difference between the international form of fund management and the ESG management. The global sustainable investment alliance has shown data from 2018 which highlights the fact that the corpus under ESG investing stood at 30 trillion. It covers 30-40% of the assets under management in the entire universe. Experts believe that it is poised to double by the time the next data comes out as the pandemic has played a significant role for the huge influx. It was unthinkable to visualise India having a corpus of 10,000 crore under ESG investing within a span of 24 months. As it continues to gain mainstream traction across the globe, investors in India are looking towards the ESG factors on a serious level. As foreign investors are looking for ESG compliant companies to invest in, Indian organizations since their inception are turning out to be ESG compliant and making the cut to receive investments.

Valuations are higher for those companies that are ESG compliant. Indian investors have looked at the global impact of such an investment trading style. Hence it is bound to turn into a mainstream sight for all to behold. Subsequently, it will lead to alpha generation among investors and institutional stakeholders as well.

ESG is not about altruism, and it is not about changing the world in a positive way but it is the only way forward in which alpha will be created.

At Avendus, integrated style of ESG investing is followed which is imbibed in the fundamental analysis of companies. The various parameters will be included in cost, sales and EBITDA numbers before taking a wise decision. The Indian government is poised to take measures to control air pollution which will affect the automobile industry significantly. An articulated fuel strategy will help a company overcome the negative factors and rank higher in the ESG levels. There are risks that might affect cost and sales numbers once government regulations are taken into consideration. Furthermore, Avendus issues the carbon footprint of its portfolio to help create awareness among investors as to where the funds are allocated.

The webinar was well rounded up with the fact that a fund should keep Nifty as its benchmark and not Nifty ESG as it is important to beat the larger portfolio of companies. ESG factors help fund managers to rank companies on a higher scale and hence take the crucial decision of investing or not.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION