Introduction

In the dynamic realm of portfolio management, our quest for excellence often centers around identifying businesses with the potential to compound investors’ capital over the long term. However, amidst the pursuit of greatness, a crucial question looms large: does the identification of a great business automatically translate into a great stock? This challenge has become increasingly pertinent, particularly in the Indian market landscape in recent years as a large basket of ‘Super Quality Stocks’ started trading at unexplainably high valuations. But behind the glittering facade lies a tale of twists and turns that has left investors scratching their heads in recent times. We at Monarch AIF uncover the secrets of these enigmatic stocks and unravel the lessons for investors.

A Look Back: The Rise and Fall of market darlings

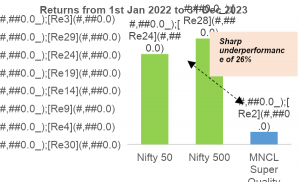

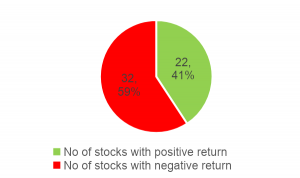

In January 2022, our analysis at Monarch AIF covered in our investor newsletter (https://bit.ly/AIF-SQS2022) unveiled a basket of 54 ‘Super Quality Stocks’, riding high on a wave of valuation euphoria. These stocks enjoyed immense popularity and were trading at exorbitant prices, far exceeding their intrinsic value but were considered as Buy at any Price companies for low risk compounding. We very boldly called out these stocks trading at astronomical valuations back then and argued for their sharp underperformance. The ensuing years brought a reality check, with these stocks failing to match the exuberance of benchmark indices. During Jan’22 to Dec’23, while benchmark indices soared to new heights, the performance of our identified ‘Super Quality Stocks’ basket painted a different picture. With a modest rise of 3.5% compared to the Nifty 50 and NIFTY 500’s gains of 25.2% and 29.6%, respectively, over the same period, the underperformance was glaring. Thirty-two out of the 54 identified stocks closed in the red, bearing the brunt of market revaluation. The punishment given by the market was quite severe in cases where earnings couldn’t live upto the lofty expectations. This emphasized the critical importance of grasping the intricate dynamics of valuation and the risks associated with paying excessive premiums for stocks, even if their underlying fundamentals appear strong.

| Massive underperformance from ‘Super Quality Stocks’ basket of 54 stocks | 59% of the stocks in the basket closed negative based on last 2Y returns! |

|

|

| Source: Bloomberg, Monarch AIF, Returns are from 1 Jan’22 to 31 Dec’23 | Source: Bloomberg, Monarch AIF, Returns are from 1 Jan’22 to 31 Dec’23 |

Key implications for investors:

- Ignore valuations at your own peril – We believe that sound investing is incomplete without fair assessment of valuations done through application of various valuation techniques including both approaches of DCF as well as earnings multiples. Not giving any importance to valuations altogether for great businesses in the pretext of fancy expectations of future can be a recipe for disaster as the business is always an evolving story and can see large changes in its valuations ascribed by the market in a short time frame on small issues which can come up in the interim. We, at Monarch AIF, prioritize margin of safety and assess valuations through various techniques to mitigate risks and capitalize on opportunities.

- Holistic Evaluation is needed – Growth cannot be taken for granted in today’s disruptive world, and market expectations often prove to be overly optimistic. Investors need to exercise extra caution and maintain a margin of safety, especially in the face of unrealistic growth assumptions and inflated valuations. Evaluating valuations holistically, considering strong fundamentals and market flows, is crucial to navigating market uncertainties and making informed investment decisions.

Identifying the new ‘Super Quality Stocks’ basket trading at astronomical valuations

In our Jan 2024 analysis covered in our investor newsletter (https://bit.ly/AIF-SQS2024), we at Monarch AIF have identified and put forth a new basket of 36 ‘Super Quality Stocks’, characterized by even more stringent parameters, yet plagued by astronomical valuations. While the quality of these businesses remains commendable, the inflated valuations suggest a rocky road ahead on similar lines of the earlier identified basket of such stocks.

Conclusion

We have noticed that while a fair bit of valuation normalisation has taken place in the ‘Super Quality Stocks’ in last two years but absolute valuations remain very extended. Additionally, there has been widespread expansion in valuation multiples in many other segments of the markets and particularly in the low quality and vulnerable segments which have historically been plagued by poor execution and poor governance practices. Based on our study of past market cycles and our analysis of ‘Super Quality Stocks’ of last two years, we can safely conclude that if very good quality stocks can show massive underperformance on account of stretched valuations (like we saw in last two years) then investors would be well reminded of what can happen to low quality stocks which have started to trade at extremely stretched valuations in many pockets of the markets now. Investors would be well served by exercising caution.