India’s private credit market has undergone significant transformation in recent years, evolving as a critical component of the country’s alternative financing ecosystem. With US$6 billion in deals recorded in H1 2024, private credit has emerged as a vital funding source for mid-market companies and sectors such as real estate, manufacturing, and infrastructure. This growth follows US$8.6 billion in investments during CY2023 and US$5.9 billion in CY2022, indicating a steady upward trajectory.

Private Credit aligns well with market structures, meeting the need for long-term investments and more flexible company-specific or asset-specific lending. It brings in the flexibility with regards to type, size and timing of the transactions making it a preferred borrowing instrument. The regulations in the banking sector have limited the risk banks can take, retreating them from select lending deals.

The Growing Confidence in Indian Private Credit Market

The rapid expansion of the private credit market is underpinned by India’s robust macroeconomic fundamentals, supported by improving capital expenditure, rising domestic demand, government reforms and stable monetary policies. Furthermore, regulatory developments, including improved oversight of Alternative Investment Funds (AIFs), are fostering transparency and investor confidence.

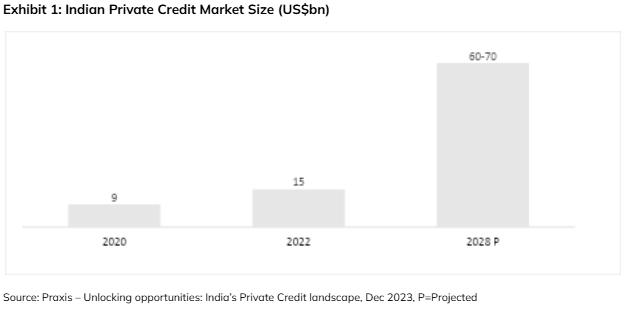

The asset class is estimated to fourfold in size between 2022 to 2028. India has emerged as a preferred destination with its robust economic growth, strategic initiatives and a large young workforce which works in its favor.

Exhibit 1: Indian Private Credit Market Size (US$bn)

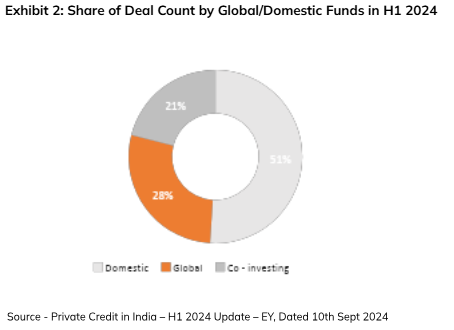

The growing preference in the asset class in reflected in the number of deal counts in H1 2024. The domestic funds are dominating the space with their local presence, relationships, and market coverage. Whereas, the global funds typically focus more on larger deal value and so are leading the market in terms of deal value with 58% share as compared to domestic market with 42% share. The surge in the deal value is majorly accounted by the high performing deals that took place during the year.

Exhibit 2: Share of Deal Count by Global/Domestic Funds in H1 2024

Growing Preference for Performing Credit

Of all the existing credit options, performing credit is the most preferred one. Suited for the mid-market companies, this segment provides medium risk and returns, avoiding stressed situations and focused towards growth and capital requirements of the companies. With the private capex expected to pick up, the demand for performing credit is estimated to be robust as well. In contrast to the high-risk world of distressed debt or the potentially stagnant returns of government bonds, performing credit offers encouraging risk-adjusted returns.

We at ICICI Prudential Alternates, look at companies that have fundamentally sound businesses and are managed by an experience team or promoters. We aim to evaluate investments based on several factors, as may be applicable, which may include, but are not limited to, management quality, credit quality, structure, etc. The investment team utilizes both qualitative and quantitative assessments in the selection process of the investment. On ground presence helps us necessitating fragmented and localized deals. We pay special attention to proprietary deal origination within our ecosystem. Attention is also given to avoiding deals in greenfield projects, distressed deals, groups with poor past history and in unfavorable sectors.

Buoyancy to Continue in 2025 and Beyond

We believe the private credit market will continue to support transactions related to M&A financing, bridge-to-IPO funding, and structured credit. Performing credit, which focuses on high-quality borrowers with predictable cash flows and secured lending, backed by collateral will see a decent traction.

The M&A activity has been buoyant in the country with mega deals in first half of 2024. As per Indian Brand Equity Foundation (IBEF), M&A activity in India rose by 13.5% in the first eleven months of 2024 to reach US$88.9 bn. A positive M&A trend in other sectors like automotive and energy is also expected

as we see a rise in investments in the electric vehicles and the growing emphasis on clean and renewable energy. Transactions in the buyout deals seems to have gained traction. The Private Credit funds have executed deals by serving as a bridge till the IPO takes place or by providing funds to the promoters for the PE firms exit, in our view this trend could continue.

Capital expenditure/Growth financing is one of the crucial drivers of the Private Credit funding. Domestic funds are gaining market share because of the growing awareness of this alternative financing instrument, its distinctive features like flexible structuring solutions, negotiable security options, better understanding of the local dynamics and relationship. We believe Private Credit is bringing a shift in the credit market, with growing preference for it over the traditional sources of capital.