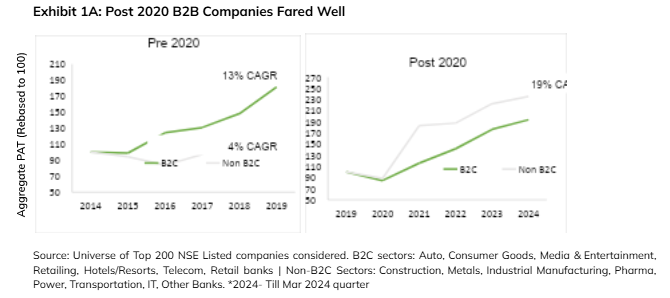

In our Annual Outlook CY 2024, “Stay the Course” we highlighted a shift in earnings trends wherein B2B businesses saw healthy recovery in their profits, which we believe is likely to continue in 2025. The past four years have been supported by India’s renewed focus on kick starting investment activity in the economy. This began with Government-driven capital expenditures and end-user demand necessitating capacity expansions in sectors with high capacity utilization. In this journey, we have also seen improved financing capacity coming from internal accruals of corporates/individuals, improvements in asset quality (particularly among public sector banks) and active capital markets. The primary beneficiaries of this trend have been B2B compared to B2C businesses.

Given our positive stance on these sectors and companies, our strategies have managed to create alpha for investors in this phase. Along with prudent stock picking and spotting the right trend, the market beta also played a key role in generating strong returns for our investors. The easy pickings on this front are seemingly less in offer from Mr. Market in CY 2025 and to that extent, this will be a year of Resetting One’s Expectations. We cite following reasons (a) the near term past was way too good both from beta (earnings growth exceeded GDP growth) as well as alpha perspective (B2B fared well compared to B2C) (b) going forward beta will be soft (modest in the near term and healthy in the long term) in line with nominal GDP growth and generating alpha will be difficult (given B2B valuations has caught up with their long term averages and exceeded in some cases.

Exhibit 1A: Post 2020 B2B Companies Fared Well

One needs to tone down expectations on both counts, absolute returns and its velocity. In our view, absolute returns are considerably less likely to be beta driven and more of rowing the boat upstream i.e. purely based on bottom up stock picking and creating alpha.

One needs to tone down expectations on both counts, absolute returns and its velocity. In our view, absolute returns are considerably less likely to be beta driven and more of rowing the boat upstream i.e. purely based on bottom up stock picking and creating alpha.

Looking back, CY 2024 was marked by significant geopolitical events, and an election heavy year with over 70 countries, including (most notably for our markets) in India and the United States. Further, Europe and China also faced slower economic growth compared to their historic trend line. These events added to uncertainty on direction of policy movement in these markets and their implications for rest of the world. On the monetary policy front, 2024 saw many G10 central banks begin rate-cut cycles to stimulate growth as inflation started to come within their comfort zone. Despite these uncertainties, the broader Indian markets delivered YTD returns to the tune of 16%. (NSE 500 TRI Data as of Dec. 30, 2024)

Exhibit 2: Long Term Drivers of GDP Growth

Key to 2025 will be more of bottom up v/s top down (i.e. theme/sector agnostics). Our focus has been towards companies with prudent capital allocation, earnings growth and improving RoEs to identify them as good companies. Marrying that with the right risk-reward that these companies offer, through our time tested BMV (Business, Management and Valuations) framework is what has worked for us in the long run and we strive to continue the same. In the current scenario, we are finding these set of companies in B2B space have better earnings growth potential and are available at reasonable valuations. But all said, the market will transition from Beta driven (supported by solid macro, decent global growth and government heavy lifting) to one where bottom stock picking will likely add alpha. Key risks to our outlook remains (a) the uncertainty in global trade and investment landscape due to US policies, (2) continued overhang from Chinese overcapacity and (3) low visibility of long-term domestic and global demand.

In CY 2025, Nifty 50’s earnings growth may moderate. While the near-term outlook might be challenging due to global economic uncertainties, India’s long-term growth story does remain strong. Key drivers include demographics, digitalization, infrastructure development, financialization, and a growing middle class. Structurally, we believe India Inc. can sustain a 10-12% earnings growth rate in line with nominal GDP growth. Despite the recent correction, Nifty 50 P/E remains significantly above the 10-year mean. We expect CY 2025 market performance to be driven by earnings, favoring sectors with a lower risk of EPS cuts.