Date & Time: 16th April 2021, 05:30 PM – 06:30 PM IST

Speakers:

Parijat Garg- Senior VP- Fund Management, IIFL Asset Management

Shashi Singh– Senior Partner, IIFL Asset Management

Shishir Bajpai- Executive VP, IIFL Asset Management

Moderator: Sankalpo Pal- Biz. Development, PMS AIF WORLD

Demystifying Quant Investing and its potential for OUTPERFORMANCE

To start with the basics, it might come as a surprise to many, but NIFTY is a Quant Product. It is an index that is widely used by Indian Investors; almost by anyone and everyone, but not everyone knows that it is actually a Quant Investment Product. Quantitative or Quant Investing, though sounds complex, is actually very simple.

Looking closely at most underperforming funds (with off course good quality stocks), one can observe that the underperformance is mostly because of the sentiments or the emotions of the fund managers involved. Human involvement can sometimes become a limitation to the performance of the fund. With the help of evolution and technology, a lot of work in all fields is shifting gear towards Machine Learning (ML) and Artificial Intelligence (AI). On the same path Quant Investing is the future of Investing.

Quant Investing is an objective, rules-based system to pick stocks and build portfolios.

It does not necessarily have to be very fancy, or use complex codes, or involve a ton of mathematical formulas or AI; but it necessarily has to be both objective and rule-based. For instance, one might come up with the rule to buy only cheap stocks; but this ‘cheap price’ is not objective- it is subjective and hence this strategy cannot be classified under Quant Investing. Hence, it is primary for the system or strategy to be both objective and rule-based to classify under Quant Investing.

Taking this definition, one can figure out how Nifty 50 is a Quant Product. Simply calculate the market cap of all stocks, sort in descending order, pick the top 50 (stock selection), buy in proportion to market cap (stock allocation).

Consider this delicious cake to be the entire market. Now the slice that’s cut-out represents the quant products that are maybe the benchmark indices – everything (cake, cream, fondant, sprinklers) in proportion. But then there might be some people who will remove the cream and just eat the cake and some who will just lick the cream. To satisfy all such desires, different kinds of Quant Investment Products are available.

So how else can one cut the market cake?

There are lots of ways to do that- Growth, Quality, Defensives, Sectoral, Thematic, Momentum, and so on. If you have a higher risk appetite, you don’t mind going for Mid-caps, a risk-savvy person who thinks that the markets are risky, might buy Defensive Stocks, and so on. But what are defensive stocks? SEBI/AMFI has laid-out, set definitions for mid-cap or large-cap stocks; but there is no guided definition for what is a defensive stock. As mentioned earlier, Quant Investing is objective and rules-based. So if the rule is to buy Defensive Stocks, to be objective about it will need a proper mathematical definition.

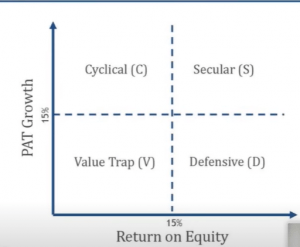

The S-C-D-V Framework followed at IIFL Multicap PMS (as explained by Mr. Anup Maheshwari in this webinar) categorises the various stocks as Secular, Cyclical, Defensive or Value Trap. So if for the 10 years under observation, a stock has given an ROE of >15% for at least 6/10 years, it is a Defensive Stock. So this is no longer subjective or dependent upon who runs the company or the likes. This simple formula, once put on any spreadsheet will give the same results across.

A live poll was conducted during the webinar, to select between companies with a long history of high ROE and strong profit growth and all the BSE 200 Companies. 87% attendees said that given a choice, they would go for first option, as opposed to the 13% who opted for ‘all the BSE 200 companies.’ The 87% attendees will, on an average, do better than the rest 13%. Selecting companies with a long history of high ROE and strong profit growth as opposed to the BSE 200 companies is an intuitively correct choice, and this is exactly what a Quant Investor ‘latches on’ to— Objectively define the rules, then run a back test and then systematically bet on the category that consistently does well.

The next aspect that applies to Quant Investing is ‘Risk.’ Let us take a hypothetical scenario and assume that an investor follows the methodology of investing in only those stocks which has a cheap Price to Book Ratio. Given this, once the portfolio is built, it will likely have no FMCG company because typically in India, FMCG companies tend to trade at high P/B and high P/E multiples. So the stock selection might be good but the portfolio skewness with respect to sectors will be highly lopsided. This is where Risk Management comes in and is well defined and managed well via Quant Investing. Humans can bring in the bias of investing in ‘cheap’ stocks but since Quant does not involve any emotions, that bias is eliminated.

To summarize, a Quant strategy can be made by following these steps :

- Objectively define the strategy and its characteristics,

- Establishing value of investing in those characteristics (via back-testing), and

- Building an explicitly risk-managed portfolio.

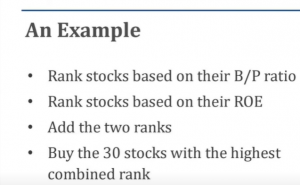

This is a classic example of a Quant Strategy that is popular since the last decade. It is one of the most DIY strategies. One can get this calculated on a spreadsheet, back-test the winners and take a wise call.

Myths & Realities of Quant Investing

Myth : A lot of people today believe that Quant investing only works in theory and not in practice.

Reality : In the West, there have been Quant Strategies that are into play since 30 years and have been performing phenomenally well.

Myth : A lot of people think ‘engineers with no understanding of markets’ build Quant strategies, so these can’t be replied.

Reality : Quant Strategies can mathematically combine parameters like ROE, Gross Margin, Debt/Equity, etc. to conclude on the ‘Quality’ Factor. Similarly ‘Value’ can be comprehended by combining P/B, P/E, Dividend Yield, etc. ‘Momentum’ can be concluded by combining parameters like yearly/half-yearly/quarterly returns

Why does Quant Investing work?

One important reason is the absence of behavioural bias [best example: in the March 2020 crash, a lot of fear was imbibed in the people; in Quant, there is no fear – if the system triggers a buy suggestion, you go and buy, simple; on the flip side, it does not have greed, it will sell when a stock becomes expensive]. Apart from that factors like compounding learning and objective back-testability work its own charm and deliver results. Thus, Quant Strategies can deliver Alpha based on these advantages that they have over Discretionary Strategies.

As a crux, to win at any game, a proper process-driven, method-driven strategy is needed, and that is precisely what Quant Investing brings in. It’s a combination of both old school and new school thoughts and takes the subjective portion from the Discretionary Strategies and quantify it as much as possible to mould an efficient Quant Strategy.

With people moving towards passive funds and realizing that it will get difficult for active managers to beat the Index in the long run, it is the right time to switch gears towards Quant Investing!

For Risks of Quant Investing, how can these be contained, and much more, watch out 23rd April Webinar between IIFL AMC & PMS AIF WORLD, India’s Most Trusted, New Age Investing Platform for Making Informed Investments.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION