Phillip Capital Multi Asset PMS: Diversified Multi Asset Portfolio Approach

Speakers: Nishit Shah | Fund Manager & Principal Officer- PMS & AIF at Phillip Capital (India) Pvt. Ltd.

Moderator: Sankalpo Pal, Biz. Dev, PMS AIF WORLD

Session Highlights

It is common to hear Indian folks regarding Equity as one of the best asset classes to generate highest possible returns. This myth was busted by Mr. Nishit Shah by showing a tabular data that represented the CAGR of various asset classes across a long horizon of April 2007 to Nov 2020. The table clearly represented that amongst all the asset classes (Nifty50, S&P 500, Gold, 10Y Bharat Bond), Nifty50 had the lowest CAGR and the highest volatility as well as drawdown.

There has been an uptick in the equity markets in the last 4-5 years, but if a longer horizon is taken, equity markets have not generated favorable returns or the highest of returns, so to say. Of course, “No single asset class can deliver everything an investor wants” as all asset classes have their own bouts of volatility and drawdowns. Hence, diversification is the key.

“Diversification helps. Especially on the downside.”

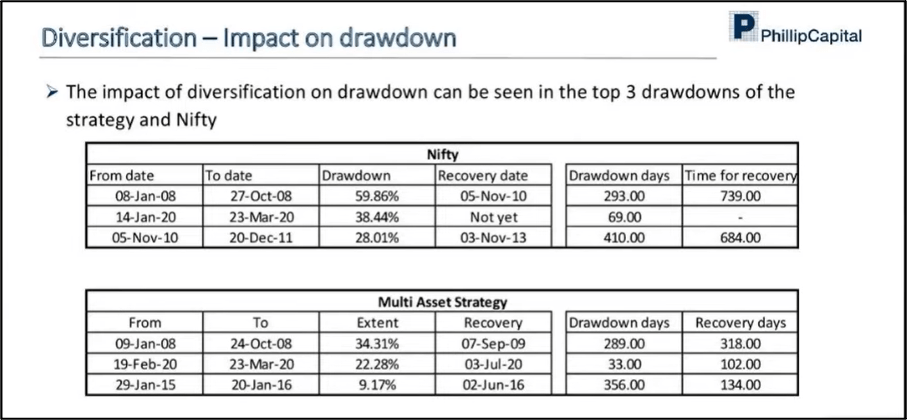

To put the idea of diversification into perspective, he represented the below table.

For the purpose of explaining, he mentioned that if for instance, the portfolio is diversified into 4 asset classes- Nifty (50%), Gold (20%), S&P 500 (10%), and Bharat Bond 10Y (20%), it is evident from the table that historically, a multi asset strategy has generated better returns than just investing into (Indian) equities.

It is evident from the above back-tested data that diversification not only reduces drawdown but also ensures that the portfolio recovers much faster.

It is imperative to understand and manage volatility first and then aim at returns. Keeping this in mind, under the Phillip Multi Asset PMS, such diversification (across equity, gold, international indices, and bonds) takes place to reduce the volatility (the lesser the portfolio falls, the faster it can recover) and generate maximum returns (the portfolio churn is structured to minimize costs and provide better post-tax returns as well).

The allocation of Phillip Multi Asset PMS as follows:

• Indian Equities: 0%-70%

• Fixed Income Instruments: 0%-50%

• International Equities: 0%-20%

• Gold: 0%-20%

The tenure of this PMS is minimum 3 years and under this, the Indian equities are dynamically allocated using proprietary quant model (algos that generate buy and sell outputs). This dynamic allocation ensures that drawdown is meaningfully reduced, while not losing out on the equity upside. The investment objective of Phillip Multi Asset PMS is to build a diversified portfolio across low correlated asset classes, in such a way that drawdowns and overall portfolio volatility is reduced.

Risk Disclaimer: Investments are subject to market risks and there is no assurance or guarantee that the value of or return on investments made will always appreciate, it could depreciate as well and may also result in loss of capital. For details, please refer to the risk factors mentioned in the disclosure document that applies to this investment approach.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION