Motilal Oswal Focused Midcap Strategy

Open-Ended Focused Mid Cap Portfolio with investment universe of stocks ranked 101- 400 as per market capitalization

In-depth 5P and QRC Analysis of Motilal Oswal Focused Midcap Strategy, with data as of 30-Sept-2020. 5P factors cover People, Philosophy, Performance, Portfolio, and Price. These are studied to determine the 3 most important attributes i.e. Quality, Risk and Consistency.

PEOPLE : Portfolio Manager, Management, Team

Raamdeo Agrawal, Chairman, MOAMC

Investment Mentor

- Raamdeo Agrawal is the Co-Founder of Motilal Oswal Financial Services Limited (MOFSL).

- As Chairman of Motilal Oswal Asset Management Company, he has been instrumental in evolving the investment management philosophy and framework.

- He is on the National Committee on Capital Markets of the Confederation of Indian Industry (CII), and is the recipient of “Rashtriya Samman Patra” awarded by the Government of India.

- He has also featured on ‘Wizards of Dalal Street’ on CNBC. Research and stock picking are his passions which are reflected in the book “Corporate Numbers Game” that he co-authored in 1986 along with Ram K Piparia.

- He has also authored the Art of Wealth Creation, which compiles insights from 21 years of his Annual ‘Wealth Creation Studies’.

- Raamdeo Agrawal is an Associate of the Institute of Chartered Accountants of India.

Rakesh Tarway, Fund Manager

Portfolio Manager

- Experience: He has an overall experience of 18 years in equity markets, with a focus on identifying emerging businesses in the small & midcap segment.

- Positions: He has earlier worked as Head of Research at Motilal Oswal Securities and Reliance Securities.

- Academic Background: Rakesh has a Masters in Management Studies (MMS) degree from Jamnalal Bajaj Institute of Management Studies (JBIMS), Mumbai.

- Funds Managed: Rakesh has been managing a Small Cap AIF since August 2018

PHILOSOPHY : QGLP (Quality, Growth, Longevity, Price)

Midcap – oriented PMS Strategy seeking to primarily invest in stocks ranked 101- 400 as per market capitalization. The Strategy aims to deliver superior returns by investing in stocks of India’s emerging businesses. It aims to predominantly invest in midcap stocks that can benefit from growth in earnings and re-rating of businesses. It aims to invest bottom-up by identifying high-quality companies, having superior growth and sustainable competitive advantage.

Quality

Growth

Longevity

Price

QGLP is the core investment framework followed by Motilal Oswal for Equity related investment decisions, but the same has seen evolution over time, with following five refinements add to the discipline over discretion.

- Allocation to be a function of convictions on companies and don’t necessarily dependent on price

- Maintain active targets of profits and prices on stocks with 1, 2 and 3 years view

- Mismatch of price and timelines should lead to action on folio on both sides i.e. selling and buying

- Regular trimming of positions if price targets run ahead of time lines

- Regular addition in positions if profits are inline/ahead of times and stock prices not responding.

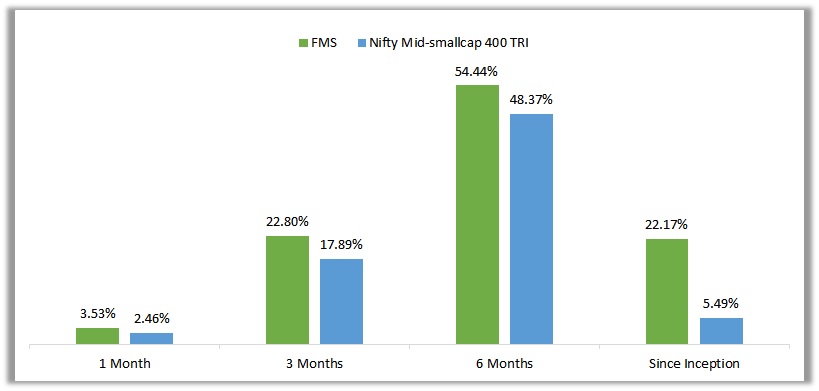

PERFORMANCE : Returns Over Benchmark

NOTE: Data as of 30th September 2020

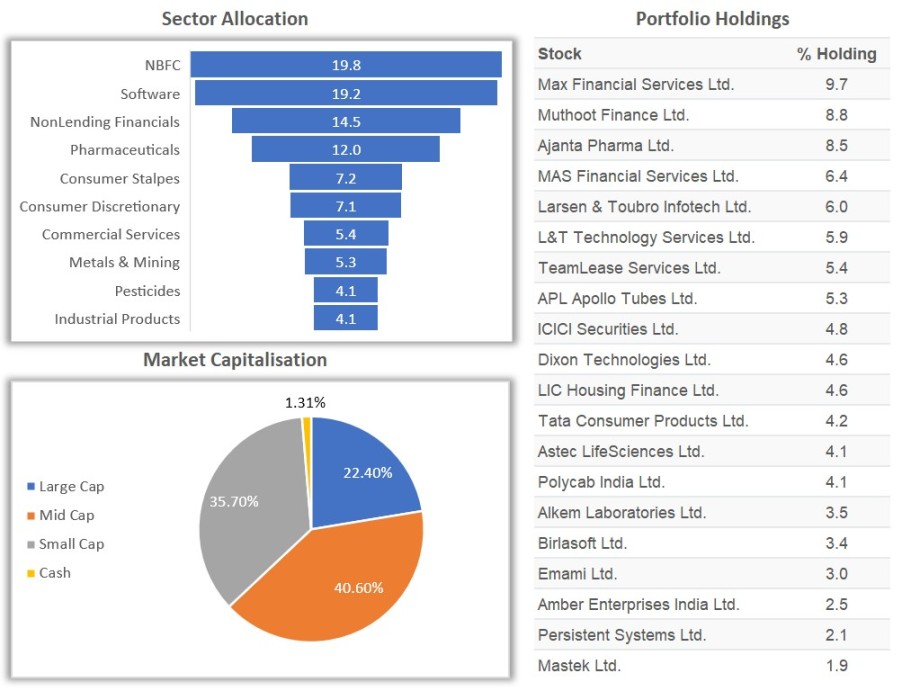

PORTFOLIO : Stocks / Sectors / Market Cap Allocation

NOTE: Data as of 30th September 2020

PRICE : No Fixed Fee – Pay On Performance

- Management Fee: Zero Fixed Management Fee

- Hurdle Rate : 6% p.a.

- Profit Share Fee: 20% of profits over the hurdle rate

- Exit Load: 2% within 12 months of investment

- Other Charges: Nil

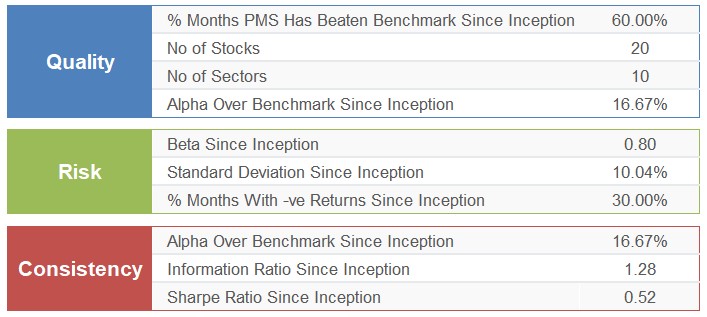

QRC : Quality, Risk, Consistency

NOTE: Data as of 30th September 2020

We at PMS AIF WORLD work with investors not just to make them invest, but associate to make informed investment decisions towards long term wealth creation and prosperity of our clients.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION

Do Not Simply Invest, Make Informed Decisions

RISK DISCLAIMER: - Investments are subject to market related risks. The report is meant for general information purpose and not to be construed as any recommendation. Past Performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. Portfolio Management Services are market linked and do not offer any guaranteed/assured returns. SPECIAL DISCLAIMER : Different Portfolio Management Services present number differently. Some follow aggregate portfolio returns method, some follow model portfolio returns method, and some follow first client portfolio returns method. It is imperative to understand this difference before comparing the performance for any investment decision. Thus, it is necessary to deep dive not only performance, but also, people, philosophy, portfolio, and price before investing. We do such detailed 5 P analysis. Do not just invest, Make an informed investment decision.