Historically, business cycles used to last for extended periods, allowing investors to ride long waves of economic expansion. Over the past few decades, business cycles have shortened due to rapid technological advancements/ disruptions, fast evolving consumer behavior, impact of climate change and rising geopolitical and policy uncertainties. For instance, in the past few years, economic cycles and stock markets have been disrupted by external events such as taper-tantrum, trade wars, Covid-19 pandemic, unseasonal rains in India and Deepseek causing massive corrections in US based AI stocks. Amidst this uncertainty, we continue to believe that India remains a structurally expansionary market. However, several external and internal factors will continue to create periods of cyclical acceleration and deceleration in economic growth.

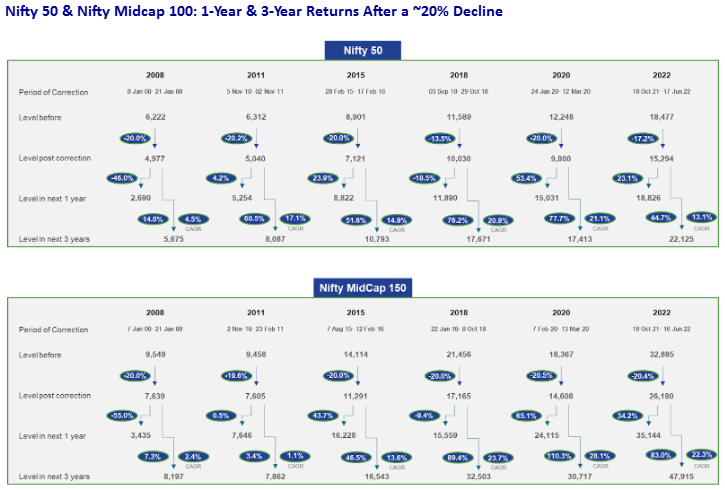

The current market scenario presents similar unique challenges, along with uncertainties around growth. However, these conditions also create opportunities to generate alpha, especially for those who position themselves closer to market bottoms and take calculated risks in the recovery phase. While market tops and bottoms are difficult to predict with pinpoint accuracy, historically markets bottom out when investor sentiment is highly pessimistic, earnings expectations are revised downward, and valuations compress significantly. The recent market correction, qualifies on all of the above criteria and has led to several high-quality stocks declining by 40-50% from peaks, presenting potential investment opportunity.

Current valuations of the NIFTY index suggest that forward-looking investors can generate strong returns if they enter at this stage. The NIFTY EPS for FY25 is around 1,080. CAGR expectation for FY25-28 is ~15%, meaning that the earnings trajectory remains robust despite short-term concerns. If we extend this to FY29, NIFTY EPS could be in the range of 1500-1800, depending on whether growth sustains at 12% or accelerates to 15%. The best-case scenario for NIFTY over the next three years assuming a PE re-rating to 25x, leads to an index level of 45,000. The base case, assuming a 20x PE, suggests a target of 30,000. This implies a potential CAGR of 11-25% for investors who position themselves now. Even in a worst-case scenario—where earnings growth remains sluggish at 5-6% and the market assigns a conservative 18x PE—NIFTY could correct to 18,000 in the short term. However, given historical patterns, downside risk is mitigated when investing at lower valuations and allowing a longer time horizon for mean reversion.

Recovery: Positioning for Maximum Alpha

The real opportunity in alpha generation arises during the recovery phase. History suggests that recoveries are often sharp and swift, rewarding those who take calculated risks.

- High- Risk On Plays: Benefiting from Market Re-Rating

A market recovery is often led by sectors that were the hardest hit during the downturn. Given the contraction in valuations and expected earnings growth, higher-risk on stocks could outperform in a recovery phase. Midcap and small-cap indices have seen far higher correction of ~22% and ~26% from peaks in Sep’24 respectively, vis-à-vis ~16% correction for Nifty-50 from the peaks. Investors willing to take on higher risk in select beaten down names can generate outsized returns in our view.

- Earnings Growth-Driven Approach

Consensus Earnings growth expectations for Nifty-50 is at ~15%. For Midcaps and SmallCaps, this is higher at around 20%-25%. There are at least 100 fundamentally sound stocks that have corrected by over 40-50%, making them attractive investment opportunities. Many of these stocks in particular have superior earnings growth potential, driven by sales growth and/ or margin expansion, and are now trading at attractive valuations after a steep correction.

- Sectoral Rotation: Identifying Leading Themes

In the current landscape, in our view, cyclical and rate sensitive sectors stand to benefit the most. Additionally, domestic discretionary consumption-driven businesses and select infrastructure plays

could gain from policy-driven incentives, tax cuts, and economic expansion. It would be pertinent to focus on identifying leading stocks within these sectors that have sustainable growth prospects.

- Credit Easing and Policy Support: Strong Tailwind

The markets for the time being amidst the noise of slowing growth and geopolitical factors, have largely ignored the strong pivots by both the Government and RBI. Fiscal stimulus in the form of tax cuts and resumption of rate cut cycle by the RBI along with several steps and guidances which support growth are likely to provide strong tailwind to growth focused stocks. As the monetary conditions loosen further, the equity risk premiums will decline, leading to a re-rating of valuations across the board. This would be a key tailwind for high-beta stocks and sectors reliant on lower interest costs.

Conclusion: The Path to Alpha Generation

It is imperative to pick the right strategies to maximise the returns during the recovery. Maximum alpha can be generated in the current scenario by being positioned amongst a combination of companies which are now available at attractive valuations, with fundamentally strong earnings trajectory, and especially those which are likely to benefit from the key catalysts in the form of income tax cuts and interest rate reduction.