Fund aims to compound wealth by identifying high growth good quality companies

Carnelian Capital Compounder Fund- I AIF

Tenure of Fund: 5 Years

Fund Type: Long only, Sector Agnostic, Multicap, Closed Ended CAT III AIF Fund

Founder: Mr. Vikas Khemani

Co-Founder & Fund Manager: Manoj Bahety

Portfolio Manager’s Experience:

Manoj has 20 years of rich & diverse financial services experience with marquee institutions– Edelweiss Securities, Morgan Stanley, RIL, HPCL. Prior to co-founding Carnelian, he has spent 11 years at Edelweiss Securities as Dy. Head – Institutional equity research, Head – forensic, thematic & mid cap research. He is known for his differentiated non consensus research and has pioneered forensic research, popularly known as “Analysis Beyond Consensus”(ABC research). ABC research has helped investors across the globe to take informed investment decisions based on true numbers instead of reported numbers thus avoiding “Pitfalls”- One of Carnelian’s virtues. Mid Cap research under his leadership has been credited for various multibagger ideas like VIP Industries, Supreme Industries, Balkrishna Industries, PI Industries, AIA Engineering, ICRA, Fag Bearing, SKF, Gulf Oil. He has represented various committees of CFA institute, which include Chairperson of India advocacy committee, member of USA based global CDPC committee. Manoj is a fitness freak and has been a regular marathon runner since last 8 years.

Vision: Create a global scale asset management platform known for its values & expertise

Mission: Help clients create and protect their wealth in the most optimal manner

Investment Objective

Investment Philosophy

At Carnelian, we believe in growth investing at reasonable valuations & obsess about the risk-reward trade off. As long term investors, we prefer definite returns over immediate returns and we don’t mind underperformance in the short term. We are happy to be a contrarian when the risk-reward payoff is compelling and don’t mind sitting on cash when we perceive weakness. Lastly, we are a very conscious of corporate governance and have zero tolerance towards governance issues.

Portfolio Strategy

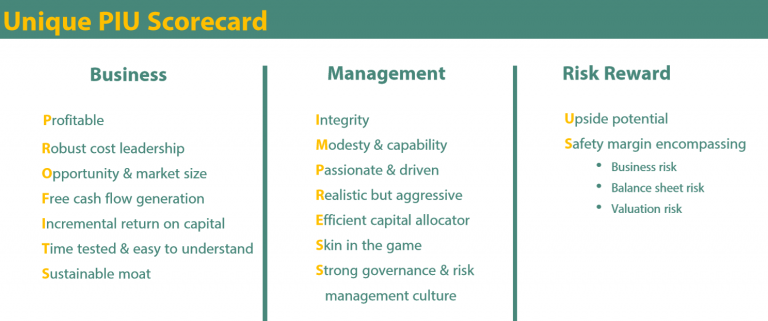

Investment philosophy revolves around Carnelian PIU framework which involves deep dive into Business, Management and Risk Reward metrics.

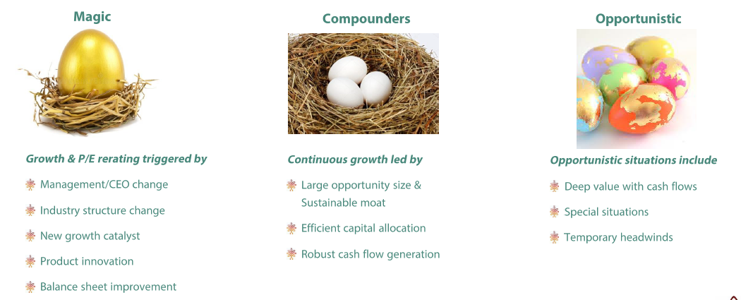

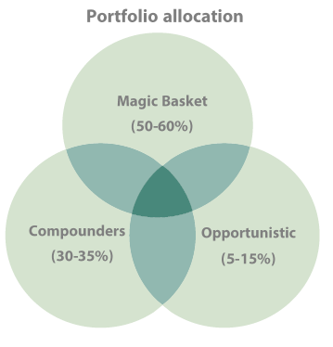

The Fund allocated portfolio in 3 baskets –

Core lies within the magic basket followed by stable basket

- Universe of 20-25 stocks

- Sector limit of 40%

- Stock concentration limit of 10%

- Ensure adequate portfolio level liquidity – 30% of portfolio can be liquidated within 5 days

- Low churn