Dear Investors,

August is unwinding a few surprises – be it at the Paris Olympics, or the Equity Markets globally.

On August 5th, reflecting the turbulence in global financial markets, Indian equities fell, and the rupee hit new lows. This was driven by concerns over a potential US recession, renewed Iran-Israel tensions, and a prolonged slump in Japanese stocks, which collectively fuelled a risk-off sentiment worldwide.

2 MAJOR GLOBAL CONCERNS:

Weakening US Economy:

The weak manufacturing numbers, low new orders, high unemployment claims, and low job creation, especially with unemployment hitting 4.3%, indicate a weakening US economy.

This has brought alive the risk of recessionary conditions prevailing in the US economy.

Major brokerages now expect the Federal Reserve to cut interest rates by 50 basis points in September, another 50 basis points in November, and 25 basis points in December.

The unease in the US has spilled over to stocks & currencies worldwide and on Monday [05th Aug] the S&P 500 was down by 3.1% in morning trading – gearing for its worst trading day in nearly 2 years.

Traders are speculating if the damage is so severe that the Federal Reserve might need to cut interest rates in an emergency meeting before the scheduled decision on September 18, 2024.

Yen Carry Trade:

What supported the Monday drawdowns worldwide alongside the news of a weakening US economy, was the Bank of Japan’s decision to raise its key interest rate to 0.25% from near zero, to counter the Yen’s decline against the USD.

Japan has been in stagflation for 40 years, with interest rates at zero. Traders, especially US hedge funds, took advantage of these zero-interest loans to invest in risky assets like NASDAQ stocks.

However, last week the Japanese Central Bank raised interest rates by 0.25% for the first time in 40 years and hinted at more hikes. This caused panic among traders who had borrowed yen at 0% interest, leading US hedge funds to sell off stocks rapidly.

The yen strengthened from 162 JPY a month ago to around 147 JPY per USD today, hurting Japanese exporters and prompting foreign investors to sell Japanese stocks.

In wake of this, the Yen Carry Trade has come into focus. A carry trade is a popular strategy where investors borrow money from a country with low interest rates and a weak currency to invest in assets in another country with higher returns. This approach has driven significant flows in the global currency market

The Japanese yen is a common choice for carry trades. Investors, including Japanese retail investors, borrow yen at low interest rates and invest in higher-return assets abroad, like US equities and bonds. But now, these trades are being reversed & positions are being exited.

The unwinding of Yen carry trades can significantly impact global markets because many investors use this strategy. When these trades are reversed, it causes major market volatility, with sharp changes in currency and asset prices. The large volume of cross-border yen borrowing further amplifies market disruptions.

Why are we STILL betting on India?

The Indian stock market has recently experienced a decline, mirroring global trends. After a notable 12% rise over the past couple of months, a correction in India was anticipated, triggered by global factors. The muted Q1FY25 earnings have also contributed to the bearish sentiment.

However, the worst seems to be behind us in terms of earnings and macroeconomic factors.

Key uncertainties related to elections and the budget have been resolved, and the demand slowdown due to these factors and the heatwave has already occurred. We can expect an acceleration in earnings for the rest of the financial year and beyond. Government spending, which was reduced dramatically in Q1FY25 due to the election code of conduct, is expected to increase, boosting growth. Additionally, better monsoons are anticipated to aid recovery.

A decline in USD and global commodity prices should reduce inflation concerns and support a dovish stance from the RBI. India’s market, driven by domestic investors, remains insulated from Foreign Institutional Investor (FII) selling and the Yen carry trade.

This makes the current correction an excellent buying opportunity.

Historically, Indian equities have seen milder declines during global sell-offs. The robust flow of domestic money has prevented sharper drops in the local market.

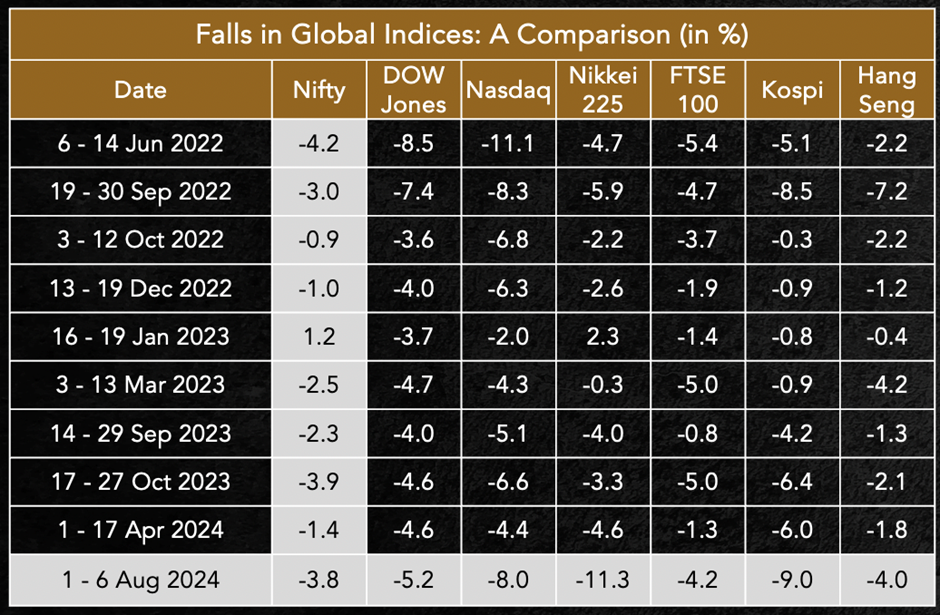

For instance, in the first 4 to 5 trading sessions of August, most Asian markets fell between 4% and 11%, whereas the Nifty dropped only 3.8%.

This has happened before also – let’s dig into some data.

Between April 1st and April 17th of this year, indices like the Dow Jones, NASDAQ, Nikkei, and Kospi fell between 4% and 6%, while the Nifty was down just 1.4%.

Similarly, from October 17th to October 27th, 2023, when the NASDAQ, Dow Jones, Nikkei, and Kospi declined by over 4%, Nifty fell by only 2.3%.

Indian markets have shown resilience due to strong economic growth and healthy corporate earnings. Domestic inflows have further supported the equity market.

Source: Economic Times

The Indian market’s ability to decouple from other emerging markets is evident. Strong economic growth, corporate earnings, domestic investment, and international investor confidence position India’s stock market for continued outperformance. Despite the recent correction, the downside appears limited, and the correction is expected to be short-lived.

MARKET OUTLOOK:

Indian stocks are trading at a record premium compared to Global Emerging Markets, and the overall earnings season has been average.

The ongoing market correction seems to be collateral damage but is unlikely to have a long-term impact. Recovery is around the corner but for the near term, investors should be patient with new investments and avoid speculative sectors.

Local positives will outweigh global uncertainties. Domestic liquidity will cushion shocks from global factors, keeping the Indian growth story intact.

We always strive to make investors optimistic, as this is the starting point of wealth creation through equity investments.

We also declutter investors’ concerns through objective evaluation of markets and assure you of the best investment services, backed by in-depth knowledge, driven by content, and analytics.

At PMS AIF WORLD, we understand the gravity of investment decisions, so we offer a well-informed experience and bespoke Wealth Management Services.

We are a New Age Investment Services Company, committed to delivering an analytics-driven, high-quality investing experience.

Our mission is to foster Wealth Creation and Prosperity for our clients.

We are driven by a dedication to excellence and meticulously offer the best Alpha-focused products.

Our suite of investment products spans a diverse range from listed to unlisted, encompassing Pre-IPO, Private Equity, and Venture Capital funds.

With us, you invest in the best.

JOIN US ON A JOURNEY WHERE TRADITION MEETS INNOVATION, AND WHERE THE FOCUS IS ON ALPHA.

For a detailed analysis and insights on around 200+ PMS and AIF Strategies, login to our analytics portal. Login to Learn – Compare – Select from the universe of professionally managed focussed investment portfolios.

Login to Our Analytics Portal

Database of all stocks / sectors & returns / risk matrices & insights of PMS & AIF

Our endeavors are to determine the Quality, Risk, and Consistency attributes (QRC). We present all data and analytics with an endeavor and the aim of informed investment decisions. If you are looking to invest and are not able to decide between PMS and Mutual Funds, or between PMS and Alternative investment funds, Book A Video Call with our experts.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION