Date & Time: August 19, 2022 | 04:30 PM – 05:30 PM IST

Speaker: Mihir Shirgaonkar, AVP – Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Mihir Shirgaonkar, AVP – Alternative Investments, Phillip Ventures IFSC Pvt. Ltd. to throw light upon an investment approach that caters to both diversification & taxation.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Mihir Shirgaonkar has 7+ years of experience in the asset management industry. At Phillip Capital, he is responsible with managing the Global PMS business domiciled in GIFT City, Gujarat, India.

He has a rich experience in portfolio management, equity dealing, market making, projects, valuations, treasury, and other functions. He was a part of ETFs & Passive Investments division at DSP Mutual Fund (earlier DSP BlackRock Mutual Fund).

He has pursued MBA from IIM-A and is also a CA & a CFA Charter holder.

Webinar Overview

There has been a lot of volatility & uncertainty in the market in the current times. Amidst this, the webinar drives focus on the importance of long term investing & investing in businesses beyond the geographical territories of India.

Why should one consider Global Investments as a part of one’s portfolio?

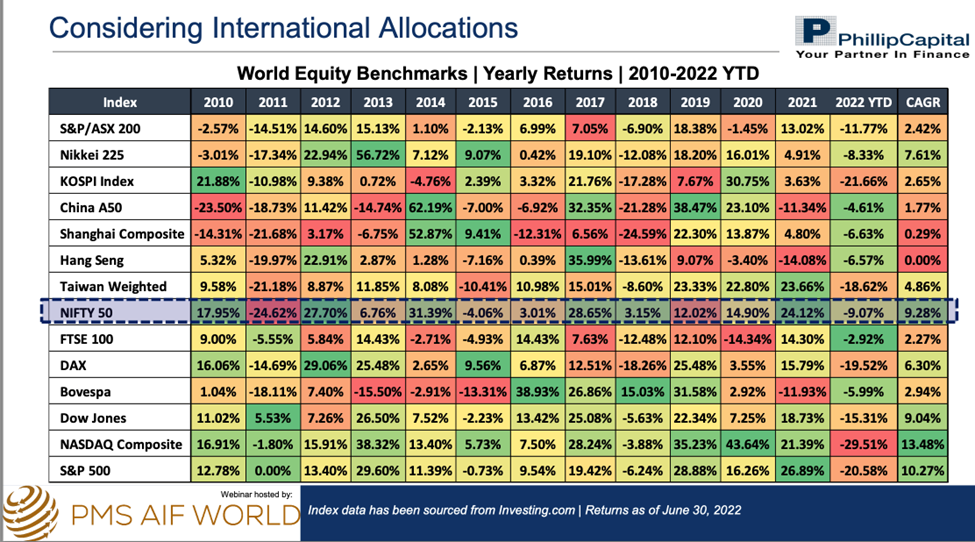

Since 2010 till date [June 2022], on a CAGR basis, a lot of global indices have outperformed Nifty50.

If we take a 15Y view, the developed markets have performed quite well, especially in the 2nd half of the period under consideration. If one would have invested 100 each (in the respective currencies) on 30th June, 2007 in all the above indices, as of 30th June, 2022, NASDAQ would’ve generated the maximum returns followed by Nifty50. Couple of indices like that of Hang Seng, Shangai, etc have been value destroying in this 15Y period. So it is imperative to note that selection of the right region wrt Global Investing is very important.

A couple of macro factors like recession, inflation, supply shortages, and so on are crippling major parts of the world. What is important is to understand those geographies that will stand to benefit out of these macro issues & stand out amongst others. To be able to identify not only the sector but the emerging trends within that sector is also crucial. For instance, within Manufacturing- 3-D Printing is evolving; within Financials- Decentralized financial system is at the cusp of disruption; within Climate Change- Renewables & EVs are emerging; and so on. Staying invested in these emerging trends is bound to capture a huge upside in the long run.

Having invested in the S&P 500 Index, an Indian investor would not only earn the growth returns on international investments but also earn returns on INR depreciation.

Phillip Capital’s GIFT City PMS invests into ETFs (Exchange Traded Funds). Here, it is wise to understand that ETFs, while it may sound like a very passive style of investing, it is indeed required to look at ETFs across the globe, understand the underlying assets, analyze the potential wins & take decisions accordingly as globally, ETFs are deeply layered. The market for ETFs is close to $10+ trillion and there are 10000+ products available listed on more than 45+ exchanges across countries. With so many choices available in the market, the investor is spoilt for choice & may end up making sub-optimal returns. The ETF investments done by Phillip Capital are into businesses, regions, and themes that the AMC believes will grow over the medium to long term. All this is done basis a lot of quantitative filters & qualitative assessments.

At present, the AMC is investing only into US Listed Securities [does not necessarily mean the ETFs are US-region focused].

So, what solutions does Phillip Capital offer?

Phillip International Pioneer Portfolio:

The investment objective of this fund is to give investors an exposure to international themes & geographies to capture growth stories across innovations & regional development. The philosophy of the fund is to have a diversified portfolio by investing in the ‘Trends of Today’ and the ‘Ideas of Tomorrow.’

Primarily, the fund will invest into Equity ETFs; but there is a provision for some allocation in emerging asset classes like bitcoins, and so on.

Phillip International Universal Portfolio:

The investment objective of this fund would be to diversify the investment amongst asset classes, geographies, and sectors. The philosophy of the fund is to have allocation to instruments with varying risk characteristics.

Primarily, the fund will invest into Equity & Fixed Income; but there is a provision for some allocation to REITs, Commodity, and Currency.

What is the GIFT City Advantage?

GIFT City or Gujarat International Finance Tech-City is India’s first Greenfield Smart C ity located in Gandhinagar, Gujarat. GIFT City has a very good state-of-the-art infrastructure & is an upcoming Financial & IT Services hub. The funds managed under GIFT City are not regulated by SEBI or the RBI but by IFSCA (Fund Management) Regulations, 2022.

As per the GIFT City Regulations, the minimum investment for investing in a Global PMS is $150,000. The route of investments for Resident Indians is the LRS Route, i.e. Liberalised Remittance Scheme. LRS is a framework structured by RBI and is applicable anytime an investor looks to invest outside India. In other words, for resident Indians to invest in a global PMS, they need to get through the LRS route. The max annual limit for remittance is: $250,000. This includes remittance for everything- tourism, medical, gift, investments, and so on.

Mr. Mihir Shirgaonkar believes that in the next 5-6 years, massive disruptions would have taken place across industries; he is looking to leverage the growth of the businesses that will benefit the most from these disruptions.

As far as the taxation is considered, the resident Indian does not have any tax advantage as such- s/he will be taxed at the global PMS income. However, there are some tax-advantages for NRIs. Investors belonging to countries which have a tax treaty with India might be able to get few exemptions on taxes*

The webinar was wrapped up with a concluding advice that an investor’s investment decision should never be a question of ‘OR’- s/he should not choose b/w investing in a domestic PMS OR a Global PMS; but it should always be a combination of ‘AND.’

*Please consult you financial/tax advisor for more details

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION